NWP Monthly Digest | April 2021

The Stock Market Fell 20% Last Night 🤯

April Fools! Oh my, what a tradition. It’s the one day a year we all have a weak excuse to orchestrate simple-minded jokes without facing the full recourse of our actions. But why do we celebrate this shallow holiday? Maybe it’s human nature, and we were always searching for justification for our distasteful actions. The exact origins of April Fools’ Day are unknown. Some point to the year 1582, when France switched from the Julian calendar to the Gregorian calendar, where the new year started on April 1st. Those slow to get the news and recognize the beginning of a new year became targets for pranks. In one example, paper fish were placed on an individual’s backs, then referring to them as a “poisson d’arvil” (April fish). This was said to symbolize a young, easily caught fish, and a gullible person. As a teenager, I embraced the holiday with open arms. When I was 12 years old, my brother and I planned our prank in February. We took the milk from the refrigerator and malevolently giggled as we placed the milk in the back of the furnace room. On March 31st, after everyone had fallen asleep, we rubbed off the expiration date and put the milk in the refrigerator. When I woke up the following day, I went to the kitchen half-asleep. My dad was patiently waiting at the kitchen table. He offered to make me some breakfast enthusiastically. “Can I pour you a bowl of Raisin Bran?” He said. I started laughing and asked him if he tried the milk? He replied, “I ate some cereal today. And I’ve never had cereal that tasted that bad!” Since then, life has kept me busy, and I haven’t been able to carry on the French's ancient traditions. I can imagine them yelling at me, “Vous ennuyeux Américain!” Maybe this year, I can atone for my lethargic lifestyle.

In January, my wife bought a Ring doorbell. She notifies me any time someone is at the door or if a package is outside. She watches the app like a hawk. In 2021, I will regress to my teenage persona and make 12-year-old Grant happy I did not grow up to be a total bore. Today, while my wife is working and I’m conveniently at the grocery store, I’m going to have people pretend to break in through the front door, carry our valuables to their car, and race off. Perhaps, this April Fools’ joke will honor the heritage of the french. If not, I can blame them for a swift divorce 😉

Perhaps my April Fools’ Joke is residual boredom from the pandemic that kept the world locked in their homes. Many of us are waiting for the opportunity to return to normalcy after being deprived of the outside world like Tom Hanks in Castaway - Mr. Wilson! We are all eagerly waiting for the vaccine to rescue us like the cargo ship that saved Chuck (Tom Hanks's character in Castaway). Currently, around 15% of the U.S. has been vaccinated, and herd immunity is within striking distance. I can only assume this means the end of my childish April Fools’ jokes. My son is going to be born this month! I hope he will make the french proud and carry on their historical traditions - but please don’t serve me spoiled milk 🙏

This March has been full of madness, and it’s only fitting for me to dunk some exciting facts in this newsletter for all the readers. A lot happened in the month of March, but I’m only listing the facts that made the Elite 8 in this newsletter. I don’t want to bore you with details that did not qualify for the tournament - I’m looking at you Colorado State 😉

1 - Time Changes Everything

A lot has changed since the last newsletter I wrote on February 1, 2021. Since then, the GameStop and meme-stock craze has petered out. Investors are no longer trading in a speculative frenzy playing catch up as they watch Reddit posts showing the Average Joe win the lottery. Two days ago, on March 30, 2021, stocks set a 2021 volume low for the second consecutive day. Just 10.3 billion shares traded hands on the New York Stock Exchange and Nasdaq. That's less than half of the total from the year's highest volume day on January 27, the peak of the GameStop and meme-stock craze. Furthermore, what a difference a year makes? Many of you remember our conversations when we encouraged you to take more risk in your portfolios in mid-March of last year. Let’s take a look at an excerpt from the newsletter I wrote exactly one year ago:

“Buy stocks when there is blood in the streets, even if it is your own blood.” - Baron Rothschild

By the time the clouds begin to clear, the market will have already shot up, and it may be tough to catch. Don’t focus on the headlines, focus on the fundamentals and stay rational. The average investor’s inability to stick to the plan is the reason the investment experience for the average investor is significantly different from those taking a long-term approach. From 1998 until 2018, the average investor lagged a portfolio of 60% stocks and 40% bonds by over 3% annually! How did this happen? It’s simple, they forgot the first rule of investing - buy low and sell high.

During that time, I told my clients, “I don’t know when the bottom will be. All I know is you are getting one heck of a deal right now, and when you look back a year or five from now, it’s hard to imagine a scenario where you would be disappointed with your decision. At Noble Wealth Partners, we are not market-timers, but we know how to spot good value.

