NWP Monthly Digest | April 2020

A Stimulus Package for Knowledge

“The one fact pertaining to all conditions is that they will change.” – Charles H. Dow

Let’s face it, Charles Dow was right, the conditions have changed and there is a lot to discuss as we wrap up the worst first quarter on record for the Dow Jones Industrial Average. Before going into the details of exciting wealth-building opportunities, we hope your friends and families are safe. In this month’s newsletter, we packed the shopping cart full of helpful information on the market environment to help you manage your wealth through these difficult times. Plus, we decided to give the “Noble Wealth Pro Tip of the Month” a stimulus package of knowledge to help you consider financial planning strategies and digest the changes to legislation.

Source: Bloomberg. COVID Tracking Project.

Lately, every company you have ever given your email to has decided to share their thoughts on the COVID-19 outbreak. I appreciate what they are trying to do but do I really want to hear an assessment of the pandemic from the dry cleaning company I use? You have probably heard enough about the coronavirus so I will make this section brief. What matters to the stock market is the delta or the rate of growth instead of the fact the total number of infected people is growing. Jeff Brainard likes to say, “the stock market does not wait to see the light at the end of the tunnel, instead the stock market waits to see a different shade of black.” On Sunday evening (3/29/2020), S&P 500 futures prices were pointing to losses at the open on Monday. However, the latest numbers came in showing the number of new COVID-19 cases dropped from the previous day. This lighter shade of black could have been the ballast investors were looking for to invest in the stock market and on Monday (3/30/2020) the S&P 500 closed up 3.35%. Investors will be closely observing the apex of infection rates, which experts predict peak will occur in about a week or two.

