NWP Quarterly Investment Review

Stocks Complete an Impressive Rebound in Q2

Market volatility spiked in the second quarter as the S&P 500 dropped sharply in early April following the announcement of sweeping reciprocal tariffs. However, those initial losses were gradually recouped over the remainder of the quarter as initial tariff rates were reduced, economic growth proved resilient, and inflation remained low. This enabled the S&P 500 to reach a new all-time high and close the quarter with a strong gain.

The second quarter began with a significant drop as President Trump announced sweeping tariffs on virtually all U.S. trading partners on April 2nd. The tariffs were significantly larger than markets had expected, sparking fears of a trade-war-driven economic slowdown and causing the S&P 500 to drop by more than 10% in the days following the announcement. However, the low on April 8th marked the quarter’s bottom, as the administration took steps to reduce the practical impact of the tariffs. A week after reciprocal tariffs were announced, the administration declared a 90-day delay, setting tariff rates on most trading partners at just 10%, far below reciprocal rates. This delay was followed by exemptions for key imports like smartphones, semiconductors, pharmaceuticals, and computers. These measures gave investors confidence that the trade war would not automatically trigger a recession. Combined with a solid first-quarter earnings season, the S&P 500 rallied through April and closed with a slight loss of 0.68%.

The market rebound accelerated in May when Treasury Secretary Scott Bessent announced he would meet with Chinese trade officials in Geneva. This raised expectations for tariff relief, which were realized as tariffs on Chinese imports were dramatically reduced from 145% to about 30%. This reduction, alongside steady economic growth, eased recession fears, and the S&P 500 extended its rebound. Strong earnings from tech leader Nvidia (NVDA), which highlighted the growth potential of AI, also fueled the rally. Additionally, the Court of International Trade ruled that the administration’s tariffs were illegal under the law that justified them. Although the case was appealed, this ruling raised the possibility that tariffs could be eliminated by the courts soon. This bolstered confidence that tariffs would not derail the economy, and the S&P 500 turned positive for the year, finishing May up 6.29%.

The rally continued in June, though trade headlines took a back seat to geopolitical concerns after Israel launched a major attack on Iranian nuclear and military sites. The hostilities caused oil prices to spike temporarily, pausing the rally as investors weighed the risk of rising oil prices hurting growth and increasing inflation. However, the volatility was limited. After U.S. strikes on Iranian nuclear facilities, a ceasefire was agreed upon, and oil prices fell sharply, ending the quarter on a negative note. This decline, combined with growing expectations for rate cuts later in the year, pushed the S&P 500 to new all-time highs in late June.

In summary, the stock market completed an impressive rebound from the sharp declines of early April. Steps by the administration to ease tariffs helped boost investor confidence, while corporate earnings remained strong and economic growth proved resilient despite geopolitical uncertainty and elevated policy volatility.