2 - Women’s History Month

Yesterday was the end of women’s history month. I hope the readers have taken the time to educate themselves on the gender gap in today’s society. We have made incredible strides, but we still have a long way to go. Last month, I read some constructive news on the subject - 17.8 million college students enrolled in the fall of 2020. Of those, 59% were female! The pendulum is swinging, and our country needs to strive toward labor equality. All business owners have an incentive to strive toward labor equality. If we put our efforts into equal pay and equal participation in the labor market, we have the potential to add 15 million females to the workforce and increase U.S. GDP by 7.3% (US Bureau of Labor Statistics; GSAM).

3 - Do We Need to Bail Out Bondsmen?

Are we headed for the worst year of bond market returns over the last 45 years? As of March 25th, 2021, the taxable bond market was down 3.13%. The prior record loss was 2.92% in 1994. Does this mean you should abandon your bond allocation in your portfolio? Would you stop paying for fire or flood insurance because the costs outweigh the benefits? Think of your bond allocation as your insurance policy. It may detract from your performance, but it helps you sleep at night when the market drops 30% in one month. If you do not mind seeing intermittent volatility in your portfolio and you have the wealth to support your lifestyle even if your portfolio takes a hit, then you may be a candidate to shed bonds from your portfolio. Either way, please seek competent help from a professional before you reach your final decision.

4 - Be a Farmer, Like Bill Gates

Maybe one day, my son will tell me, “when I grow up, I want to be a farmer, just like Bill Gates.” Did you know Bill Gates is now the largest private owner of farmland in the US with 242,000 acres (The Land Report)? I came across this fun fact last month and had to share it in the newsletter. I know it is random, but it’s all part of the March Madness.

5 - Bankruptcies Are…Down?

The pandemic broadsided many households, and they have yet to recover. Others seem to be doing just fine. Some readers are aware of what pundits are deeming a K-shared recovery. I was shocked to learn that only 522,808 Americans filed bankruptcy in 2020, down 30% from 752,160 filings in 2019 (US Courts, Table F-2). Without the unprecedented stimulus measures taken over the last year, this number would surely be higher.

6 - Speculation Is Down, but Not Out

What about Archegos, a present-day version of the collapse of Long Term Capital Management (LTCM). Both are firms established to manage the wealth of the ultra-wealthy. LTCM was established as a hedge fund, and Archegos was set up as a family office. The similarities are striking both leading up to the collapse and subsequent fall. What caused this collapse? The answer is almost always leverage.

“Leverage is like driving with a knife glued to your steering wheel and pointed at you. It can promote better driving but when things go bad, it’s fatal.” Warren Buffet

Ironically, LTCM started their name with the words, “long-term"?” LTCM was founded in 1994 and went bust just four years later. A repugnant solution for the high net worth and accredited investors to preserve a legacy. But to the investors on Reddit, four years is an eternity.

Many investment legends have not held their tongue when discussing the meme craze and investment frenzy into names left for dead. “I hate this luring of people into engaging in speculative orgies,” Mr. Munger said. He added, “It’s really just wild speculation, like casino gambling or racetrack betting. There’s a long history of destructive capitalism, these trading orgies whooped up by the people who profit from them.” Charlie Munger Renews Robinhood Criticism, Likens App to Racetrack Betting - WSJ

A preview of the image by the artist Beeple that was sold for 69 million dollars

7 - Non-Fungible Tokens

The cousin of the stir-crazy movement of new investors looking for a place to park stimulus checks goes by NFT. NFT stands for net-fungible tokens. No, I did not misspell the prior sentence. Ok, yes, I did. If you noticed, it should have been non-fungible tokens - you passed the test. In just one month, collectors and speculators have spent more than $200 million on NFT-based artwork, memes, and GIFs!

But what are these new forms of payments using technology from the blockchain? NFTs are similar to virtual proof of ownership or a deed. The scarcity has made many of them valuable. Lindsey Lohan, Paris Hilton, and Rob Gronkowski are just a few examples of the famous people trying to cash in on this latest fad. The digital artist known as Beeple just sold a digital image or JPEG file for 69 million dollars! In a CNBC interview, the buyer stated they were willing to go even higher.

8 - Please Teach Your Children Personal Finance

Many states do not require our country's youth to learn this beneficial information in high school. Junior Achievement and other programs are helping, but it is not enough. Even if they are learning this information in school, I encourage you to further educate your children on the subject. Your knowledge and direction could be the difference between their financial independence and being buried in debt. I included a map of the progress each state has made toward rolling out financial education. If you’re with me in Colorado, we have a long way to go…If you need help, please reach out. I have volunteered with Junior Achievement, and I am more than willing to help if you are interested.

