A Randemic Impacting Millions

Today, we are facing a retirement pandemic. Let’s call it a “randemic.” Why has retiring become so difficult? You work, you save, you retire. Simple….right? Well, not exactly. To save for our retirement, we have to fight the urge to spend our money as we earn it, and defer the enjoyment of our hard-earned money in hopes that our money will compound interest over time. A concept many of us struggle with. Parents - teaching this concept to your children at a young age is invaluable. A rule of thumb for financial planning is to make sure you are saving 10% of your gross income every year plus 3% extra for every child if you plan to pay for college expenses. Let’s say you are working and plan on putting two kids through college. It’s easy to say you should save 16% (10% plus 3% for each child in college) and that may be a good place to start. As your life progresses, the world will change, and so should your financial plan. The future will not be a mirror image of the past, so it is important that you base your financial plan on what may occur, not what has already happened. A difficult feat.

It’s tough to make predictions, especially about the future - Yogi Berra

There are many variables we encounter in our lives. This can make it difficult to map out a path to financial success. We are seeing this today as many baby boomers are not experiencing the retirement they envisioned.

In 1991, 1.2 people out of every 1,000 in the U.S. filed for bankruptcy and 2.1% of those filing for bankruptcy were between the ages of 65 and 74. In 2016, 3.5 people for every 1,000 filed for bankruptcy and 12.2% of those filing for bankruptcy were between 65 and 74.

Over a 300% increase in only 25 years! What is causing this? Human behavior is paramount. Life expectancy, medical expenses, and a myriad of other factors also contribute to this phenomenon.

Investor Behavior

Psychology of money is a fascinating aspect of financial matters. Most studies involve rational assumptions but humans often act irrationally. Especially, when it comes to their financial well-being. Our frontal lobes and the anterior cingulate cortex provide us with executive functioning skills and give us the ability to think rationally. When we are emotional (e.g. fearful, anxious, excited), we resort to using our amygdala and other primitive portions of our brain to make decisions and may result in irrational decisions.

Let’s say someone is trying to lose weight, and they eat a slice of pizza knowing that eating the pizza will hinder their ability to meet their weight loss goals. Prior to eating the pizza, they came up with weight loss goals because they decided the immediate satisfaction from the pizza was not worth the negative impact on their health and feelings. A logical result from using their executive functioning skills. They knew this prior to eating the pizza, so why did they eat it? It’s simple, craving the pizza causes an emotional response, their primitive portion of the brain takes over and they are unable to act rationally. This behavior is also exhibited when people make financial and investing decisions.

Investor behavior has impacted our ability to retire due to these developments:

Decline in pension plans: Corporations got tired of getting stuck with the retirement bill of their employees so they lobbied for sweeping changes which resulted in the rise of Defined Contribution plans (e.g. 401k, 403b, 457, etc.). As pension plans become nearly extinct, each employee is now responsible for their retirement success or failure. As we have just discussed, this burden has been jeopardized by human behavior and this change has eroded the wealth of the American working class.

Stock market returns: Did you know, the average investor’s annual return on their investments is only 2.6% per year (according to J.P. Morgan)? Shocking. But it makes sense when you consider that most investors are not investment professionals. Also, when investors manage their own money, they struggle to set their personal feelings and emotions aside when making investment decisions.

I have seen countless investors sell their investments in 2012 and 2016 when their presidential candidate was not elected only to see the market soar to new highs. The opportunity costs were enormous. For the record, politics matter, but these political decisions must clear a bar that is much higher than the average investor thinks it is.

What about Bitcoin? Why would someone ever buy Bitcoin? The most common reasons I hear are either: they are worried fiat currency will be replaced causing the dollar to lose its value. Or, they see the gains Bitcoin has experienced and they get excited about the possibility of doubling (or tripling) their investment. This would solve their debt problems, or allow them to buy that car they’ve always wanted, and so on. In both of the reasons, emotion is dictating the decision to buy. Let me just say, if the dollar goes to zero, you will have bigger things to worry about and Bitcoin will not save you. Second, prudent financial habits should help you out of debt or allow you to afford that dream car, not Bitcoin.

Fear of losing your money in the stock market has also caused many react emotionally and sell at the bottom of the market, even though they know to buy low and sell high. This also holds true for investors that know they should sell but they fear making a wrong decision, so they do nothing at all. In behavioral finance, we call this “regret-aversion bias.”