Second Quarter Performance Review

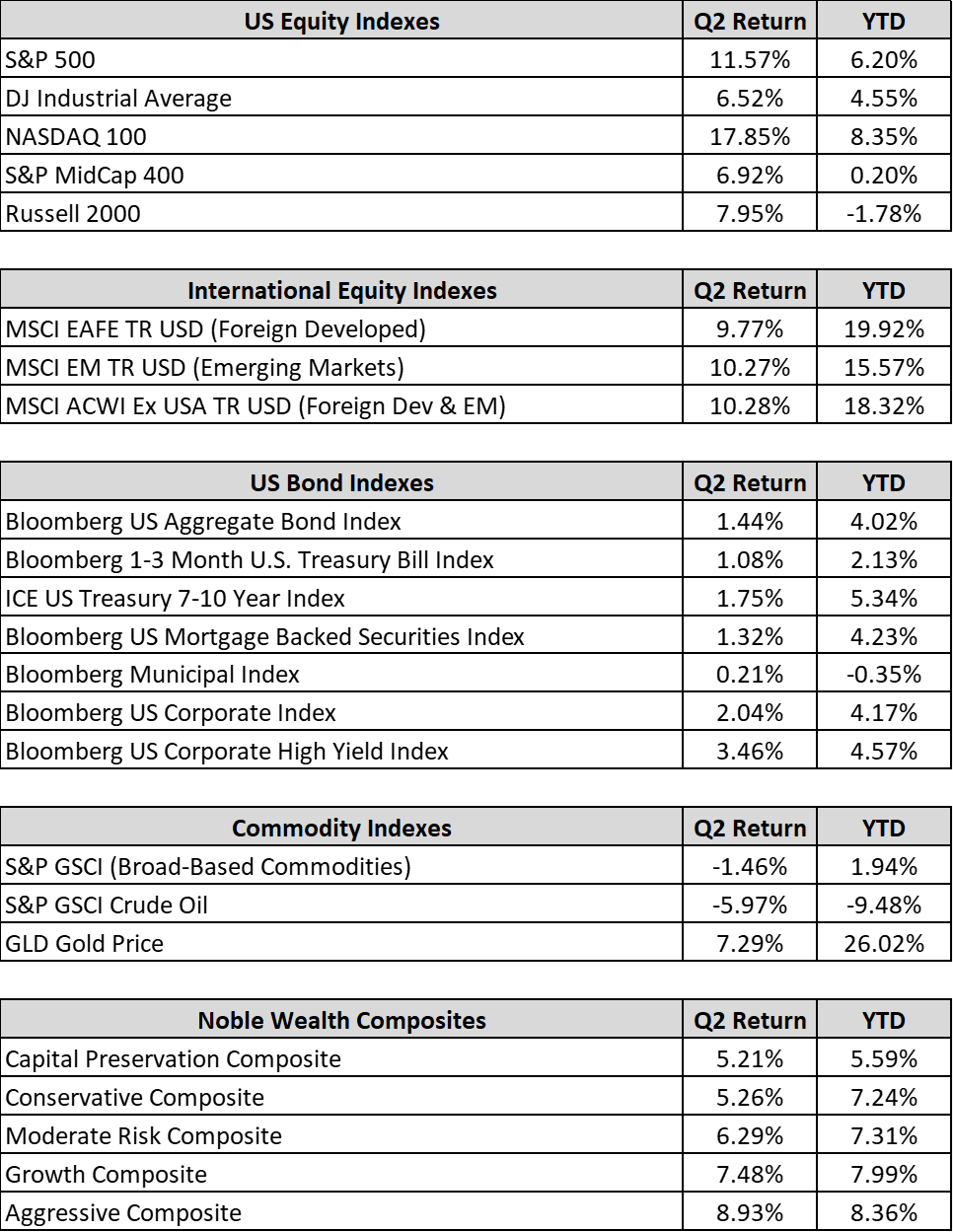

The S&P 500’s gains in Q2 were particularly impressive given the intense selling in early April. The rebound was broad, with most indices, sectors, and factors posting positive returns.

Source: YCharts

Composite performance results are shown for informational purposes only and do not guarantee future results. Past performance is not indicative of future returns. Actual client results may vary due to individual circumstances, fees, and other factors. This information is not intended as investment advice or a recommendation.

By market cap, large caps outperformed small caps, as they did in Q1. A lack of Fed rate cuts, elevated bond yields, and some soft economic data late in the quarter weighed on small caps, although they still finished the quarter positively.

From an investment style perspective, growth significantly outperformed value in Q2, with tech-heavy growth funds attracting investors after the April sell-off. Tariff reductions and exemptions improved the outlook for major tech firms, while strong earnings from AI leaders Nvidia (NVDA) and Oracle (ORCL) helped revive enthusiasm for AI. Value funds, held back by weakness in the energy sector, still posted slightly positive returns.

On a sector level, seven of 11 S&P 500 sectors finished with gains. The top performers were AI-linked technology and communications services, along with industrials. These sectors benefited from tariff reductions and exemptions due to their international exposure.