Noble Wealth Pro Tip of the Month

Tax Tips Regarding the Latest Stimulus Legislation

The pandemic's most recent stimulus package, the American Rescue Plan Act of 2021 was signed into law on March 11, 2021. The plan injected $1.9 trillion into the economy and was intended to provide relief to those most impacted by the pandemic. But what does it mean to you? Key levels to pay attention to on your 2019 and 2020 tax return are $75,000 for individuals and $150,000 for joint returns. If you are significantly above or below these thresholds, there may not be any opportunities. If you are around these levels, you may want to schedule a meeting with your accountant to ensure you utilize these benefits to their fullest extent. We are also available if you would like to use us as a resource.

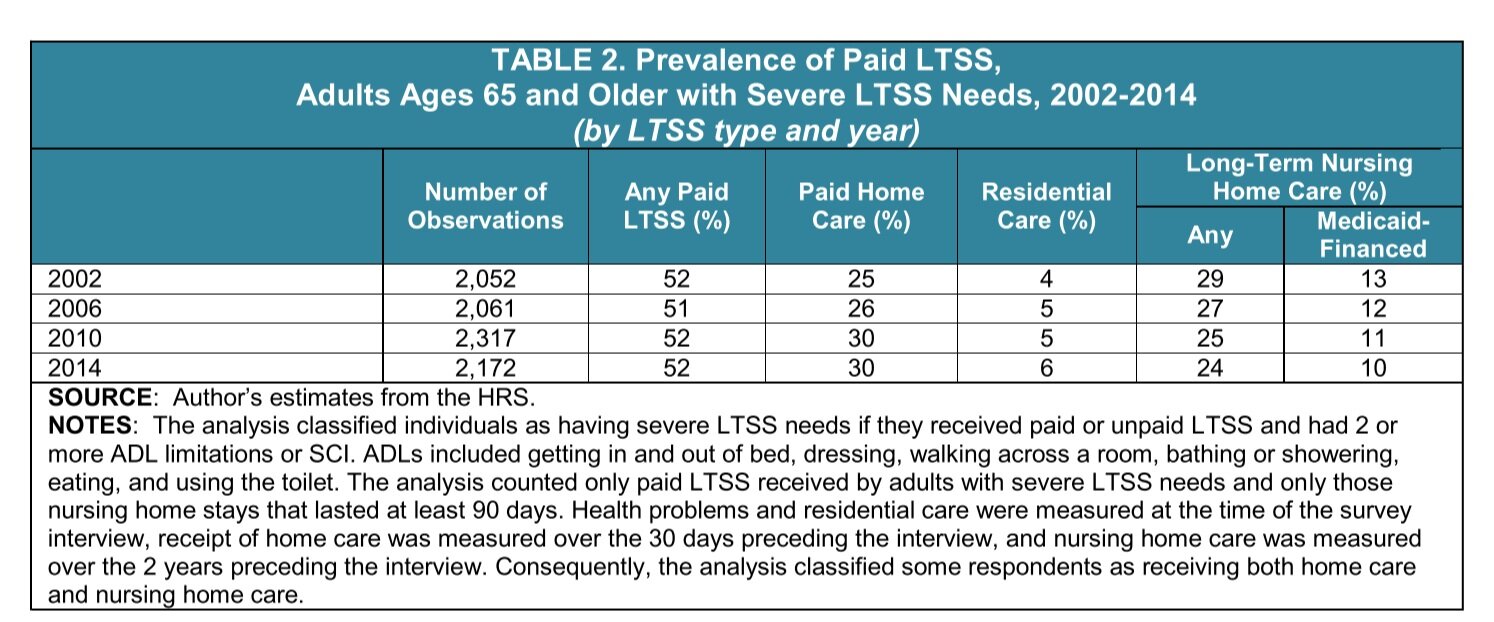

Should You Buy Long-Term Care Insurance?