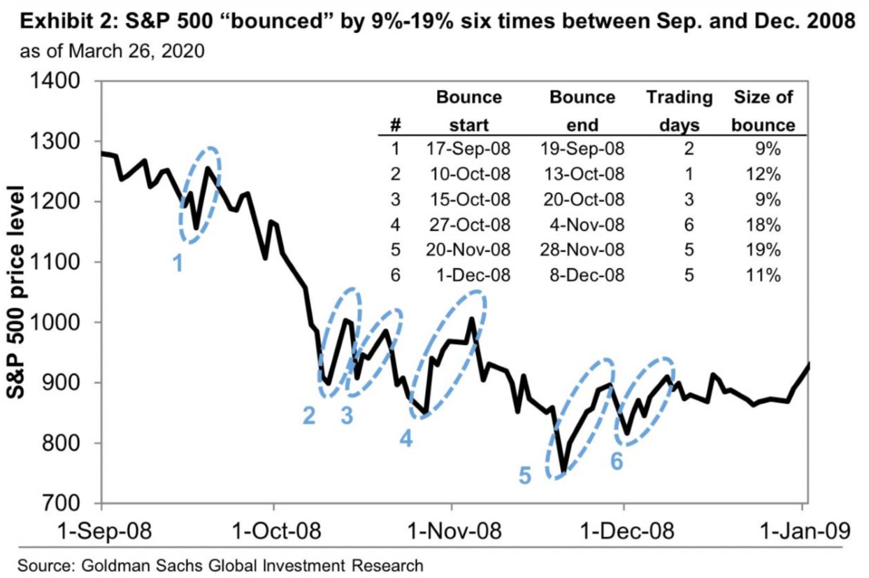

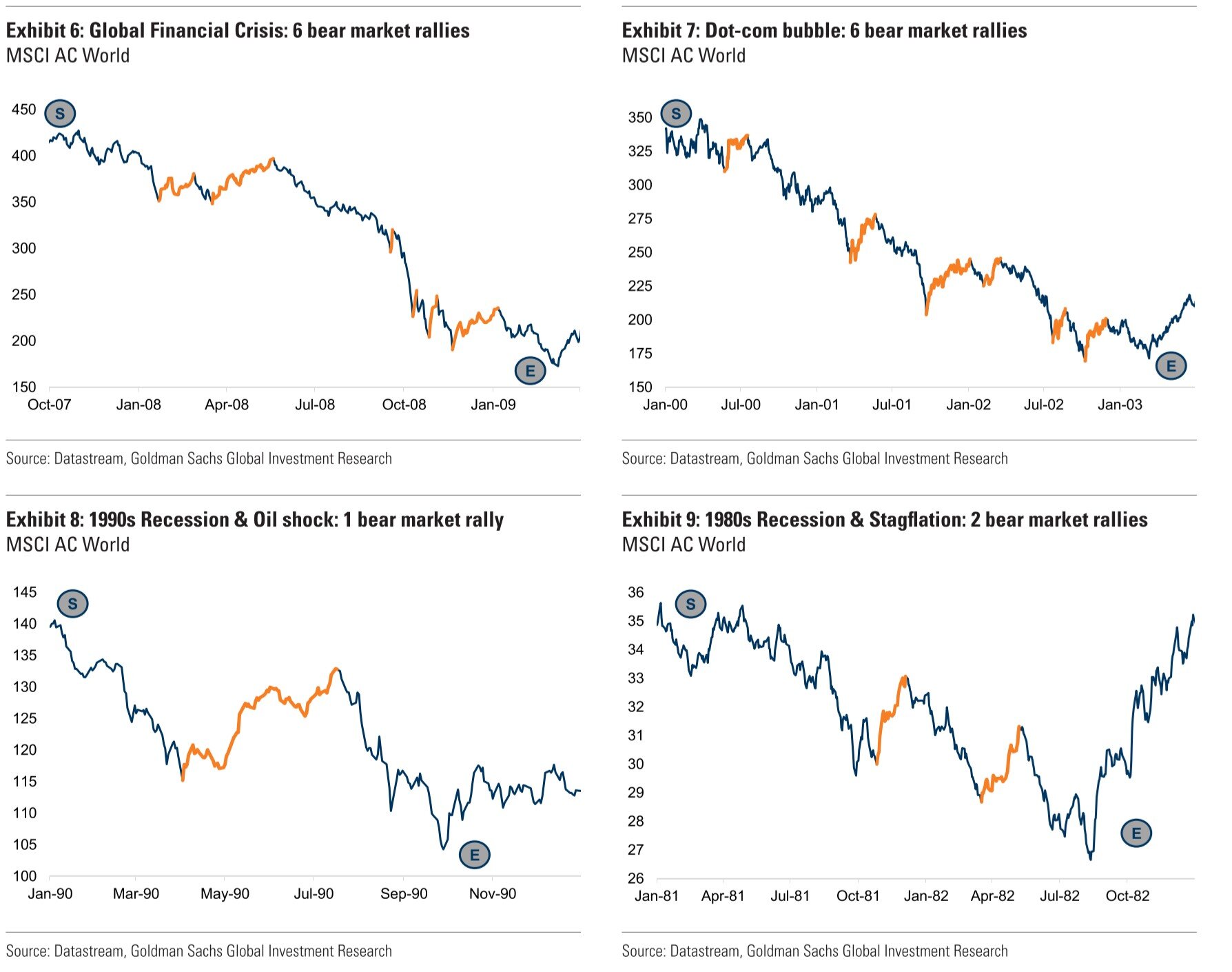

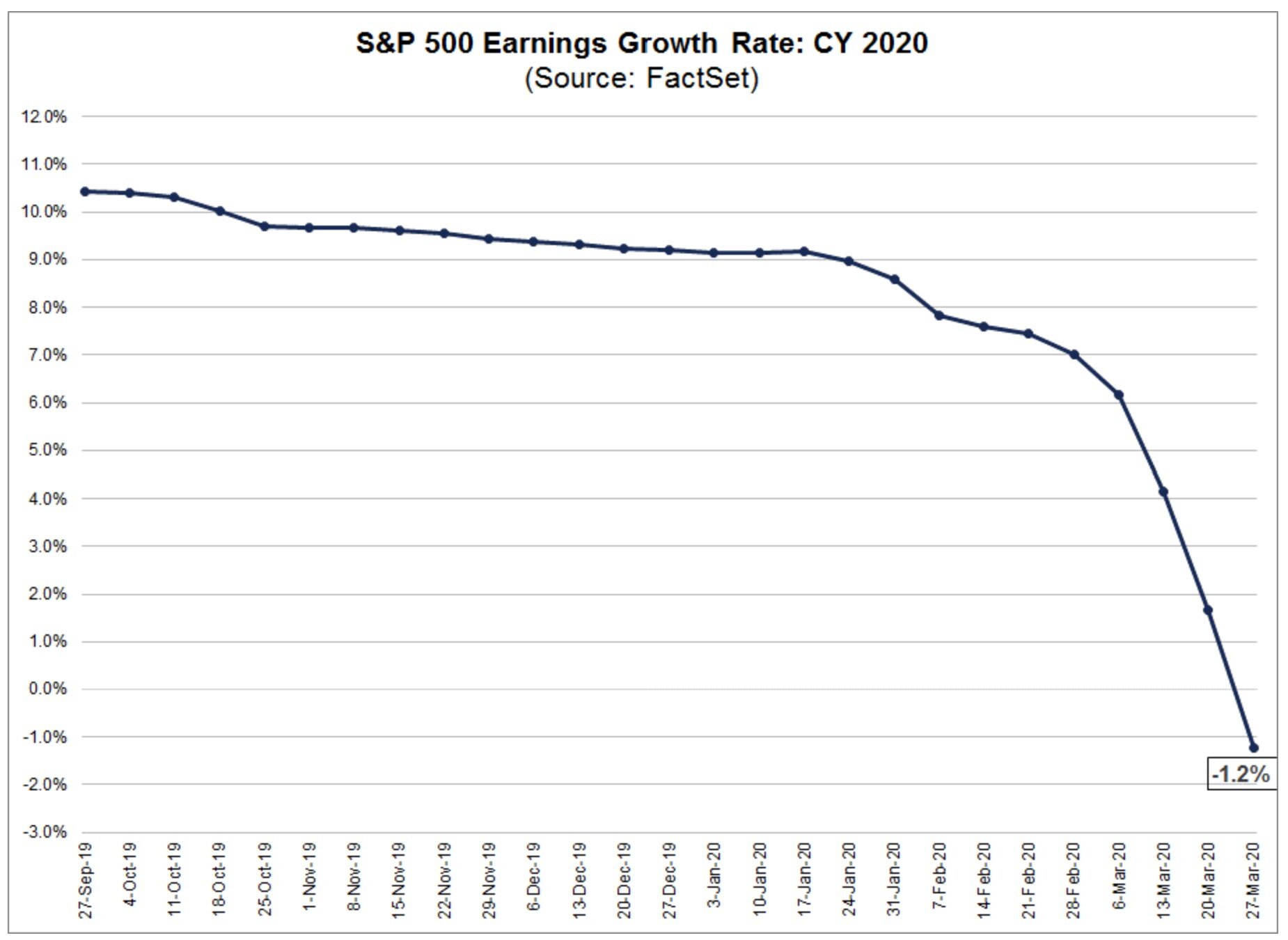

We had a great day on Monday, and last week we saw the best three-day stretch in the Dow Jones Industrial Average since 1931, but we are still not out of the woods yet. Stock market rallies in bear markets are quite common. The stock market enjoyed four rallies of over 10% in 2008 as the market crashed. I do not say this to worry you. Instead, it is important you understand how markets function. After the pandemic is addressed, we then have to re-focus our attention on the economic fallout from the pandemic. This may cause havoc for the financial markets. Last week, over 3 million individuals filed for unemployment claims. That number was almost five times higher than the previous record. This ominous signal should indicate the worst is yet to come as we prepare for unemployment numbers to could reach colossal heights of around 30% as economic growth picks up the hobby of base-jumping. Recent research from Goldman Sachs predicts GDP growth in the second quarter to fall as much as 25% as earnings growth for the S&P 500 falls over 100% from the prior year.

The charts below shows previous stock market rallies during bear markets

Huge spike in unemployment claims

Source: U.S. Department of Labor

GDP is Q2 is expected to take a big hit

…Along with earnings

Before going into the wealth-building opportunities the present environment has given us, let me first take a minute to show you we were not blindsided by this stock market collapse. For those clients and readers of our newsletter, Noble Wealth Partners is not an investment bank or Wall Street firm with an incentive to push optimistic messages to our readers to keep them invested with heavy allocations to equities. Our job is to grow our client’s wealth and keep our wealthy clients from going poor. We analyze the data and report it as we see it. We also adjust our portfolios based on our objective findings which explains why we went into this downturn about 13% underweight equities (i.e. if 60% stocks is a neutral allocation, we were ~47% stocks). Our view was not concealed from our clients, just read our blog posts fo a vivid picture of what our views are, or read pasts blogs for what our views were. For example, here are some quotes from our 2020 Outlook:

Well then, what should the stock market expect for 2020? Will the stock market contract the bat/snake pandemic? It's possible - would we then call it a stock mandemic? Who knows?

