NWP Monthly Digest | September 2025

Kids are back in school, Warren Buffett turned 95, and Starbucks brought back the Pumpkin Spice Latte last week. As much as it pains me to admit it, summer is officially behind us. Welcome to colorful September! And the leaves will be falling along with the federal funds rate later this month.

The stock market has once again charged ahead to new record highs on the back of lower-than-expected tariffs, the resumption of earnings growth, a resilient economy, and the prospects of a cut to the federal funds rate. But another factor propelling the stock market higher is the prospects of artificial intelligence and the hundreds of billions of dollars the tech titans have put into this new technology. For that reason, I wanted to take a deeper look at artificial intelligence and the implications for our society as a whole in this month’s newsletter. But before jumping into that topic, I'd like to address the noise surrounding the Federal Reserve and the importance of their independence, as it's been all over the headlines.

Threats to Federal Reserve Chair Jerome Powell continue from the president, leaving the market uneasy about the implications—and for good reasons. The bond market is providing us with a clear signal of investor angst over these prospects. The NOB yield (notes over bonds), which measures the difference between 30-year notes (the long end of the yield curve) and 10-year bonds, is currently at its widest point in the past four years. Why, you ask? Strong economic growth and/or elevated inflation expectations are lifting interest rates at the long end of the curve. And while this backdrop usually wouldn’t justify cutting rates or easing monetary policy, political pressure on the Federal Reserve could lead to premature rate cuts at a time when inflationary pressures from tariffs could reignite the surge we saw a few years ago. If this were to materialize, it would resemble the 1970s, which proved detrimental to both stock and bond portfolios.