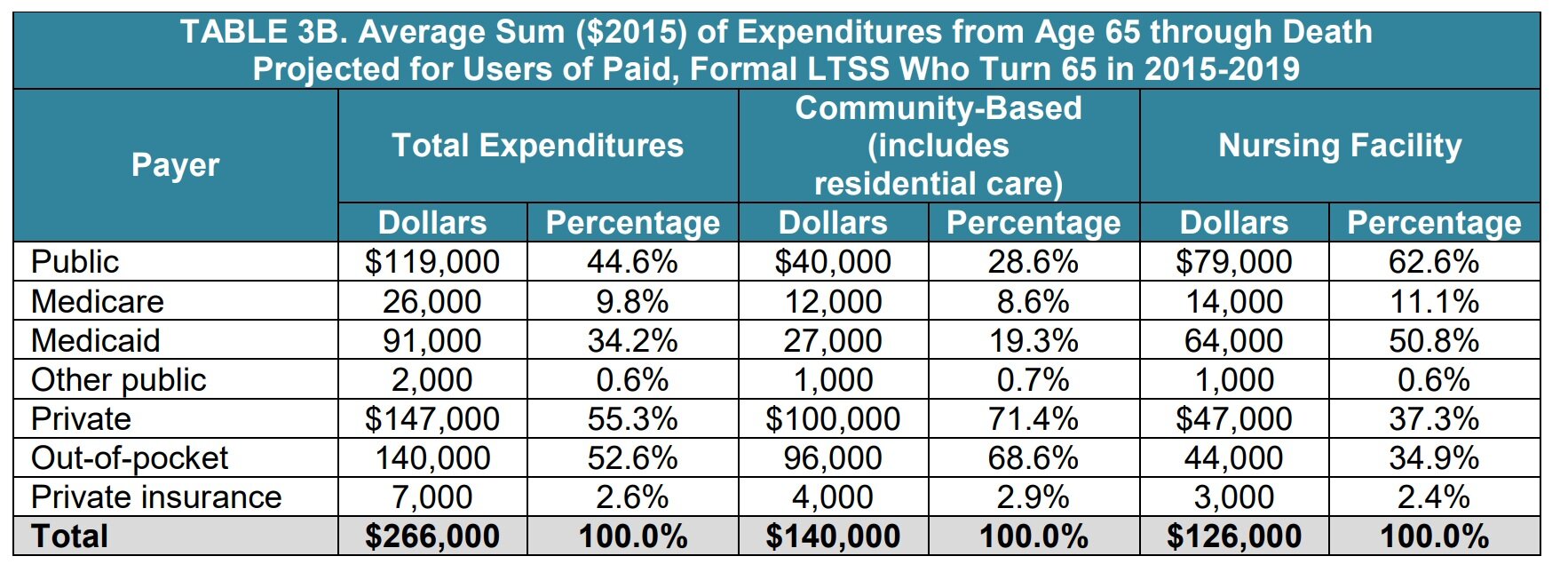

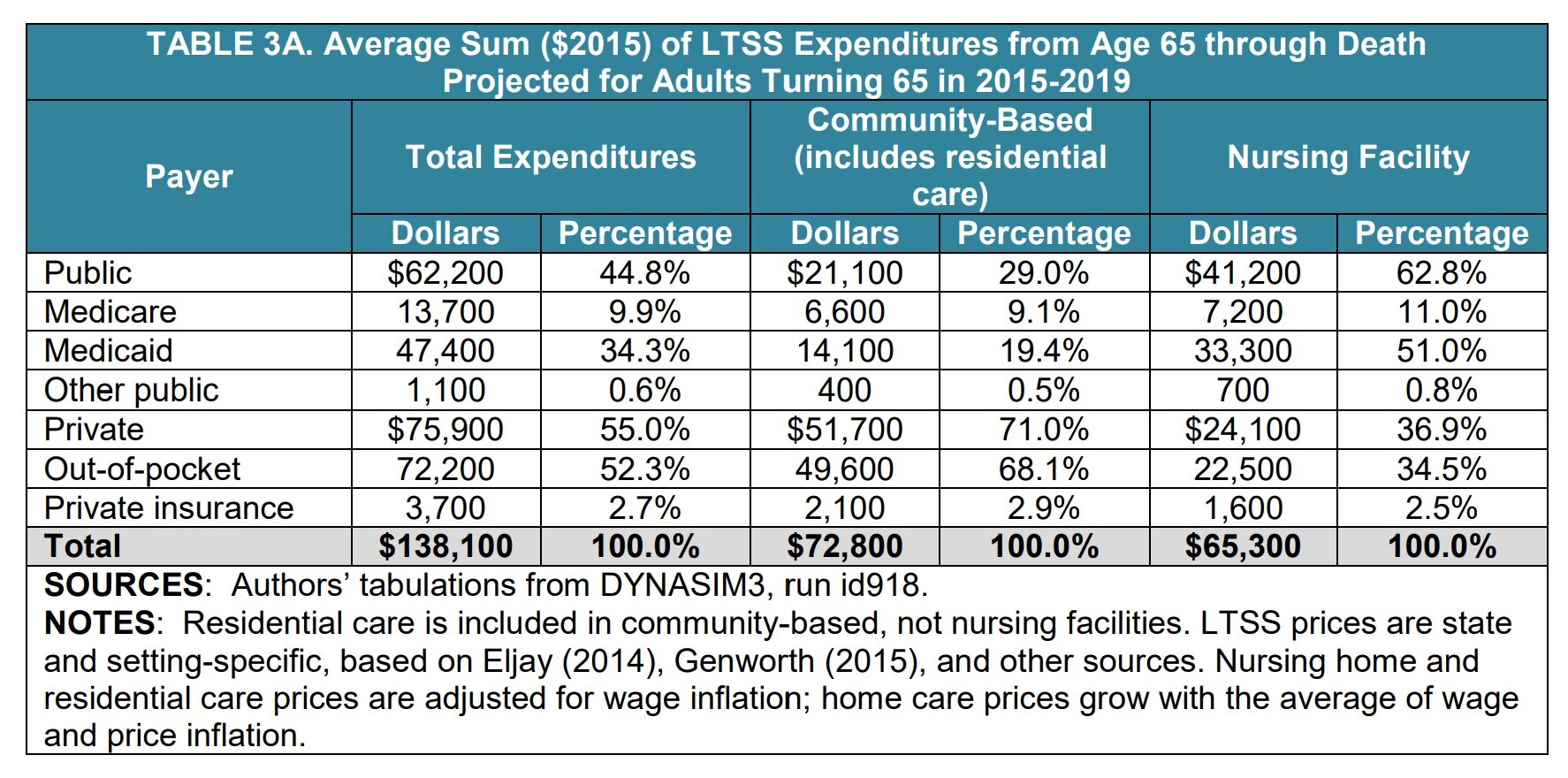

AARP estimates 52% of all Americans turning 65 today will need some form of LTSS (long-term services and support) at some point during their lives. On average, the duration of the need is around two years. The average American will need 138,100 for long-term care services. Is it prudent to purchase a long-term care policy to preserve your wealth? As I was playing tennis last month, a friend of mine said it best, “Do the insurance companies price the policies so that you have the upper hand?” But sometimes, the right decision is not the optimal one. If you don’t feel you need the protection, you may be able to stop there. Does this decision invoke an emotional response from you due to the experiences and circumstances in your life? IF so, perhaps you should seek help from a professional to talk you through your options. At Noble Wealth Partners, we do not sell insurance or earn commissions on any insurance products, but we are happy to spend the time you need to be comfortable with your decision.

Things We’re Reading and Enjoying

Range: Why Generalists Triumph in a Specialized World | by David Epstein (Book)

The #1 New York Times bestseller that has all America talking: as seen/heard on CNN's Fareed Zakaria GPS, Morning Joe, CBS This Morning, The Bill Simmons Podcast, Rich Roll, and more.

