NWP Monthly Digest | January 2026

You’re Crushing It! Now What?

After three straight years of double-digit gains in the stock market, there's a moment that happens right about now. You look back and think, I handled that. I made good decisions. I stayed invested. I didn't panic. I'm getting better at this.

And you might be right.

But the real danger in strong tailwinds is what they can tempt you to believe about yourself.

The Lemon Juice Problem

Enter the Dunning-Kruger effect: the idea that when people are new or underskilled in a specific area, they tend to overestimate how good they are at it. Not because they're arrogant, but because they don't yet know what "good" actually looks like.

The most famous illustration involves McArthur Wheeler, who robbed banks after smearing lemon juice on his face, believing it would make him invisible to security cameras. When police arrested him later that day and showed him the footage, he reportedly said, "But I wore the juice!"

That line is funny until you realize how human it is.

He wasn't trying to get caught. He wasn't trying to be ridiculous. He genuinely believed he'd discovered a "hack." He felt confident because he lacked the knowledge required to know how wrong he was.

It's a perfect metaphor for personal finance, because money has a way of giving us confidence right when we should be adding humility.

And if you did crush it last year, this is the moment to decide what kind of win it was: Was it skill, discipline, and a repeatable process? Or was it lemon juice?

Knowledge Breeds Humility

How many of you have taken the Dunning–Kruger roller-coaster ride in your own career? I can relate. Three years out of college, I had passed Level I of the CFA exam and the Series 7 with a 94%—the highest score in my department at JP Morgan. A year later, I was promoted to work with high-net-worth clients. Confidence was sky high.🎢

But then came Levels II and III of the CFA—a grueling process—while learning about private equity at a new firm (where I met my business partner, Jeff). At this juncture, I began my descent on the hill of confidence. Later, while working with high-net-worth clients, I remember building a complex strategy for a client's stock-based compensation when my confidence sank to new depths. I felt a different emotion: humility. I realized there was still so much to learn, and the roller-coaster ride of my career was far from over.

In Malcolm Gladwell’s Outliers, there’s the idea that mastery takes roughly 10,000 hours—about five years of focused work. Wealth management spans multiple disciplines: financial planning, investment management, and tax planning. That's potentially 15 years to develop true expertise across all three. Today, with decades of experience, my confidence is actually lower than it was in my ambitious twenties—which is precisely what Dunning-Kruger predicts.

What makes the wealth management profession unique—especially in investing—is that people often don’t realize they’ve been naive or reckless until they decide to learn more and truly master the craft. I’m no exception.

If you want to become a neurosurgeon, and you’ve read some books and feel vaguely familiar with the techniques, you still know—immediately—you’re not qualified to open a skull and remove a tumor. But if it’s investing an IRA balance that’s sitting in cash, some people jump right in and buy Google, Nvidia, Microsoft, or an S&P 500 ETF. Because it’s your own account, and it isn’t life or death.

Worst case, you tell yourself, it just means working an extra five years.

Did you make a mistake? Are you too exposed to a risk that could derail your plan? Are those investments aligned with your goals? The reality is: you may not know. But does it look okay? Probably. And that’s the trap—because you don’t know what you don’t know.

So when someone says, “I’m pretty good at managing my investments,” I believe them. But it’s all relative. “Pretty good” isn’t the same as “prepared for the complexity you can’t see yet.”

This is what humility does for you:

It keeps you open to the possibility that you're missing something important

It keeps you curious instead of defensive

It makes you build systems, not stories

In the realm of financial planning, humility shows up as:

Not mistaking familiarity for diversification

Not assuming last year's refund means you "nailed it."

Not assuming “I’ll work longer” is a plan without doing the math

Some of the costly sentences in personal finance may sound reasonable:

“I’ll revisit this after things settle down.”

“This has worked so far—no need to overcomplicate it.”

“John Smith uses this same approach.”

“I’ve read enough to understand the risk.”

“I’d rather keep it simple than pay for something I can coordinate myself.”

Sometimes you can do it yourself—and many people should. But the real question is whether you're doing it with a process that catches your blind spots, or the hollow assurance of lemon juice.

Here's the tricky part: blind spots rarely show up when markets are calm. They emerge under pressure—when a big decision has a deadline, when emotions are high, or when multiple parts of your plan collide at once. That's why a good advisor's value is building a system that holds up when conditions change.

Even Titans Implode

Stockton Rush, CEO of OceanGate, ignored repeated warnings about his Titan submersible. When his director of marine operations delivered a safety report outlining serious concerns, Rush fired him on the spot. He dismissed skepticism, brushed off standards, and treated challenge as disloyalty.