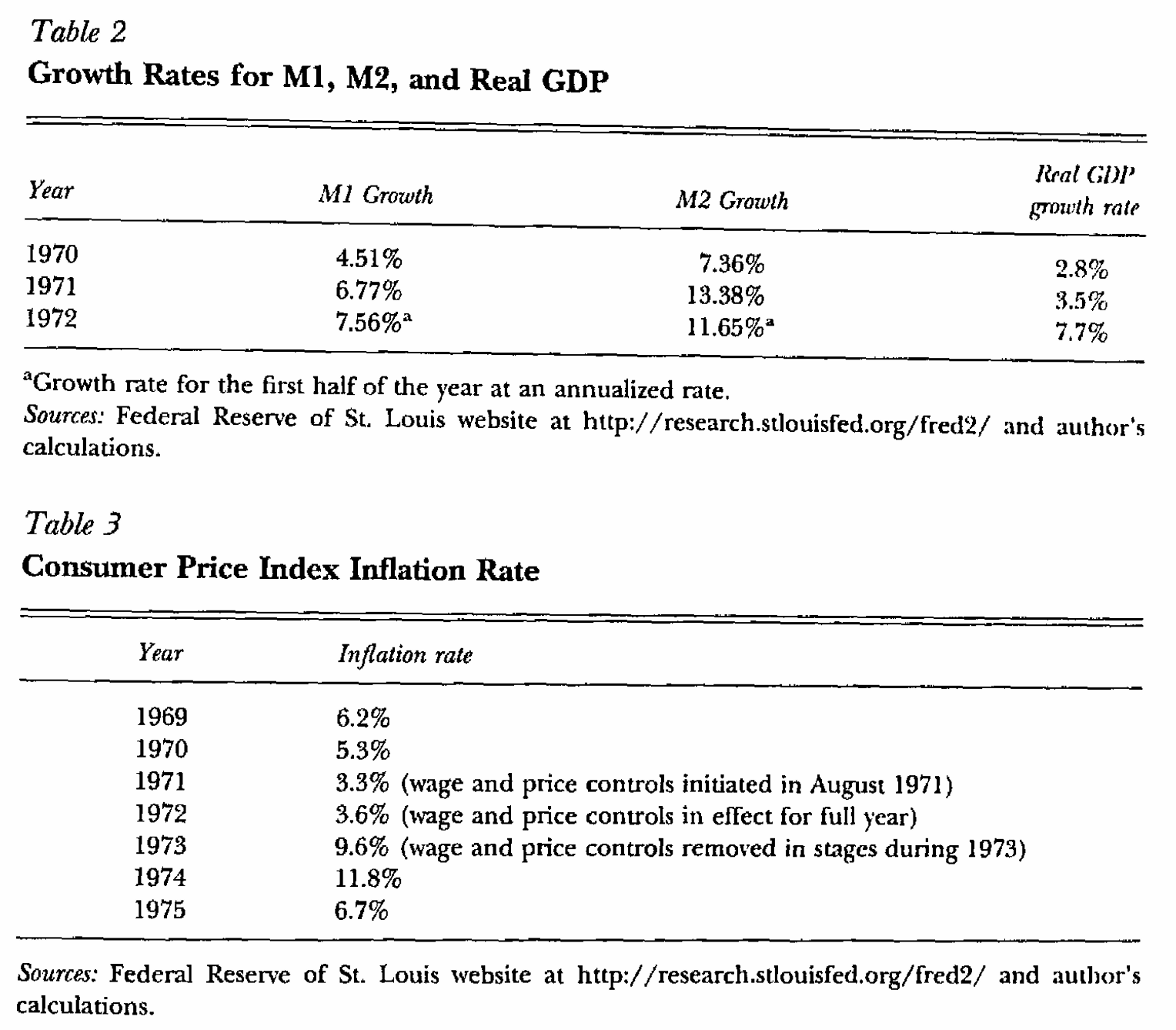

The blue line in the chart represents the personal consumption expenditures index excluding food and energy, also known as core PCE, which is the Fed's preferred inflation gauge. While this line appears to show low inflation, it was purely the result of wage and price controls implemented from 1971 through 1973. Once those controls were lifted, inflation skyrocketed.

A history lesson in economics would spell out the dire consequences of the administration pressuring the Federal Reserve. The inflationary disaster of the 1970s was partly caused by the political pressure Richard Nixon put on Fed Chair Arthur Burns to engage in expansionary monetary policies ahead of the 1972 election, as revealed in the Nixon tapes. Although Burns was a renowned economist, Nixon sought him out because he was a loyal Republican. It's clear Nixon, through various channels, had convinced Burns to pursue an expansionary monetary policy. In the chart, you can see that despite rising inflationary pressures and steady or falling unemployment, the Federal Reserve mistakenly lowered discount rates from 6% to 4.5%. Within just a couple of years, inflation climbed above 10%. Caving to political pressure and maintaining an accommodative monetary policy that was either too aggressive or lasted too long may have laid the foundation for the persistent and uncontrollable inflationary pressures that lasted through the 1980s.

What made these inflationary pressures particularly painful was that tightening monetary policy worsened an already fragile labor market. In normal times, inflation stems from a healthy economy and strong labor conditions, where prosperity drives consumers to increase demand for goods and services, ultimately pushing prices higher. Conversely, a deteriorating labor market usually coincides with lower demand and decreasing prices. However, during the 1970s, the Fed was at an impasse with rising unemployment and inflation. Today, we know this phenomenon as stagflation. The Fed needed to raise interest rates to control inflation, but raising them aggressively slowed economic growth and increased unemployment further. Ultimately, the Fed, led by Paul Volcker, ripped off the band-aid and hiked rates to 20% by 1981. Though this aggressive policy led to a recession, these measures were taken to curb inflation.

Jerome Powell was nominated by Donald Trump in 2018. While Powell has leaned toward more expansionary policies during his term in line with the administration’s wishes, he has repeatedly stated that he does not want to risk a policy mistake like the 1970s. Yet the pressure from the administration and the relentless attacks on Powell have not let up. This combination of potential political influence and concerns over stagflation has investors on edge. The unemployment rate remains very low by historical standards. The Fed’s preferred inflation gauge (Core PCE) is currently hovering around 3%, still above the 2% target, and has remained sticky over the past few years. Cutting rates would only be justified if the labor market were weakening. By entering a rate-cutting cycle now, the Fed is either making a policy mistake reminiscent of the 1970s or signaling that the economy is not as strong as believed. It has to be one or the other—you can’t have your cake and eat it too.

Interfering with the Fed and pressuring for accommodative policies while the labor market remains healthy and inflation runs above target makes the parallels with Nixon’s administration easy to draw. But what if the administration were able to compromise the independence of the Federal Reserve and appoint sycophants willing to pursue its agenda, easing monetary policy despite the risks? In that case, policy could be used to inflate asset bubbles and potentially trigger out-of-control inflation. The consequences might not surface for a decade or two, but eventually, the price would have to be paid. There’s no free lunch here. These are serious risks that shouldn’t be dismissed, which helps explain the market’s reaction. Still, there’s no need to lose sleep, as the risks remain relatively low. While they are rising, an imminent crash in the economy or stock market is unlikely. Our base case continues to be one of Trump-driven euphoria in the markets, with the economy running at above-trend growth. So don’t go running for the fences, as it’s far too early to make adjustments to your portfolio, but these risks warrant close monitoring.

