NWP Monthly Digest | November 2024

I can't believe it's already November! Even though my oldest son was a turtle for Halloween last night, this year feels like it's flying. And as the leaves fall to the ground, the stock market is heading for the clouds with year-to-date returns exceeding 20%. This is encouraging news for investors, especially as public stock markets may be poised for a strong rally in November as uncertainty surrounding the U.S. elections diminishes, public company earnings continue to impress, and the positive impact on the economy is pervasive. Disposable personal income has reached nearly $22 trillion, and total household net worth has climbed to about $154 trillion—almost $50 trillion higher than five years ago. U.S. consumers now feel financially confident enough to make larger purchases.

The global luxury market has also rebounded sharply from the lows experienced during the pandemic, boosting Bernard Arnault, the chairman and CEO of LVMH Moet Hennessy Louis Vuitton, into the ranks of the top five wealthiest individuals in the world. Importantly, it’s not just the wealthiest who are benefiting; the median value of money invested in the stock market for the average investor has risen to over $250,000, up from $150,000 at the end of 2023.

I feel incredibly blessed to have a loving wife, two amazing children, a roof over our heads, and the security of knowing there will always be food on the table. It's natural to attribute this to hard work, career choices, thoughtful actions, and other variables within my control because we know how the story ends. For that reason, it's difficult to imagine another outcome or a different path life may have taken us down, and even how much luck may have been a factor in our achievements. But even if that were true, our understanding of past events—how we achieved success or arrived at our current situation—can change over time as new information, perspectives, and interpretations come to light. The quote from Russian poet Fyodor Tyutchev describes this phenomenon perfectly: “The past is more unpredictable than the future.”

In the spirit of the month of Thanksgiving, be thankful for everything that you have. But also, don't forget about giving. Try to recognize that not everyone may have experienced these good fortunes, often due to circumstances outside of their control. For that reason, I encourage everyone to lend a helping hand to those who didn’t have a tailwind in life and those in need.

Giving Back

When I was 33, I began volunteering at Hope House of Colorado, a nonprofit organization that provides shelter and resources to teenage mothers who often lack a safe place to sleep. I offered these mothers complimentary financial planning services to equip them with the education and resources they needed. My goal was to help them gain the tools and roadmap necessary to achieve financial stability, not only for themselves but also for their children.

Finding ways to lend a helping hand has always been a passion of mine, but I have always considered this to be a pivotal time in my life as I was able to make a significant impact by volunteering my time and expertise. But maybe that was just a narrative I told myself… In that same year, I launched my financial planning practice, Noble Wealth Alliance (now known as Noble Wealth Partners), and I was building the business from the ground up, so I did not have the financial flexibility to pursue any philanthropic endeavors. In fact, I didn't even know when my business would become profitable.

I also taught high school students personal finance classes in the Junior Achievement program in an effort to help those students understand simple principles when it came to their finances, which was also a great experience, but none of those roles compared to the work I've done over the past seven years for Colorado State University.

Colorado State University

In the summer of 2017, I received a call from the treasurer of Colorado State University regarding an opportunity to serve on the Investment Advisory Committee. This committee was responsible for managing the university's operating assets in accordance with House Bill 08-1002, which was maintained by the state of Colorado. I learned in July that I had been selected as one of five members of the board, and we held our first meeting on August 15, 2017. I vividly recall that first meeting in the conference room at the main office in downtown Denver, which offered a view of the city. I have to admit I was quite nervous—understandably so—since I was the youngest member by at least a decade. I found myself sitting next to the retired CFO of Hewlett-Packard and facing the board of directors. While this situation was humbling, it also motivated me to prove myself.

Over the next few months, we analyzed the university's cash flows, broke the operating account into three different buckets, and constructed an investment policy statement designed to accomplish the university's investment objectives. The first two buckets were designed to earn slightly higher returns while preserving liquidity within the operating portfolio, and the funds in the last bucket would pursue a more aggressive investment mandate in an effort to generate additional resources for the university while recognizing any constraints we might encounter from the board of directors.

Random thought: Can you imagine how different the investment policy statement and the breakdown of investments across various categories would have looked if we had known a pandemic would shock the world in just two and a half years?