The result? In summer 2023, the vessel imploded at ocean depths, killing all five people on board.

When a system isn't challenged, it doesn't just stay the same. It gets weaker. Not because anyone is careless on purpose, but because humans normalize risk. We get comfortable. We take shortcuts. We stop asking hard questions because nothing bad happened last time. When you remove independent challenge and treat standards as optional, a single point of failure turns catastrophic.

In wealth management, the stakes aren't life-or-death in the same way—it's important to say that plainly. But the principle still matters: Unchallenged confidence is fragile.

In wealth management, "pressure" takes the form of:

A bear market

A job change

A business sale

A concentrated stock position that finally cracks

A health event

A divorce

A parent or child needing more support than expected

If your financial plan only works when life is smooth, it's not a plan. It's a fair-weather story.

Surround Yourself with Those Who Challenge You

A while back, I wrote about Federer and the idea that, for stretches, dominance can quietly reduce the urgency to evolve. But when Rafael Nadal emerged, suddenly Federer's game wasn't enough anymore.

When you're not challenged, you don't get sharper by accident. And when you are challenged, you either adapt or you get exposed.

At age 33, Federer changed rackets for the first time in his career—switching to a larger frame capable of producing more power. He worked on driving through his backhand and getting off the defensive. After the change, he dominated Nadal 7-2 in their head-to-head matchups, despite being five years older.

That's what a healthy challenge does in any domain. It forces you to work harder, become an expert, and master your game rather than rely on naive confidence.

The same applies to your wealth. Good years lull you into believing your current approach is fine. Hard years remind you it's not.

This is why the best financial outcomes usually come from some form of constructive friction:

A spouse who asks, "Are you sure?

An advisor who will tell you "no" (and explain why)

A financial plan that forces trade-offs

You don't want yes-people around your money. You want truth-tellers.

If you're self-reliant by nature, I get it. Letting someone challenge you can feel like losing control. It's the opposite. It's how you keep control when your brain is most tempted to wing it.

The Point of Winning Is to Earn the Right to Get Better

If last year was strong for you, enjoy that. Let it count. Take the win.

But don't let the win convince you the game is solved.

The people who build real wealth over decades aren't the ones who never make mistakes. They're the ones who keep upgrading their decision-making before the next test shows up.

Confidence is valuable. Humility is protective. Challenge is the engine.

Market strategists are forecasting another strong year for stocks. That's the exact moment when complacency becomes most dangerous—when everything feels dialed in, and the lemon juice starts to look like wisdom.

The question isn't whether you crushed it last year.

It's whether you're building something that can crush it for the next twenty.

Noble Wealth Pro Tip of the Month

Your 2026 Financial Planning Checklist

The new year is an ideal time to review and strengthen your financial foundation. Here's a practical guide to help you navigate your 2026 financial planning.

Assess Your Financial Foundation

Start by understanding the relationship between your income, assets, expenses, and debts. Compare your projected after-tax income to your actual expenses—and be realistic. Your financial plan should reflect reality, not wishful thinking.

Ask yourself: Can you save 20% or more of your income? If you're falling short of your savings goals, now is the time to identify areas where you can cut back. Subscriptions are often the easiest place to start trimming unnecessary expenses.

Eliminate High-Interest Debt

Tackle any debts with interest rates above 6%. While it's hard to watch your bank balance drop as you pay these off, high-interest debt will undermine your entire financial plan. If you're considering investing instead of paying down these debts, remember that the prospects for higher investment returns look significantly different today than they did three years ago.

Build an Adequate Emergency Fund

Establish a dedicated emergency fund that matches your personality and circumstances. If you tend toward extreme optimism, add a bit more to this fund than you feel comfortable with. Conversely, if you're prone to financial anxiety, resist the urge to overfund this account beyond what's absolutely necessary—too much sitting in emergency savings can also weigh down your financial progress.

Review Your Investment Strategy

Take time to review your asset allocation and ensure it aligns with your financial goals. You'll hear countless predictions about what the stock market will do in 2026—ignore all of them. The stock market cannot be reliably predicted over short time horizons.

Check Your Retirement Planning

Evaluate whether you're on track to retire when you want to. Are you saving in the most tax-efficient accounts available to you? Make adjustments now if you're falling behind on your retirement goals.

Optimize Your Tax Strategy

Reflect on any tax challenges you faced in 2025. What steps can you take in 2026 to reduce your future tax liability? Strategic tax planning throughout the year can make a meaningful difference.