Among laggards, energy and healthcare posted negative returns. Volatile oil prices and recession fears pressured energy despite the Israel-Iran conflict. Healthcare faced uncertainty over pharmaceutical tariffs and legislative focus on lowering prescription drug costs.

Internationally, foreign markets outperformed the S&P 500 for most of the quarter, though the late June surge allowed the S&P 500 to surpass both emerging and developed foreign markets. Emerging markets outperformed developed foreign markets due to the easing of U.S.-China trade tensions and positive economic data from China. Developed foreign markets also saw solid returns from falling interest rates and resilient growth.

In the fixed income market, the Bloomberg U.S. Aggregate Bond Index posted a modest gain, supported by stable inflation and some cooling of U.S. growth late in the quarter.

Longer-duration bonds outperformed shorter-duration bonds due to stable inflation and weaker economic data. Shorter-term bonds lagged as the Fed remained cautious about rate cuts, awaiting the impact of tariffs on growth and inflation.

In the corporate bond market, both investment-grade and high-yield bonds posted solid gains. High-yield bonds outperformed investment-grade bonds as resilient growth and potential tax cuts encouraged investors to take on more credit risk.

Third Quarter Market Outlook

Markets enter Q3 after a strong first half, with the S&P 500 hitting new highs despite larger-than-expected tariffs, increased policy uncertainty, and Middle East tensions. While tariff and trade policies were expected, the first half of 2025 saw tariffs both higher and more extensive than most anticipated. Administrative efforts to ease tariffs, along with the court ruling invalidating reciprocal tariffs, reassured markets that trade disputes would not derail growth. Tariffs matter because mismanagement could slow the economy or cause stagflation—slowing growth amid rising inflation, which contributed to April’s sell-off. Encouragingly, economic data remained largely resilient throughout Q2, with no significant signs of slowing growth or rising inflation, which supported the market rebound. Geopolitical risks increased with the Israel-Iran conflict, U.S. involvement, and the ongoing war between Russia and Ukraine. Still, markets view these as isolated conflicts unlikely to threaten global oil supply or derail growth.

Beyond trade and conflict, fiscal policy also demands our attention.