It's incredible to reflect on the progress our committee made and the milestones we achieved while navigating a global pandemic and a 34% stock market drawdown. This was no small feat, especially for a portfolio that had been sitting in an interest-bearing account with the state of Colorado until our committee was formed. Fast forward to the end of the second quarter this year, and we have successfully generated $109,733,537 in investment returns, of which $47.5 million has already been utilized to fund various initiatives at the university.

Lessons Learned

I admit when I first started on the committee, seeing the size of the portfolio did make me a bit nervous, as I had never managed anything remotely close to a portfolio of this size. However, after reframing how I looked at various aspects of the portfolio to view each position as a percentage instead of a dollar amount, I was able to hit the ground running and serve the university.

After seven years on the investment committee, I can say the knowledge and experience I gained were invaluable. Furthermore, three concepts of the work our investment committee performed for the university also apply to the work I do for my clients today: cash flows and liquidity analysis, goals-based investing, and portfolio management according to the investment mandates prioritizing simplicity and asset allocation.

Cash flows and liquidity analysis:

The university receives donations that are not evenly distributed throughout the year. Many of our clients out there can relate, as large bonuses are paid, stock options vest, and businesses sell—you get the picture. Our first task with the university was to take a detailed look at the cash flows, determine when the cash balance was expected to be at its lowest point in the year, and set a target balance to hold as a cushion in cash and cash equivalents. At the onset, this was set at $80 million, and this was our Tier 1 bucket. But the emergency reserves didn't stop there, as we decided to allocate another $55 million in reserves that may be needed over the next five years; this was our Tier 2 bucket.

Goals-based investing:

When the committee was formed, all of the operating assets were invested at a fairly low rate at the state treasury. After dividing the total portfolio into three buckets, we had intentional investment objectives within each bucket and targeted higher returns for similar levels of risk, being cognizant of the purpose of the funds within each bucket.

The Tier 1 bucket was directed into money market funds and other cash equivalents with interest rates that were considerably higher without increasing the risk of the money in that bucket.

The Tier 2 bucket was created out of an overabundance of caution. But this was money that may have been needed in the very worst-case scenarios, and to give you an idea of what I mean by that, at the depths of the pandemic, we were nowhere near close to ever needing these funds. However, since the purpose was to keep this money liquid if it was needed in the next five years, we pursued limited-term fixed-income instruments with a low risk of default with the goal of earning about a percent more than treasuries with a similar duration would earn.

Finally, the Tier 3 bucket was money that we knew would not be needed, and for that reason, we were able to invest these funds with a longer-term horizon. Even though this information by itself would allow for a portfolio that was nearly 100% stocks, we had to be cognizant of how the board of directors might react if the stock market crashed after pursuing this strategy with the university's operating assets. This is not unlike how we gauge a client's willingness (not ability) to take risks in their investment portfolio. Given the possibility of the board pulling the plug if there was a large drawdown in the assets, we set the initial equity target at 60% of the portfolio.

Portfolio management:

The Tier 3 portfolio was built from the ground up. We selected low-cost investments and initially targeted a strategic asset allocation. For those unfamiliar with strategic asset allocation, this simply means that we set the portfolio targets—for example, stocks at 60% of the portfolio—and we would not increase or decrease this exposure unless the equity portion of the portfolio drifted by more than 4%. This was a very passive approach and differs from something like a tactical asset allocation, where equity targets may increase or decrease by, let's say, 10% depending on the market environment. And like all investors, there were conversations where one member may want to overweight a specific area or divest from emerging markets—the list goes on. Though these thoughts can be tempting to any investor, it's important to remember that close to 95% of the portfolio returns are driven by the broad asset allocation of the portfolio. The thoughts that run through many investors' heads—like whether or not to buy NVIDIA or decrease the weight in small-cap stocks—may take up 50% of their time but, at the end of the day, may only contribute to 5% of the overall returns, if anything. I'm proud to say we were pragmatic throughout, and the various university initiatives that were funded as a result of this portfolio were a reminder to never lose sight of your long-term goals.