With that out of the way, let’s jump into AI…

Is AI Making Us Stupid?

AI adoption is rapidly spreading across industries and has the potential to add trillions of dollars to global GDP through productivity growth, labor market disruption, and the acceleration of innovation cycles. As an example, AI could surely write this newsletter in seconds when it takes us hours, though I'll explain why it's important for us to avoid delegating these tasks to AI (though we rely on Grammarly to avoid looking stupid—which our clients appreciate😉).

Like any transformative technology, there are externalities, ranging from widening inequality between workers, firms, and nations to challenges in reskilling workers. But I’m going to explore the cognitive price we may be paying by increasing our reliance on this technology.

When society adopted transformative technologies in the past, scientists observed negative impacts on our cognition.

In the late summer of 2008, Nicholas Carr published an article titled “Is Google Making Us Stupid?” which was highly critical of the internet's effect on cognition. The main argument was that the internet has detrimental effects on cognitive function, diminishing our capacity for concentration and contemplation. Although internet mapping services and GPS navigation are extraordinarily helpful, overreliance on GPS has had a traumatic impact on our spatial memory. It affects our ability to recognize landmarks and navigate without assistance, making individuals less adept at using visual cues in their environment to orient themselves. Other studies have shown an increased risk of Alzheimer’s and dementia for those who are overly reliant on GPS.

If neurologists have observed such negative impacts stemming from the use of technology like GPS—which we use for such a small fraction of our day—how serious are the implications of using AI as part of our daily lives? Only time will tell the true impact of broad AI adoption on our cognitive abilities, but so far, the research is daunting.

MIT recently released a report demonstrating the pressing matter of a likely decline in learning skills based on their study results. Although the benefits of using AI were initially apparent, over the course of four months, they observed a significant decrease in brain activity, resulting in low use of neural pathways, cognitive dependency, and skill erosion.

I was watching Wimbledon this year, and when Alcaraz hit a serve at 230 kilometers per hour. But how fast was that in mph? Since one mile is about 1.6 kilometers, I could divide 230 by 1.6—but I had left my phone in the car. With only a pen and paper handy, I figured I could knock out the long division in no time, right? I used to solve this in 15 seconds… but that was 35 years ago. This time, it took me three tries and several minutes instead of seconds, highlighting the “use it or lose it” concept for our brains. While it’s a skill we may never need again, it underscores the risks of allowing technology to replace the thought processes that make us human.

Are We Destined to Become Zombies, Unable to Think for Ourselves?

If we rely on AI to perform many of the thought processes we use on a daily basis without intention, what MIT researchers call passive use of AI, there can be dramatic effects on our cognition. Fortunately, the paper argues that the use of AI assistance can amplify human intelligence when used with active, reflective engagement, fostering learning and growth.

While the threat of displacement is a frightening prospect, we can harness the technology and use it to prosper—and society will benefit. One example of this can be seen in my line of work (financial planning), where technology has significantly enhanced the value of working with a financial advisor. In the ’70s and ’80s, a client would discuss investments with a financial advisor, and that advisor would mainly sell a specific mutual fund and receive about six cents on the dollar for doing so, while providing little financial planning or assistance with a client’s financial goals. That client wouldn't receive ongoing advice unless they had new money to invest—clearly, not the best compensation structure to align the interests of brokers and clients. In the ’90s and early 2000s, investing in a stock meant paying $100 or $200 in commissions just to buy something like Apple. Now, those commissions have largely disappeared, which means financial advisors have to provide holistic financial planning for their clients and structure their fees so that interests are aligned.

The AI revolution will also benefit clients. Financial advisors who do not provide proactive service and advice—those who only respond to client inquiries or meet with clients upon request—may see their businesses deteriorate. To thrive in a world where AI is prevalent, advisors need to engage proactively and offer valuable advice. If they fail to do so, they may not be considered worth hiring.

I don’t want to dismiss or be insensitive to the careers that may be displaced, as technology often makes our output more productive. Like robots building cars, progress comes with a loss of humans performing much of the work, but many careers can adapt and deliver greater value to customers.