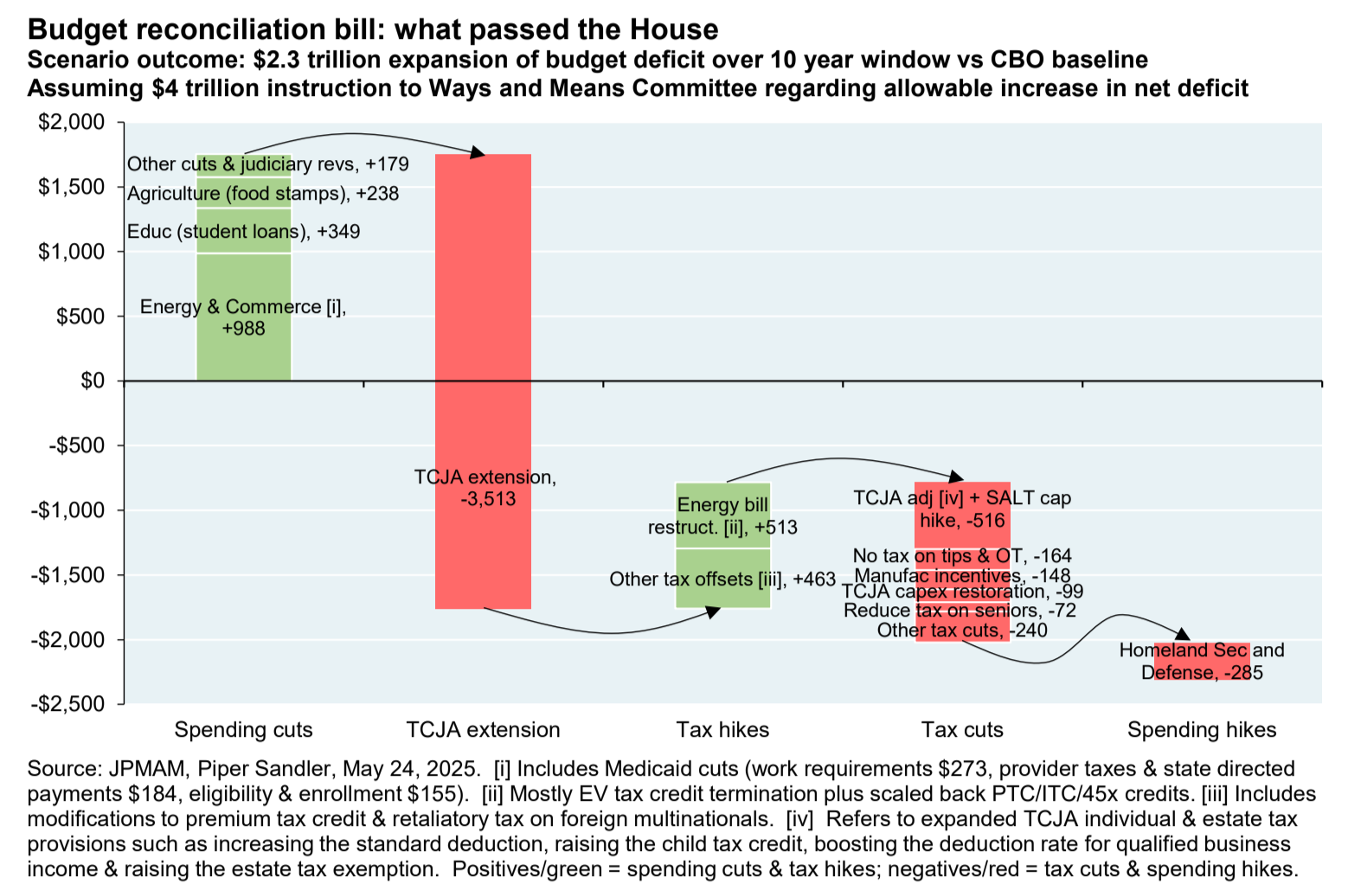

A Big Beautiful Bill

As discussed in last month’s newsletter, I explored stimulus measures from Washington and their impact on short-term growth. “Short-term” was explicitly defined as any fiscal stimulus that will likely boost the economy and stock market in the near term—tax breaks put more discretionary cash in pockets and lift corporate earnings today, but come at the expense of long-term spending and earnings. Growth is pulled forward at the cost of longer-term growth. There’s no free lunch, and eventually the bill comes due.

Nonpartisan committees project that the bill will add close to $4 trillion in debt, which at a 5% interest rate means roughly $200 billion in extra annual interest. Budget cuts are partly offset by a $2.5 trillion extension of the Tax Cuts and Jobs Act, and planned tax hikes of under $1 trillion are outweighed by cuts. That net effect pushes projected debt toward 130% of GDP over the next decade😱

I’d hate to be a politician right now—they don’t have an easy job. Like you, I enjoy tax cuts as they put more money in my pocket, but the current national debt is unsustainable. Non-defense discretionary spending accounts for only 14% of the budget. That 14% must cover education, infrastructure, and other essentials; everything else is locked up in defense, mandatory programs, and interest. In 2024, total education spending was $268.4 billion—the lowest relative to GDP in U.S. history. It’s tempting to assume tax breaks will spark a boom and allow us to grow our way out of debt, but it’s simply not sustainable. The same argument preceded the Tax Cuts and Jobs Act in fiscal 2019; yet, the deficit was still over $800 billion, even with near-zero rates and a healthy economy. Once debt reaches an unsustainable level, something has to give. Rising interest costs will crowd out other priorities, squeezing long-term growth and living standards. While this bill may provide a growth tailwind over the next one to five years, it will have a meaningful impact on the quality of life for our children and grandchildren. I wonder whether members of Congress believe a fairy-tale ending is possible, or are simply caving to political winds.