Looking back at this time, part of me may have thought it was possible to donate to the university, but I volunteered instead in an effort to make the greatest impact. Though any monetary donations I would have made to Colorado State University would have been insignificant compared to the value of my time serving on the investment committee, it's becoming clear my understanding of these past events may have changed as new perspectives and interpretations came to light. Was I volunteering because the value of my time was worth more than any money I could give? Or was that just a story I told myself because I didn't have the financial flexibility to do anything else? We'll never know, but Mr. Tyutchev might remind me that the past is more unpredictable than the future. 😉

I will always cherish the experience. I look forward to serving in a similar role in the future, and next time, I'll bring decades of experience to the table!

Noble Pro Tip of the Month

Year-End Personal Finance Housekeeping

As the end of the year approaches, you may want to double-check and make sure you're not leaving any planning opportunities on the table. Consider the following when applicable:

Harvest or realize capital losses to offset any gains and write off up to $3,000 against ordinary income.

If you hold taxable investments subject to significant capital gain distributions, consider selling before those distributions occur to avoid any unnecessary tax liability.

Those of you in your 70s with IRA accounts or employer-sponsored plans, and those with inherited IRA accounts, don’t forget to take your required minimum distributions. The penalty for any missed RMD is 50% of what should have been taken.

Harvest income if you expect your income to increase significantly in the future, or if you anticipate the 2017 tax reform will sunset at the end of 2025. Additionally, consider this if you foresee an extension of those reforms that could lead to higher deficits, potentially resulting in a greater debt burden and higher future tax rates to manage that debt load.

Roth conversions: Convert some of your traditional IRA assets to a Roth IRA. This triggers taxable income now, but the money grows tax-free for future withdrawals.

Take IRA and qualified plan distributions: Those relying on Pretax retirement plans for their income may want to consider taking additional amounts in 2024.

Recognize business income or defer expenses: Business owners may want to evaluate strategies to recognize additional income this year or defer expenses In situations where it's possible to influence the timing.

Exercise Non-Qualified Stock Options: Exercising non-qualified stock options (NSOs) will trigger ordinary income, so consider this if you expect tax rates to be higher in future years.

Exercise Incentive Stock Options: evaluate any opportunities to exercise ISOs if it’s possible to do so without paying AMT taxes.

For those over 50, remember that you can contribute an extra $1,000 to an IRA or $7,500 to most group retirement plans.

Be sure to spend any remaining balance in your flexible spending accounts before the end of the year.

If you've hit your health insurance plan’s annual deductible or the maximum out-of-pocket expenses, explore the possibility of incurring additional medical expenses before the end of the year.

Those passing down wealth have until the end of the year to gift up to the annual exclusion amount of $18,000 (per year, per donee) tax-free.

Check your tax withholdings and either update your current withholding or make an estimated tax payment before January 15th to avoid or reduce underpayment penalties, which have become significant in recent years.

This is not an exhaustive list of all planning strategies, but it may give you some things to think about or remind you of something not explicitly listed. Don’t hesitate to reach out to us if there’s something we can help with.

Fun Facts of the Month

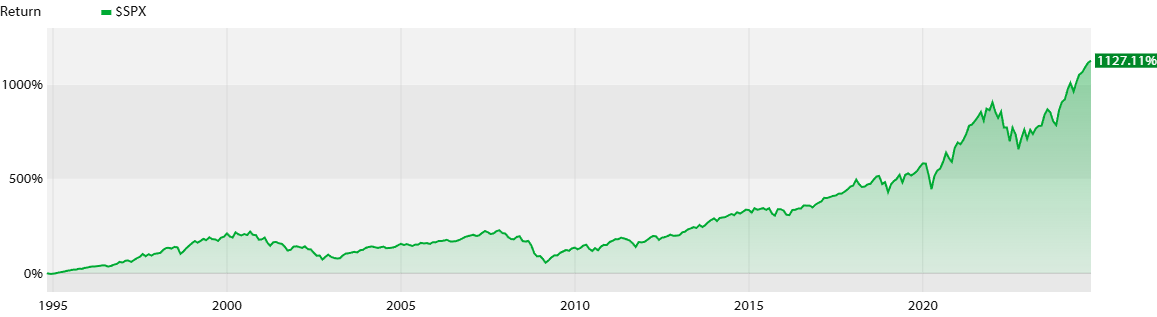

Best Year Since '97: The S&P 500’s 21.4% year-to-date (YTD) price change through October 9 (195 trading days) was its strongest YTD gain at that point in a year since 1997. Within the index of 500 stocks, 200 are up over 20% YTD on a total return basis, 33 are up more than 50%, and 4 are up more than 100% (Bespoke).