Deficient savings: 64% of people think they need at least $500,000 to retire. Yet, the median value of a household’s retirement savings is only $126,000 by the time the head of the household is 65 years old. A savings gap of $374,000! This gap is partly attributed to the decision to spend instead of save, because some want immediate satisfaction from their money. An emotional response that impacts many of those working toward their financial goals.

Other Factors contributing to the randemic

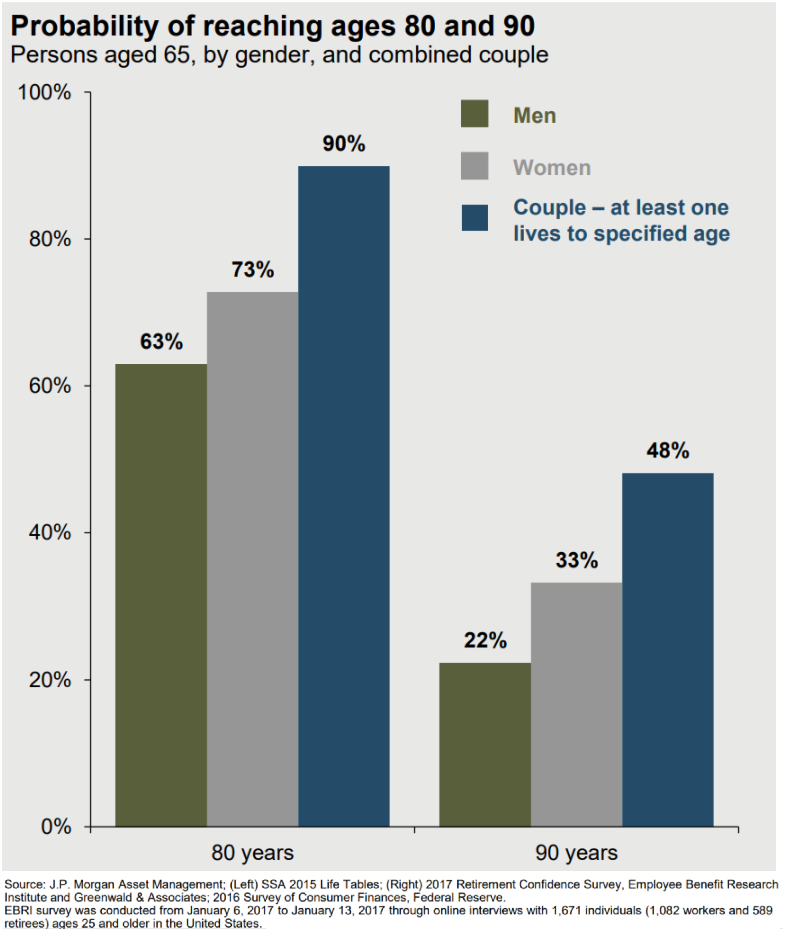

Increase in life expectancy: Did you know a 65 year old female has a 33% probability of reaching the age of 90? Most individuals do not plan for this type of longevity risk.

Health care costs: In Colorado, the average Medigap plan costs those on Medicare $1,623 per year. Also, married couples with income of over $170,000 have to pay at least $134 per month for Medicare Part B. These extra costs paired with medical bills and rising prescription prices can impair your ability to maintain your lifestyle in retirement.

https://howmuch.net/articles/medigap-plan-costs

How to Stay Safe

Get a seasonal review every year from your financial planner

Avoid those spending too much around you

Cover your mouth and ears if you hear someone talking about their Tesla purchase

Call the CDC (Center for Deficient Common Sense) if a friend tells you to buy Bitcoin. They need to be quarantined immediately.

A Tailored Approach

A competent financial planner can help you prepare and execute a successful retirement. At Noble Wealth Partners, we proactively stress test our client’s financial plans to discover and discuss the factors that pose significant threats to their financial goals. Our team then addresses these risks by taking the necessary steps to mitigate the adverse impacts of these threats if they were to occur. Every plan is different and every client is different. We tailor our recommendations and our investment solutions to your needs and your financial plan. Noble Wealth Partners does not sell insurance products, we receive our compensation based on the advice we provide you and not on the products we sell. We are committed to helping our clients achieve a successful retirement. If you are not already a client of Noble Wealth Partners, call us today at (720)598-8818 or email us at team@NWPplan.com, and discover what we can do for you.