The only tailwind for the market was provided by an accommodative Fed, a puzzling development. Given the massive price increase in the stock market and debilitated fundamentals, we would caution readers not to expect too much from the market in 2020…investors have failed to recognize that the fundamentals of the market have deteriorated. We could be in the midst of a final melt-up in the stock market before an eventual downfall leading to a recession - like we have seen so many times in the past.

This is from our December 2019 newsletter:

Skip this section if you are an anxious person. If you sleep like an Opossum, feel free to continue reading. Now that Thanksgiving is behind us, turkeys across the country discovered what their eventual fate would be. But how would they know before then? All year, farmers had been treating each turkey like a god up until their demise. Stock markets often follow a similar pattern. Providing healthy returns to investors up until the point it is too late. Recently, the stock market has once again risen to new highs. Over the past ten years, the markets have been fed a gluttonous portion of low-interest rates, quantitative easing from central banks, and yield-hungry investors chasing returns. Analogous to the turkey, life for investors may seem great but the risks have not gone away.

And finally a few from our Bull vs. Bear blog post in October 2019:

Most economists know forecasting the timing of a recession is a fool’s errand. I knew this in 2017 when I told clients I expected the stock market to climb higher until our next recession, which may occur in the first quarter of 2020…In the blue corner, weighing in at only 600 lbs is the challenger and making a comeback after more than ten years of hibernation - the Bear Market! Don’t bet against this rested beast that will bring a flurry of global manufacturing weakness, an inverted yield curve, fading corporate profits, and ongoing trade uncertainty into the ring. The bear is back and ready to put on a good fight…Investors should consider diversifying and possibly decreasing equity risk in their portfolios (depending on their starting allocation). Even if investors believe the bull will hold the title for undisputed champion of this expansion, we must be cognizant the bear market has the weapons to pull off the upset.

And now, let’s focus on exciting opportunities to help you grow your wealth…

Noble Wealth Pro Tip of the Month

Tip #1 - Stay Rational

When we meet with new clients, we often ask them if they are willing to take a more conservative approach as the market is reaching for new heights? The goal is to hold a conservative portfolio as the market falls so investors do not fall as far as the market. Once the market has fallen, we then ask if the investor is willing to increase risk so they can participate more fully on the upside. Every client we asked agreed this was a sound strategy through some wished the account was more aggressive in the summer and fall of last year. However, once the market fell over 30%, only about half were willing to increase their risk. Isn’t this the opportunity investors were waiting for? What changed?

“Everyone has a plan until they get punched in the face.” - Mike Tyson

The first development is the market is no longer gumdrops and candy canes. There are many distinguishing features of this bear market. However, there are many similarities with past bear markets. First of all, all bear markets come with horrible news and doomsday predictions. Many of those looking at a chart showing the market bottoming in the spring of 2009 would agree investing at that time was a great idea but very few actually did. That was the very moment headlines called for the dollar to go to zero while Wall Street executives were jumping out of skyscrapers on a daily basis.

“Buy stocks when there is blood in the streets, even if it is your own blood.” - Baron Rothschild

By the time the clouds begin to clear, the market will have already shot up and it may be tough to catch. Don’t focus on the headlines, focus on the fundamentals and stay rational. The average investor’s inability to stick to the plan is the reason the investment experience for the average investor is significantly different from those taking a long-term approach. From 1998 until 2018, the average investor lagged a portfolio of 60% stocks and 40% bonds by over 3% annually! How did this happen? It’s simple, they forgot the first rule of investing - buy low and sell high.

The chance of wealth destruction is drastically mitigated for those taking a longer-term perspective. Another similarity between this environment and past periods of market distress, the stock market has always returned to the prior peak. Even if it took five years to get to the prior peak, investors would realize 7.9% annual returns during that time. Investors ask, “but what if I invest too early?” Yes, it would be great if you were able to perfectly time the market and buy in at the low but that is nearly impossible. In the chart to the right, you can see that even if you invest when the market is still 20% from the bottom, on average, you would recover your initial investment in only 129 days (on average).

From here, what would the annual returns be to get back to prior peak?