Sweep: As of October 31, 2024, there is a roughly 24.1% probability of a Republican sweep. Out of 1,000 simulations, Trump beat Harris 514 times, Republicans took control of the Senate 890 times, and Republicans took control of the House 527 times (Project 538).

Tech’s Heavy Weight: The technology sector’s weighting in the S&P 500 eclipsed 32% on October 10. Since 1990, the tech sector’s average S&P 500 weighting has been just under 18%, but over the last five years, its average weighting has been 27.5%. The financials sector is the next largest in the index with a weighting of just 13% (Bloomberg).

Easy Money: The Chicago Fed’s National Financial Conditions Index for the US reached the ‘loosest’ levels since November 2021 in the week ended 10/4. Of the 105 indicators that go into the index, 101 showed looser-than-average conditions, the most since 1/28/22 (Chicago Federal Reserve).

Earn Like the 1%: You need an annual income of $788 thousand to crack the top 1% of wage earners in the US. Washington, DC has a higher income threshold than any state at $1.21 million. West Virginia has the lowest hurdle to make the top 1% at $420 thousand (SmartAsset).

Rafa Retires: Rafael Nadal announced his retirement from tennis, ending his career with 22 Grand Slam titles, second only to Novak Djokovic’s 24. Nadal ranks just 137th in tour history in first serve points won (72.0%) but was the best on his second serve, winning 57.1% of all points (ATP Tour).

Not all utilities are created equal: Through Q3, the S&P 500 Utilities sector rallied 27.4%, while the Dow Jones Utilities Index gained 20.2%. The 7.2-percentage-point performance gap in favor of the S&P 500 Utilities sector was the widest since 1990 (Bespoke).

F.I.R.E: While the "FIRE" (financial independence, retire early) movement has gained traction online, retirement data from Motley Fool shows that only 11% of Americans aged 55 to 59 were retired from 2016 to 2022, compared to 19% from 2002 to 2007. For Americans in their 40s, only 1% to 2% were retired (Motley Fool).

Big money blues: In a recent survey of the uber-wealthy, 73% of ultra-high-net-worth families said they feel isolated and uncomfortable talking about financial concerns, while just 11% felt comfortable discussing the topic with their financial advisors (Bernstein Private Wealth Management, FA Mag).

Perfect passer: In his start on 9/30, Detroit Lions quarterback Jared Goff completed all 18 of his pass attempts, becoming the first QB to ever attempt more than 10 passes in a game without an incompletion. Not only did Goff complete all his passes, but he also caught a touchdown pass from Amon-Ra St. Brown (CNN).

Wrong way rates: Following the US Federal Reserve’s 50-basis-point rate cut last week, the 10-year Treasury yield increased from 3.65% on 9/17 to 3.73% on 9/24. In the eight prior rate cut cycles since 1984, the only two times the 10-year yield rose in the week after the first cut were in January 2001 and September 2007 (Bespoke).

Open houses open up: In the week ending 9/22/24, when the Fed cut rates by 50 basis points, Redfin’s Homebuyer Demand Index rose 7% month over month and saw its first year-over-year increase since October 2023. The index measures home tours and other homebuying services (Redfin).

Bankruptcies jump: In Q2 2024, 2,462 companies filed for Chapter 11 bankruptcy. That’s up 109% over the past two years and the highest reading since Q1 2012 (Administrative Office of US Courts).

Cash-conscious millennials: According to the Fed’s latest report on household wealth, the sub-40 age cohort has 20.2% of financial assets in deposits and money market funds, which is higher than for those ages 40 to 54 (15.1%), 55 to 69 (12.6%), and even 70+, who keep just 16.2% in cash (US Federal Reserve).

