NWP Monthly Digest | October 2025

As my family prepares for a night of trick-or-treating, I find myself wondering, what scares me most as an investor this year? The key theme I keep coming back to is the financial media and analysts' incorrect portrayal of market reality. The outlook for stocks and risk assets remains constructive, but if conditions deteriorate, the return implications could become a real horror story. When risky assets are priced for perfection, there's little room for error.

When I filter out the noise, my fears narrow to three key scenarios: an AI bubble, credit stress, and a deteriorating labor market.

Scary Situation 1: AI Bubble

The question of whether we're in an AI bubble has quickly become one of the most debated topics on Wall Street. But despite some potential red flags and rising concerns about excessive valuations, investor sentiment remains bullish. Stocks continue to climb, and it feels like companies announce capital commitments of tens of billions of dollars into AI infrastructure on a daily basis.

The scale of spending relative to returns raises questions. The industry is spending over $30 billion monthly (approximately $400 billion for 2025) while generating just over $1 billion monthly in revenue. The growing number of circular financing arrangements between NVIDIA and an increasing number of its biggest customers is reminiscent of telecom in the 1990s. Back then, Lucent and Nortel lent customers money to purchase networking equipment, took equity stakes so customers could buy more equipment, and even bought capacity on their customers' fiber-optic networks, allowing those customers to show revenue growth and hit Wall Street targets—ultimately leading to their collapse.

Adding to these concerns, companies with extreme valuations that appear to be little more than middlemen in the AI capex explosion (CoreWeave and others) raise eyebrows—especially since these businesses have minimal value if exponential compute demand suddenly slows.

Given the potential market impact, these concerns merit serious consideration. If the AI bubble bursts and enthusiasm evaporates, the S&P 500 could drop 10%-20% on negative earnings revisions alone, given that tech companies drive the lion's share of index earnings growth. Factor in the ripple effects of suspended capital expenditures across other industries—such as networking, utilities, and industrials—and a deflating AI bubble could trigger a significant stock market correction.