As long as we adopt AI responsibly and with purpose, we should be able to enjoy the benefits while remaining mindful of the risks—especially concerning our cognitive health. During this busy season, it can be tempting to let AI handle the writing of our newsletters, but Jeff and I truly enjoy writing these blogs and newsletters ourselves. It allows us to gather our thoughts and keep our skills sharp. We want to ensure that our useful abilities do not diminish and suffer the same fate as long division.

Use AI wisely to increase your productivity and quality of work, but avoid overreliance on this tool. Perhaps, there should be a warning disclaimer for AI tools similar to a bottle of alcohol:

Use AI in moderation

Excessive reliance may be harmful to your cognitive health

Use AI responsibly,

And never, under any circumstances, use it while driving.

Noble Wealth Pro Tip of the Month

OBBBA Takeaways and Strategies

The bill was signed into law on July 4, 2025. Most of the bill permanently extended provisions from the Tax Cuts and Jobs Act, while other parts were modified either temporarily or permanently, and several new provisions were added. There’s a lot to digest, so I won’t cover every change, but I want to highlight some aspects of the bill that may be relevant.

The itemized deduction for state and local taxes (SALT) was quadrupled to $40,000. However, taxpayers with adjusted gross income above $500,000 need to be aware of phaseout thresholds, as this deduction can be reduced back down to the previous $10,000 cap.

Beginning in 2026, charitable contributions will change. Only contributions exceeding 0.5% of income will be deductible. At the same time, non-itemizers will be eligible for an additional deduction of $1,000 for single filers and $2,000 for married couples filing jointly.

Educator expenses will no longer be allowed as an itemized deduction starting in 2026.

There were also significant changes to the Alternative Minimum Tax (AMT). This provision ensures high-income earners pay a minimum level of tax. For married taxpayers filing jointly, the first $137,000 is exempt from AMT. However, once income exceeds $1.274 million, that exemption phases out. Beginning in 2026, that threshold drops to $1,000,000. Households at or near this level with unexercised incentive stock options may want to carefully evaluate whether exercising them this year makes sense to avoid a much higher future rate. In 2026, the higher SALT deduction limit will also make it easier for some households to be subject to AMT. For married couples, the greatest risk of AMT exposure is between $300,000 and $500,000 of taxable income.

Businesses will continue to benefit from 100% bonus depreciation.

Several new provisions were introduced:

A refundable tax credit for seniors and no tax on tips or overtime

Seniors should note that the refundable tax credit phases out at $150,000 of income for married filers, the same threshold that applies to the tax credits for overtime pay and tips.

A deduction for auto loan interest

Also subject to income limits.

Expanded qualified 529 expenses

Trump Accounts were created (see the section below for more information)

If any of these provisions may be relevant to your financial situation, our team would be happy to take a deeper dive with you. Please don’t hesitate to reach out.

Trump Accounts for Kids

After the One Big Beautiful Bill Act was signed into law, children born between January 1, 2025, and the end of 2028 will receive a $1,000 contribution from the Treasury Department into these accounts. Parents and others can contribute as well, and additional Trump accounts can be opened for any child with a Social Security number who is under 18 in the year the account is established. Parents, relatives, and friends can contribute up to $5,000 annually before the child turns 18, and employers can contribute up to $2,500.

Those considering contributions should proceed carefully, as the taxation can be complex and may outweigh the benefits. While the accounts grow tax-free, withdrawals are taxed at ordinary income rates. If the funds are not used for qualified purposes, such as higher education or retirement after age 59½, a 10% penalty may also apply. The taxation works much like non-deductible IRA contributions: you can withdraw your contributions tax-free, but all earnings are subject to tax—and yes, the Treasury’s $1,000 contribution is treated as taxable earnings.

If you add your own contributions, the account will include an after-tax portion (your contributions) and a taxable portion (earnings plus the Treasury’s contribution). You’ll need to track these amounts over the years to properly classify withdrawals.

Unlike 529 plans, once the child turns 18, the money is fully theirs. It’s important they understand the tax rules and implications to avoid unnecessary costs.

In short, you should certainly accept the free $1,000 from the Treasury, but think carefully before adding more. If you’ve already maxed out all other tax-advantaged accounts like 401(k)s, IRAs, and 529 plans and still want additional tax-sheltered savings, this may be worth exploring. Otherwise, you may be better served evaluating alternatives such as a standard brokerage account, where dividends and capital gains could be taxed at more favorable rates, before committing extra dollars to these new accounts.