Update Your Estate Planning

Review your trust and will, and verify that all your beneficiaries are current. While this rarely tops anyone's priority list, having these documents in order can save your loved ones from dealing with courts and complications during an already difficult time of loss.

Taking these steps now will help you build a stronger, more intentional financial future for the year ahead.

Things We’re Reading and Enjoying

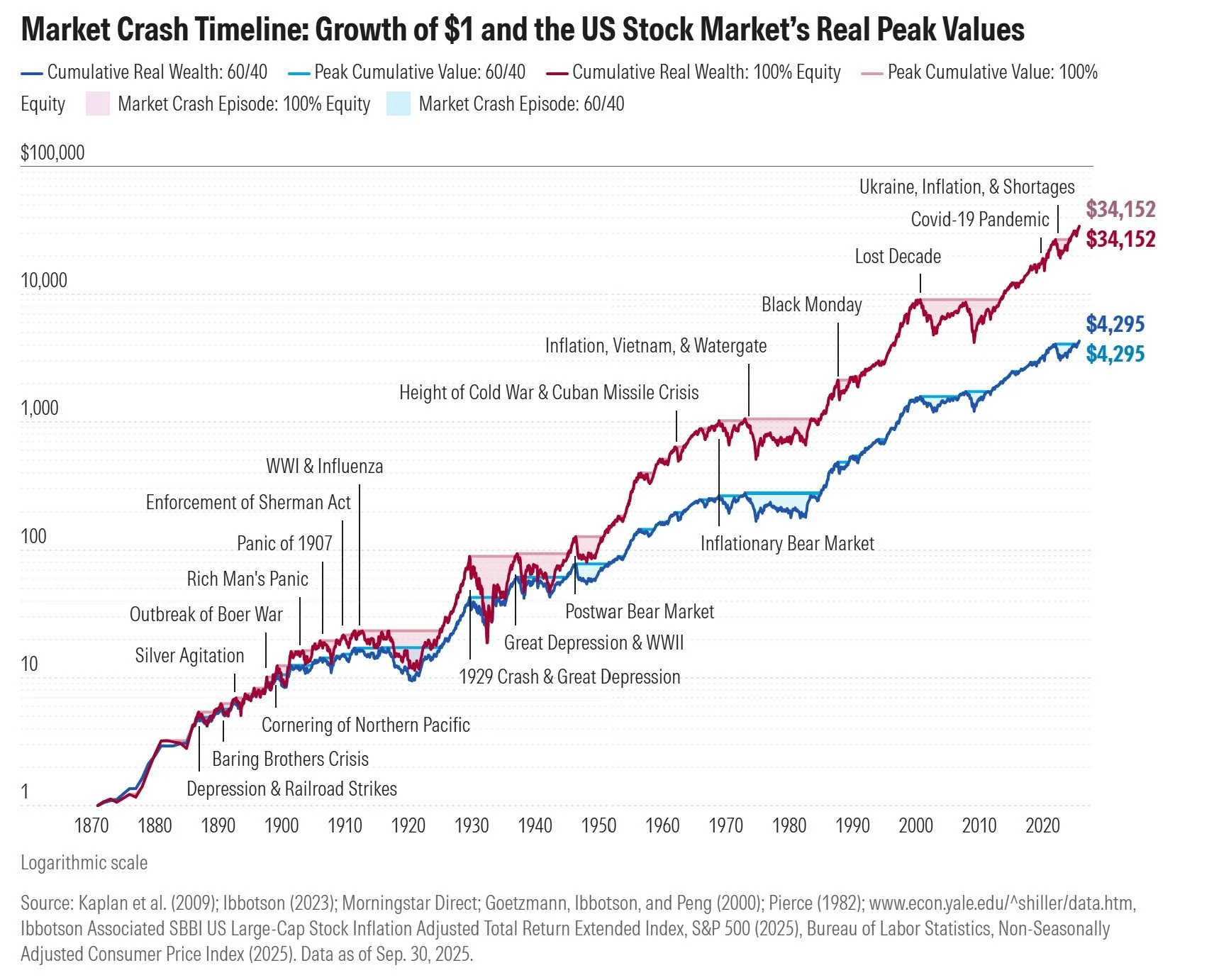

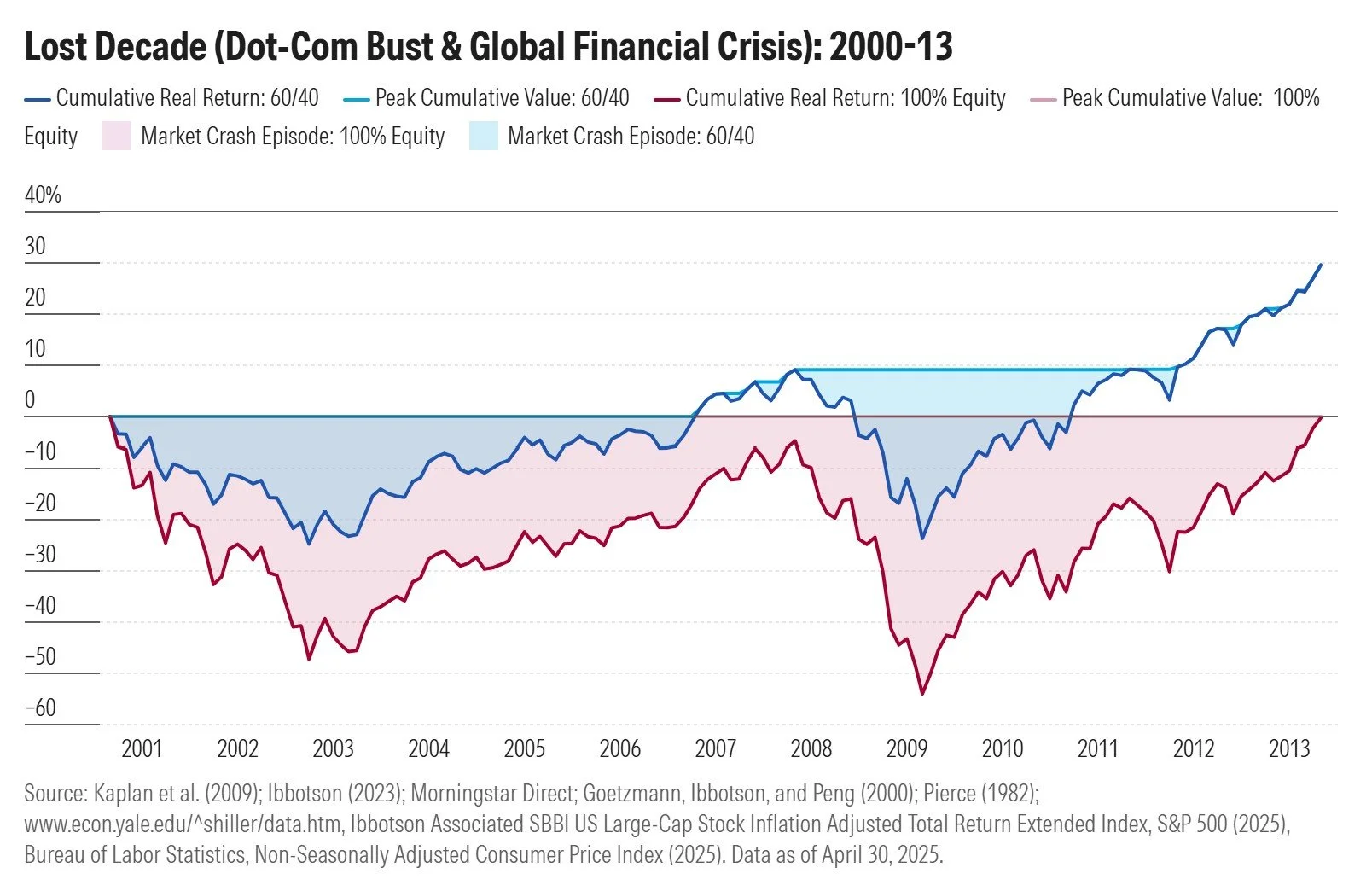

The 60/40 Portfolio: A 150-Year Markets Stress Test | Morningstar-Emilia Fredlick

Over the past 150 years, stock markets have gone through many crashes but always recovered. A balanced 60/40 stock-and-bond portfolio has usually lost far less and recovered faster than stocks alone, making downturns easier for investors to endure. However, it's natural to question the merits of diversification after extended periods of market strength.

Recently, diversification has also been put under the microscope following the bear market that started in 2022—the only downturn where the 60/40 portfolio hasn't outperformed stocks. This means not only was your upside hampered, but the diversified portfolio didn't provide any protection either. Rest assured, this was an aberration. Market crashes are inevitable and unpredictable, but diversification remains the most reliable way to soften losses and stay invested for the long term—and this is paramount as you near retirement.

“There is nothing noble about being superior to your fellow man. True nobility is being superior to your former self.” - Ernest Hemingway