Length of time to recoup your investment at various stages of a bear market

Last week, a client sent me a delightful story and to me, this summarized the current situation better than I ever could. In this story, Apollo 11's Buzz Aldrin shared the secret of how he's passing the time while trying to stay safe from coronavirus:

"Lying on my ass and locking the door," he said simply. Intended or not, Buzz’s message is a little like Virts’s words on the economy: Relax. This will get better; these times will pass. Viruses and bacteria have had their way with humanity since we emerged on the savannah, and we have had our way right back at them—first via our immune systems, later by acquired knowledge of social distancing and good hygiene, and later still by advanced science, vaccinating and medicating the pathogens into submission. COVID-19 is, in some ways, just like Apollo 13.

Tip #2 - Review Your Estate Planning Documents

In the living will, the document that states your wishes and outlines what you would want to happen in the event of a life-threatening emergency. Unfortunately, many individuals created this document with a clause stating they, “do not want to be kept alive with artificial means.” How is that a problem? By definition, a ventilator is artificial life support.

Next, please review your advance medical directives where you state the person you want to make medical decisions in for you in the event you are unable to make them. Many clients have chosen family members or close friends that live out of the state assuming that person would be there in the event of an emergency. With the current travel restrictions, that may not be possible.

For these reasons, it is worth a second look to make sure you would not be impacted by these issues if something were to occur.

Tip #3 - Strategic Roth Conversions

Roth IRAs grow tax-free and traditional IRAs grow tax-deferred. For this reason, the benefit of a Roth IRA is magnified when market opportunities present themselves and the forward-looking returns are lifted. For that reason, it may be worth evaluating if you should convert some of your IRA savings to a Roth IRA for the potential future benefit.

Tip #4 - Rollover Any Refunded 529 Dollars

In the next few months, it is possible you are refunded higher education expenses due to the shelter-in-place restrictions. If those expenses were paid for using proceeds from a 529 withdrawal, you should strongly consider depositing those funds bank into the 529 plan where they came from. Current regulations allow you to deposit those funds within 60 days to avoid taxation and possible penalties on the 529 distributions.

Tip #5 - Suspend or Eliminate Employer Contributions (For Business Owners)

At present, many business owners are struggling to keep their business afloat. In addition to SBA loans and other assistance the government may be providing, business owners should consider the elimination or suspension of matching contributions into the company’s 401(k) plan (if possible). If the plan is considered a safe harbor 401(l), there may be language in the plan document that allows temporary suspensions of the employer contributions. If the plan document does not contain this language, section 412(c)(2) of the Internal Revenue Code allows the company to suspend contributions in certain circumstances. For some businesses, it may be worth amending the plan document to allow for the suspension of employer contributions. Please consult with your third-party administrator as this may result in losing the status of being a safe harbor plan.

Tip #6 - Consider a Loan Instead of Account Distributions (For Retirees)

In retirement, the sequence of investment returns can be one of the most important determinants of retirement success. A financial plan can be crippled if an individual retires into a bear market. The impact occurs for two reasons. First, sharp losses take longer to come back from. If your account goes down 50% and your $200 goes down to $100, a 50% return does not get you back to $200, it would only get you to $150. You need a 100% return to get back to $200 in this example. Furthermore, if you are taking distributions from your portfolio to meet your living expenses and the market is down 50%, you are locking in that loss for each dollar you withdraw from the account. To mitigate the damage, if a client has other funds they can use for six months to a year while the market is down, they may be able to better position themself for a sound retirement. I hate debt more than anyone but in some circumstances, refinancing your home, looking at a line of credit, or even a margin loan on your investment account could be solutions to the issues created when the sequence of returns does not work in your favor. We use TD Ameritrade and Interactive Brokers as custodians to safeguard our client’s assets. At Interactive Brokers, there is a good chance the margin rates are less than 2% in the current environment. We are not talking large dollars. Possibly, just $25,000 to $50,000 to meet a year of living expenses. When the market recovers, you would pay back the loan and continue pursuing your dreams in retirement, but there is a good chance you would be better off when you do so.

Please reach out to us at (720)588-4103 if you have any questions about our Noble Wealth pro tips of the month. We are happy to help.

What We’re Reading

A better question for this month is, what aren’t we reading? There is so much information about the coronavirus, investing opportunities, planning opportunities for clients, and don’t forget about the election this fall. If you are interested in data written by experts on addressing pandemics using measures like social isolation, please read this report written by the Imperial College COVID-19 Response Team.

What Have We Been Doing?

We should probably leave this section out for the newsletter for the next few months…

Until next month,

Grant and Jeff