Fun Facts of the Month

Wall of Worry: Individual investors became more bearish last week even as markets made new all-time highs. Since the weekly AAII sentiment survey began in 1987, the bull/bear spread (currently -16.3 ppts) has only been lower in the same week that the S&P 500 made an all-time high two other times in 2013 (AAII.com).

Tariffs Add Up: U.S. tariff revenues topped $27 billion in July, and if current rates hold through 2034, they will bring in an estimated $2.8 trillion. That’s close to the same amount of deficit offset from adding a 1% payroll tax ($1.3 trillion), a 25% carbon tax ($919 billion), and a 17% cut to military personnel (~$959 billion) combined (CRFB.org).

Producer Price Spike: While consumer prices (CPI) for July were in line with estimates at 0.2% month-over-month, producer prices (PPI) rose 0.9% month-over-month versus estimates of just 0.2%. It was the hottest PPI report since June 2022 and only the 15th time since 1998 that economists underestimated the number by 0.7 percentage points or more (BLS, Bloomberg).

Price Cuts: 25.6% of all properties listed for sale on Zillow had a price cut in June, up from 23.5% last June and a June low of 11.4% in 2021. Denver, Phoenix, and Raleigh had the highest percentage of price cuts, at 35% or more, while Milwaukee, Hartford, and New York were all below 15% (ResiClub).

Buyers’ Market: The typical home sold in July spent a median 43 days on the market — 8 days longer than a year earlier. That’s the longest time on the market for houses sold in July since 2015. All four regions in which homes were sold in July were in Florida (Redfin).

New Homes on Sale: The median national listing price for a newly built home remains about 8% higher than that of an existing home ($451K vs. $418K), but new homes are now cheaper than existing homes on a per-square-foot basis ($218.66 vs. $226.56), with the South and West offering the biggest discounts due to higher inventories and weak demand (Realtor.com).

It Pays to Stay: At the end of 2022, median wage growth for Americans who switched jobs ran a record 2.2 percentage points higher than wage growth for those who stayed at their current jobs, but as of this July, wage growth for “job switchers” versus “job stayers” has flatlined for the first time since October 2010 (CPS, Atlanta Fed).

AI to Upend Advisors: A recent report from Microsoft listed the 40 occupations most likely to be replaced by AI. These occupations employ a total of 8.5 million workers, or 5.3% of the total U.S. workforce. Number 30 on the list was the country’s 272,190 personal financial advisors (Microsoft Research).

Six-Figure Tuitions: The total “all-in” cost of attending Wellesley College for one academic year exceeded $100,000, making it the first U.S. college or university to cross this six-digit threshold. For the typical undergraduate family, however, average spending in the last academic year was $30,837, and 27% was covered by scholarships and grants (Wellesley College).

Alcohol Decline: The percentage of U.S. adults who consume alcohol dropped to 54% in 2025, the lowest level since at least 1939. For the first time since at least 2001, more than half of adults say drinking is bad for their health, led by 18–34-year-olds at 66%. 46% of Republicans drink compared to 61% of Democrats (Gallup).

Bay Area Billions: There are now 498 private “unicorn” AI companies worth $1B+ and 1,300 worth $100M+, according to CB Insights. The number of millionaires in the Bay Area has doubled over the past decade due to the AI boom, and there are now more billionaires in San Francisco (82) than in New York (66) (CNBC).

College-Educated Job Struggles: In the NY Fed’s tri-annual Labor Market Survey, the percentage of college-educated workers who received a job offer in the last four months fell from 21.4% two years ago to just 13.9% in July. Over the same period, the percentage of non-college-educated workers who received an offer rose from 18.4% to 20.1% (NY Fed).

Watts Up with the Electric Bill?: Thanks mostly to data center proliferation and their electrical intensity, the average price of a kilowatt-hour of electricity has increased on a year-over-year basis in 43 out of 50 states this summer. Increases have been the largest in Maine (+37.3%), Utah (+13.7%), and New York (+11.8%) (Washington Post).

Round Trip!: After experiencing a 99% drawdown from $370/share in August 2021 to $3.70/share in December 2022, online used car company Carvana (CVNA) traded above $400/share on 7/31 to make a new all-time high. Since the 99% drop, CVNA shares have rallied 10,600% (Bespoke).