Just as fiscal risks rise, so does pressure on the Fed.

Shadow Fed

The second part of my rant is the prospect of a “shadow Federal Reserve chair,” which I strongly oppose. A “shadow chair” means naming a Fed chair to replace Jerome Powell 11 months before his term ends. This shadow chair would hold press conferences and outline how they would handle monetary policy while Powell continues to announce official Fed decisions. Since investors tend to look ahead, they would likely weigh the shadow chair’s narrative more heavily than Powell’s guidance, directly undermining the Fed’s forward guidance. News of this on June 26 sent the dollar lower and interest rates down as markets anticipate how the future chair will handle policy. The Fed’s independence has been under strain since President Trump’s re-election; as of January 24, 2020, he had tweeted about the Fed 100 times since nominating Powell, pressuring for rate cuts despite inflation risks. If Powell steers the economy successfully, he won’t get credit; if it falters, he’ll bear the blame.

How to React

With fiscal stimulus pulling forward growth and the debt mountain rising, history shows that when countries climb a mountain of debt, they often prefer the path of currency devaluation and lower rates to ease the burden. Devaluation makes exports cheaper and reduces the real value of debt, but it also increases import costs and can spark inflation. Lower rates may buoy high-quality sovereign and investment-grade debt, but only until inflation picks up and forces central banks to tighten again.

For investors, diversifying beyond U.S. dollar assets can hedge against a weaker dollar and imported inflation. Still, if your expenses and liabilities are dollar-denominated, it’s not imperative to rush overseas. High-quality fixed income could benefit if rates fall, as markets price in easier policy; however, devaluation-driven inflation could erode real returns. Including inflation hedges, such as Treasury Inflation-Protected Securities, commodities, or real assets, can help protect income streams in retirement and guard against principal erosion. Real estate or infrastructure exposure may also offer durable value when both currency and rate regimes shift.

Avoid Complacency

Despite the market’s resilience and these recent developments supporting stock prices, investors should not become complacent. Risks remain. First, tariffs could still rise, as the current reciprocal tariff delay expires on July 9. Without extension, tariff rates on major partners could surge again. Overall, global tariffs remain at multi-decade highs, and their economic impact remains uncertain. The risk of tariff-induced slowdown or stagflation cannot be dismissed. Turning to geopolitics, although the various conflicts have not yet hurt global markets, risks remain elevated. If Iran disrupts global oil production or transit, oil prices are likely to rise, creating a new headwind for markets. Similarly, if these isolated conflicts spread into larger regional wars, oil prices would also increase, weighing on stocks and bonds. Investors still expect two Federal Reserve rate cuts between now and year-end; however, the unknown impact of tariffs on growth and inflation makes rate cuts in 2025 uncertain. If the Fed does not cut rates in the coming months, concerns about an eventual economic slowdown could grow and weigh on markets.

Tariff policy, fiscal stimulus, and threats to Fed independence collectively underscore the importance of maintaining diversification and discipline. Bottom line, markets have been impressively resilient so far this year, but as we enter the second half of 2025, we face significant fiscal, trade, and monetary policy risks. We will not let the market’s resilience breed complacency.

At Noble Wealth Partners, we are dedicated to helping you navigate the current investment environment. Successful investing is a marathon, not a sprint, and even intense volatility is unlikely to derail a diversified approach designed to meet your long-term goals. It is crucial to stay invested, remain patient, and adhere to the plan we have tailored for you, based on your financial situation, risk tolerance, and investment timeline.

We’re Here if You Need Us

We remain focused on both opportunities and risks in the markets, and we thank you for your ongoing confidence and trust. Please rest assured that our entire team will remain dedicated to helping you successfully navigate this market environment.

Please do not hesitate to contact us with any questions, comments, or to schedule a portfolio review.