Scary Situation 2: Credit Stress

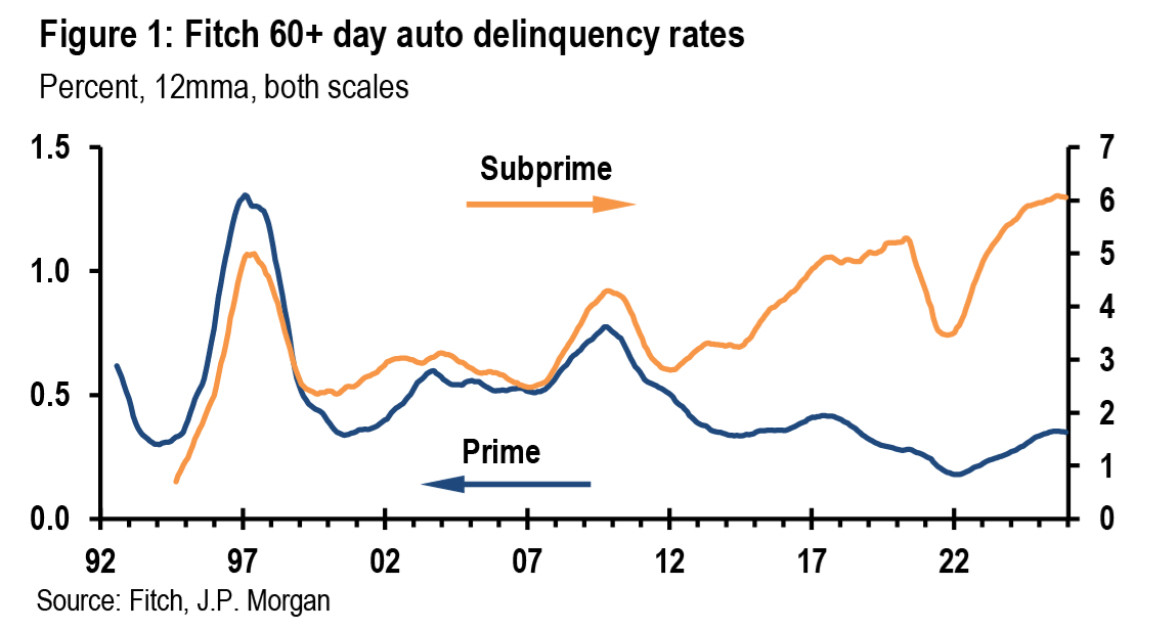

The lower end of the consumer spectrum is under stress. CarMax saw its delinquency rate spike, and car repossessions are at the highest levels since 2009. A growing chorus of companies are reporting intensifying weakness at the lower end of the consumer spectrum.

The logic is straightforward: During the pandemic and the subsequent period of high inflation, many consumers locked in payments for items (such as cars, appliances, and furniture) that were substantially higher than historical norms. Rising incomes initially offset this burden, but now that income growth has slowed while prices for other essentials continue rising, these consumers are struggling to manage these elevated payments.

Scary Situation 3: Deteriorating Labor Market

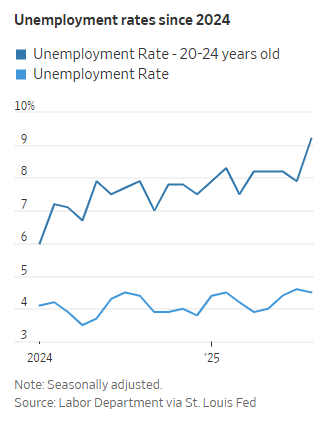

The labor market is a leading indicator. When it weakens, economic malaise typically follows. It's no longer a debate—the labor market is weakening. The only question is: how bad does it get?

For college graduates, the situation is particularly challenging. According to ADP payroll data, the adoption of generative AI tools in late 2022 led to a 13% relative decline in employment for workers aged 22 to 25 in AI-impacted fields. The U.S. unemployment rate for people aged 20 to 24 reached 9.2% in August, more than double the overall rate, while employment for older workers in the same fields and similarly aged workers in non-AI-exposed occupations has remained stable or even increased (Stanford research).

Since the negative impact is currently limited to a small subset of the labor force, markets are assuming only minor deterioration and generally resilient growth. Practically speaking, think of that as the unemployment rate rising to 4.5% or 4.6% and staying there. The problem is that it rarely happens. If the labor market shifts from the current "not hiring, but not firing either" to "reduce costs, i.e., headcount," then it will signal an economic slowdown—and that is not at all priced into stocks at these levels.

The bottom line: The market is currently pricing in virtually no allowance for recession. Outside of the pandemic, it has been over 16 years since the last recession, and no consensus expects one now—but recessions are not extinct! Recessions remain a feature of economic cycles, not an artifact of history.

Now, Here's the Horror Movie:

For investors, the ominous scenario would be all three situations playing out simultaneously. In that environment, a 30% decline in the S&P 500 is a realistic outcome that could take years to recover from, much like the downturns of the early and late 2000s.

AI has the potential to transform life as we know it, but investors should recognize that AI also has the power to tie all three scary situations together into a genuine market crisis. The scale and breadth of the exponential acceleration of AI adoption is staggering. Citi projects that AI-related revenue will grow nearly 80% annually over the next five years, reaching $780 billion in 2030, compared with $43 billion this year.

Today, AI spending accounts for roughly 1.5% of U.S. GDP and is fueling much of the economic growth witnessed over the past few years. Without large-scale AI capital expenditures (i.e., investment), the U.S. economy could be nearing a recession. If AI proves to be a bubble, the resulting downturn could bring job losses and heightened credit risks.

AI is a groundbreaking technology with clear potential to transform productivity, but like other transformative innovations—such as railroads in the late 19th century or the internet in the late 1990s—we tend to overestimate its immediate impact. Railroads eventually displaced steamboats, just as Apple, Amazon, and Microsoft forever changed modern life. But the overly ambitious rollout of these technologies led to numerous bankruptcies along the way, with inevitable knock-on effects throughout the economy.