Kids! Who needs them: Twenty-three percent of millennials¹ and Gen Z² Americans currently without children have no plans to start a family in the future. Among the most cited reasons for opting out of parenthood (43%) were financial freedom and the inability to afford a family (CNBC).

$100,000 disagreement: University of Las Vegas quarterback Matthew Sluka will sit out the remainder of the football season in what is the first public occurrence of a college player using their “redshirt” option and transferring from a college in-season over a name, image, and likeness (NIL) dispute. Sluka says UNLV coaches offered to pay him $100,000 but reneged (SI.com).

On 9/18/24, the US Federal Reserve cut the federal funds rate for the first time since 3/3/2020, marking the end of a streak of 4.5+ years without a cut in rates. This was the second-longest streak without such a cut in at least 50 years, trailing only the 10-plus-year period from December 2008 through July 2019 (Bespoke).

Fourth quarter gains: Post-WW2, the fourth quarter of the year has been the best for the S&P 500, with an average gain of 4.2% and gains 79% of the time. Q4’s average move doubles the next-best quarter of the year, which is Q1 at +2.1% and gains just 62% of the time (Bespoke).

On the rise: As consumer credit outstanding has risen, so too have delinquencies. Through Q2, the percentage of auto loans (7.95%) that were 30+ days delinquent rose to the highest level since Q4 2010, while credit card delinquencies (9.05%) hit the highest level since Q1 2011 (New York Fed).

66 problems: The number of FDIC-insured institutions on the Problem Bank List increased to 66 in Q2. That is the highest level since the end of 2017 (95) but still 77% below levels from ten years ago in December 2014 (FDIC).

Attention: At 31.8%, the interest rate for credit cards that can be used only at a specific retailer is more than 10 percentage points higher than for standard credit cards, which come in at 21.5%, according to the Fed (Bankrate).

Curve un-inverts: On 9/4/24, the spread between the yields of the 10-year and 2-year US Treasuries turned positive for the first time since 7/1/22, ending what was the longest period of inversion for this part of the yield curve on record. Elsewhere on the curve, the spread between the 10-year and 3-month Treasury yields remains deeply inverted at 132 basis points (Bespoke).

Performance after un-inversions: Since 1976, there have been six other periods when the 10-year versus 2-year yield curve inverted for at least three months. After the curve un-inverted in those six periods, the S&P 500’s median 6-month performance was a gain of 8.7%, with positive returns five times (Bespoke).

Office values plummet: According to the National Council of Real Estate Investment Fiduciaries (NCREIF), the value of US office properties declined 14.4% on a year/year total return basis through 6/30/24. Besides the previous four quarters where y/y returns were even worse, the only more negative readings were during the Financial Crisis in 2009 (Bloomberg).

Advisors avoiding crypto: In a recent survey of 1,500 financial advisors by Cerulli Associates, just 2.6% said they recommend crypto investments for some clients, while only 12.1% said they’ll discuss crypto if clients ask about it (Barron’s).

What We're Reading

The Canary | Michael Lewis

The article or short story by Michael Lewis discusses the evolution of safety within the coal mining industry, primarily from the perspective of Christopher Mark, a government civil servant tasked with making the coal industry a safer environment for miners. Surprisingly, Mr. Mark was a miner himself before working for the government; however, he was not your typical coal miner. Instead, he was a mining engineer with a PhD.

His first challenge was to analyze and uncover the reasons behind roof collapses in mine shafts. He later discovered that loose government regulation allowed capitalism to thrive, prioritizing profits over the safety of miners, which resulted in fatalities that surpassed even the peak casualties during the Vietnam War. Unfortunately, his team did not see any significant results until the government provided resources to enforce industry-wide safety standards.

Once these standards were implemented, the outcomes spoke for themselves, leading to a significant reduction in fatalities. Mark's dedication and technical expertise contributed to creating a safer working environment for miners, ultimately resulting in a historic year in which no miner in the U.S. died from roof falls. His journey reflects the unsung but vital role of federal employees in solving critical problems, often without public recognition. This piece is another masterpiece from Mr. Lewis and is certainly worth the read.