Ownership Dropping—Especially for Lower Incomes: The U.S. homeownership rate declined to 65.0% in Q2 2025, the lowest since Q4 2019. Among U.S. households with family incomes above the median, the homeownership rate increased to 78.7%, while the rate among households with incomes below the national median dropped to 51.4%, the lowest since Q3 2019 (U.S. Census).

Higher Income Defaults Accelerating: The percentage of auto loans past due by at least 30 days has increased by 10.6% over the last two years; however, the rate of increase for consumers with incomes above $ 150,000 rose to 19.8%. The delinquency rates for credit card loans have increased 6.7% overall and 27.6% for higher-income consumers (VantageScore).

Record Year for Metals: Through the market close on 7/8, gold (25.6%), platinum (55.6%), silver (25.7%), and copper (41.2%) were all up at least 25% year-to-date. This is the first time since 1990 that all four metals have been up over 25% year-to-date through 7/8 (Bespoke).

Top State: North Carolina won CNBC’s annual Top States for Business crown in 2025 for the third time in the last four years. Texas, Florida, Virginia, and Ohio round out the top five, in that order, while Hawaii and Alaska ranked 49th and 50th (CNBC).

Wealth Targets: The average American would need a net worth of $2.3M to feel “wealthy,” and 35% think they are either on track or already wealthy. Gen Z Americans say it would take an average net worth of $1.7 million to feel wealthy, while Baby Boomers would require an average of $2.8 million (Charles Schwab).

A Problem?: A recent survey on planned spending and saving found that 77% of Gen Z adults spend more than they can afford because of “buy now, pay later” (BNPL), and nearly half (49%) of Gen Z’ers say that planning for the future feels pointless (Credit Karma).

The “0” Curse: Three NBA stars injured their Achilles tendons during the 2025 postseason and needed surgery. Coincidentally, all three — Damian Lillard of the Bucks, Jayson Tatum of the Celtics, and Tyrese Haliburton of the Pacers — wear jersey number 0 (Yahoo! Sports).

Retirement Literacy: Life expectancy has increased by 17 years since Social Security began in 1935, yet the age that full Social Security benefits begin for seniors has only increased by two years since its inception, from age 65 to 67. Only 32% of U.S. adults know how long people tend to live after reaching retirement age (TIAA Institute).

Sunbelt Struggles: Nationwide, 16.4% of home listings purchased post-pandemic (after July 2022) are at risk of selling for a loss. Of the 50 most populous U.S. metros, Austin, TX (47.5%), Tampa, FL (35.8%), and Orlando, FL (31.5%) have the highest share of active listings bought post-pandemic at risk of selling for a loss (Redfin).

Housing Burdens: 33% of U.S. households are “burdened” on housing costs (i.e., spend 30%+ of their income on housing and utilities). California (41.7%), Hawaii (39.5%), and Florida (38.6%) have the highest percentage of burdened households, while West Virginia, North Dakota, and Iowa had the lowest percentage, at less than 25% each (Statista).

Less Down, More Borrowed: A record high 19.1% of new car buyers committed to a monthly payment of $1,000+ during Q1, and a record 22.4% of all new car loans had terms of 84+ months. Buyers are financing a record $42,388 of their purchase, but the average down payment of $6,433 declined 2% YoY (Edmunds).

Emergency Stockpiles Dwindle: 24% of U.S. adults have no emergency savings, and only 46% have enough to cover at least three months of expenses. 37% of adults have tapped their emergency savings in the last year, and four out of five used the money to cover spending on essentials (Bankrate).

What We’re Reading and Enjoying

The Gift of Anxiety | Diante Fuchs

Why do most people strive to eliminate anxiety from their lives? Today, anxiety is often viewed as something purely negative. But the reality is that anxiety is a natural response designed to keep you safe. Instead of fighting anxious feelings, the author recommends harnessing them to your advantage and breaking the cycle of feeling trapped by anxiety.

To do this, you should empower, accept, shift, and engage the anxiety. Empowering allows you to use anxiety as a resource to inform and support you. Accepting the anxiety gives it the space, compassion, and reassurance it needs to calm down. Shifting redirects your attention to the present moment to challenge unhelpful thoughts and reconnect with your values. Engaging means taking small, deliberate steps to address what you’ve been avoiding, helping you build self-confidence.