History may not repeat, but it often rhymes, and current conditions bear noteworthy similarities to past bubbles. If this pattern plays out, it would create a painful period for investors. To be clear, I'm not predicting this will happen—but it's a legitimate scenario we should all recognize, because the outlook for this market isn't as one-sidedly positive as current stock prices suggest.

But even if we knew with certainty this was a massive bubble in the making, we have no reason to think there is imminent danger. Money is still abundant and being thrown at these AI investments with little to no expectation of earning a return on capital. Until sentiment changes, this bubble isn’t popping anytime soon. When Alan Greenspan delivered his "irrational exuberance" speech on December 5, 1996, he was right about the overvalued market and the tech bubble, but he was ahead of his time. The market surged by more than 100% before eventually falling. And even then, the market was higher than it was before he gave the speech.

So don’t rush out the door for a prescription of Xanax. These are tomorrow’s worries, not today’s concerns. Even if AI investments never pay off for investors, this would likely take many years to unfold. And let’s not forget the fourth quarter has historically been the best time to be invested.

Noble Wealth Pro Tip of the Month

Every year, Social Security recipients receive an inflation boost to their monthly payments, and this year that increase is 2.8%—which sounds great! However, that's only $56 for the average retirement benefit, bringing it to $2,071 per month. Cutting into that net benefit is the fact that Medicare Part B premiums, which are automatically deducted from Social Security checks, are expected to rise from an average of $185 per month to $206.50 per month—and even more for those on Medicare with income high enough to be subject to premium surcharges.

Medicare Open Enrollment

Open enrollment is a chore for many and rolls around every year, akin to raking leaves. For those on Medicare, open enrollment started on October 15, and this is the time to buy a new standalone Part D plan for prescriptions or to switch to a Medicare Advantage plan if you're on traditional Medicare. For those already on Advantage, it's a chance to pick a different plan or switch back to traditional Medicare.

As insurers face economic challenges amid rising health care costs, details matter. How does your plan cover your medications, if at all? Does your doctor participate in your Medicare Advantage plan? Researching the answers can help keep your costs—and your frustrations—down.

Those with the resources to pay for a Medigap plan should strongly consider doing so to have a larger network and greater assurance that their health needs will be covered. Those seeking to save money by enrolling in a Medicare Advantage plan should understand these plans are not the same as traditional Medicare. I understand these plans are easily sold and look attractive for healthy individuals, but that could all change if you get sick down the road. Understand the risks you may be taking: your care providers, doctors, or even hospitals may be limited. Your treatment needs may not be covered, and you may have to jump through an inordinate number of pre-approvals and hurdles to get your care covered. Additionally, that network and doctor list can change at any point.

About to Claim Social Security Benefits?

A recent survey of 1,500 U.S. investors found that 90% plan to claim before age 70, and 44% plan to claim before reaching age 67 (the full retirement age for those born in 1960 or later). The primary reasons for collecting early are concerns that Social Security will run out of money or the need to collect benefits earlier for financial reasons.

There are certainly times when it makes sense to collect early, but those with the resources to delay benefits until age 70 should strongly consider doing so. Fears of the Social Security fund running out of money are not valid reasons to collect early because whether your benefits are 100 cents on the dollar or 85 cents on the dollar, you still lose the 8% annual increase for delaying your benefits for the rest of your life.

Another argument I often hear is from individuals who believe they will pass away before the break-even age—typically around 83—at which point they would be indifferent between collecting early and delaying benefits. However, I often find that clients overestimate the probability they will die before this break-even age and underestimate the likelihood they will live well into their 90s.

I understand the fear of not receiving what you feel is rightfully yours, but from a financial planning perspective, the risks are very asymmetric. If you delay your benefits and pass away before 83, chances are your financial plan will still be just fine. However, if you collect early and live into your 90s, there's a chance your financial plan could be on shakier ground.

For anyone unsure about which claiming strategy is best for them, I strongly encourage reaching out to a financial advisor to help guide the decision and overcome some of the emotional obstacles.