NWP Monthly Digest | March 2023

2022 was an unprecedented year for the stock and bond markets, and nobody expected an easy 2023 to follow. The dichotomy between the market fundamentals and the economic data is enough to make anyone reevaluate their investment strategy. When was the last time you took a second look at your portfolio?

NWP Monthly Digest | January 2023

Stocks closed out 2022 with a whimper, as major indexes suffered their worst year since 2008. Is Santa real? The stock market doesn’t seem to think so. The infamous “Santa Claus Rally” never came, but that didn’t stop the Arctic temperatures from freezing Denver. On December 22nd, Denver temperatures were the coldest it has been since 1990.

NWP Monthly Digest | March 2022

The world is watching the news like a hawk as Russia embarks on a quest to subjugate its western neighbor. Russian troops march into Ukraine, Russian protesters march all over the country to denounce the incursion of Ukraine. Russia’s seemingly pointless invasion faces global condemnation as leaders worldwide unify to chastise…

NWP Monthly Digest | April 2020

Let’s face it, Charles Dow was right, the conditions have changed and there is a lot to discuss as we wrap up the worst first quarter on record for the Dow Jones Industrial Average. Before going into the details of exciting wealth-building opportunities, we hope your friends and families are safe. In this month’s newsletter, we packed the shopping cart…

A New Year, A New Outlook

In a stark contrast to the investment returns of 2018, 2019 flew out of the gate and never looked back. In 2019, it was difficult to find an asset class that did not perform well. Baron Rothschild once said, “Buy when there's blood in the streets, even if the blood is your own.” There was blood in the streets heading into 2019. Global…

Who Would Win the Fight Between a Bull Market and a Bear Market Today?

Most economists know forecasting the timing of a recession is a fool’s errand. I knew this in 2017 when I told clients I expected the stock market to climb higher until our next recession which may occur in the first quarter of 2020. Would I end up feeling foolish if my assertions did not hold true? Of course not. A lot can change in three years…

The NWP Monthly Digest | August 2019

The summer appears to be wrapping up in unison with the global economic expansion. For the investment world, August brings waning economic growth into sharp focus and geopolitical issues we have been listening to in the late…

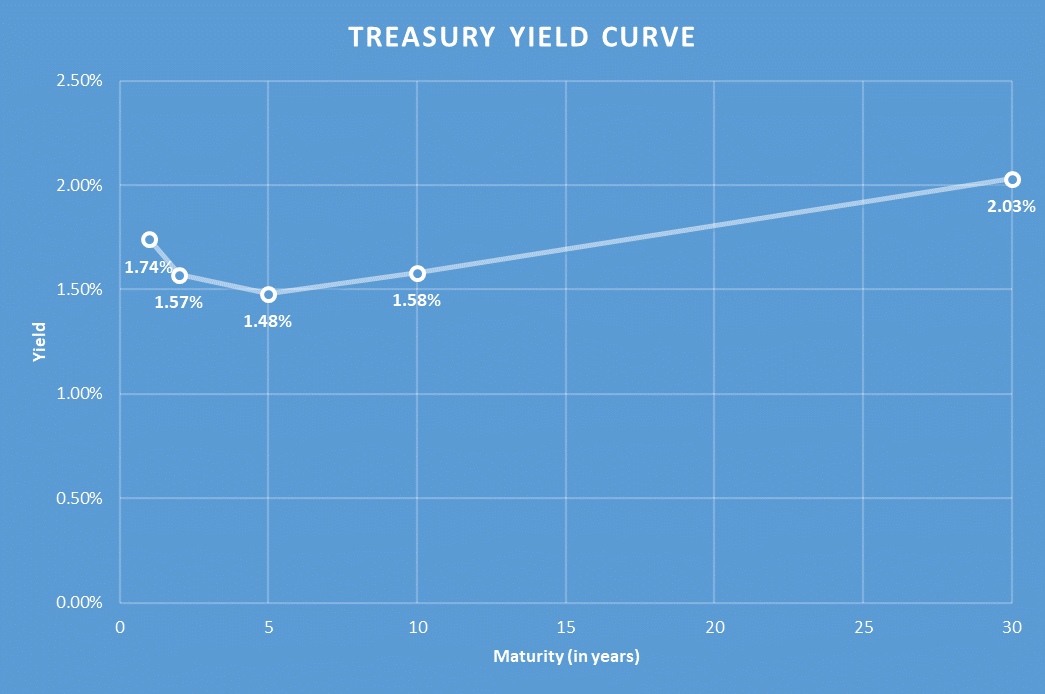

Does the Fed Have the Tool-Set to Achieve Its Dual-Mandate?

With all the talk of the fed cutting interest rates in the news recently, and with the historically low employment numbers I decided to ask the question, can the Federal Reserve achieve the other half of their dual-mandate and…

Implications of the Comments From the IMF

Today, IMF Managing Director Christine Lagarde shared her thoughts on the global economy during the United States 2019 Article IV Press Conference. For those not aware, the IMF is the International Monetary Fund which is an…

Subscribe

Subscribe and receive our most current insights.