Plenty of experts argue that anyone who wants to develop a skill, play an instrument, or lead their field should start early, focus intensely, and rack up as many hours of deliberate practice as possible. If you dabble or delay, you’ll never catch up to the people who got a head start. But a closer look at research on the world’s top performers, from professional athletes to Nobel laureates, shows that early specialization is the exception, not the rule.

What if it Doesn’t End Badly? | by Michael Batnick (Short blog)

Michael Batnick goes through the hardest question investors have to face - when will a bull market decide enough is enough?

The return on certain individual securities makes the overall stock market look like a savings account. Over the same time, Apple and Amazon have gained more than one thousand percent. Netflix more than two thousand percent. Tesla more than sixteen thousand percent. $10,000 invested in Bitcoin five years ago is worth $1.2 million….

So it’s no wonder that old-timers who have seen this movie before think that this one ends badly, like all of the others before it

The Get Rich Portfolio | by Meb Faber (long-form blog)

I really love Meb Faber and his approach to looking at investing. The best part of this piece is discussing the different types of portfolios for different people and the risks they each would have to endure.

“More money” of course is always relative. $100,000 in net worth places you in the global top 10%, but for many that would not last a hot minute. $1,000,000 vaults you into the top 1%, but for some, only Tres Comas would only suffice. Research has shown that regardless of how much money people have everyone always says they want more.

Until next month,

-Your team at Noble Wealth Partners

“Noble deeds that are concealed are most esteemed.” Blaise Pascal