NWP Monthly Digest | July 2024

Summer is here and it’s a hot one! As of June 27th in Denver, we have already seen 14 days where it has been 90° or warmer, and there will likely be two more before the end of the month, making that a whopping 16 days of 90° temperatures or more when the average during the month of June is only 8 days. The Celtics were red hot on their way to an 18th NBA championship, and the Florida Panthers and Edmonton Oilers series was red hot all the way down to Game 7 when the Panthers won the final game after losing the previous three. The only event that prevented us from sizzling into July was the lukewarm debate on Thursday night.

In the first presidential debate, Biden’s key points were overshadowed by an unconvincing delivery, and our thoughts and prayers go out to the fact-checker from the debate, who tragically exploded after Trump's opening remarks. All in all, I don't know how you readers feel, but this appears to be another election where people like myself have to say—is this the best America has to offer? It's going to be an election year for the books and one that may be best served with anti-anxiety medication and noise-canceling headphones.

How did we get here? Is this political race a natural consequence of each party putting all of their eggs in one basket? In past elections, how each candidate would present to the public and represent the country on a global stage were prime considerations. The idea of electing a candidate charged with a felony, or one seemingly lacking the stamina for one of the most demanding jobs, would have been inconceivable. If you forgot what a normal debate should look like, consider revisiting the 2012 presidential debate. Instead, we are witnessing a presidential race where the public has opted to overlook the associated risks and maintain the status quo.

“I view diversification not only as a survival strategy but as an aggressive strategy because the next windfall might come from a surprising place.” Peter Bernstein

Don’t Put All Your Eggs In One Basket

In this month's newsletter, I'd like to explore the topic of diversification. "Don't put all your eggs in one basket" is the number one argument for diversification in the investment world. Status quo bias is a phenomenon demonstrated by investors choosing to do nothing out of fear of making the wrong decision. Ironically, doing nothing is a decision, and it may be the wrong one.

In recent years, I’ve come across several headlines proclaiming the death of diversification. Last year's market was dominated by seven stocks later coined the “Magnificent 7.” Over a decade of U.S. stocks outperforming international counterparts raises a valid question: Is diversification dead? Should an investment portfolio consist of Nvidia and only Nvidia? It may seem absurd, but the persistent pattern over the years has led investors to ponder this very question. Yes, I still believe in diversification, and I do still believe that it's the only free lunch when it comes to investing. However, I will admit it's only free if, as an investor, you are patient and willing to practice pragmatism until you reap the benefits. And when I say patience, I'm not talking about weeks or months; I'm talking about years and possibly decades.

Diversification can be approached in multiple ways. Starting with the U.S. stock market, which is familiar to many, one must decide whether to invest in the largest companies—such as Microsoft, Apple, Nvidia—or to spread investments across the broader market. The aforementioned companies have significantly outperformed the broader market in recent years. Yet, history demonstrates that sometimes the higher things go, the farther they fall. This isn't to predict a downfall, but it presents a compelling case for investing in the broader market. Empirically, when a small group of stocks generates the lion’s share of the market's returns, the rest of the market often catches up in the following years, potentially leading to the underperformance of the initially high-flying names.

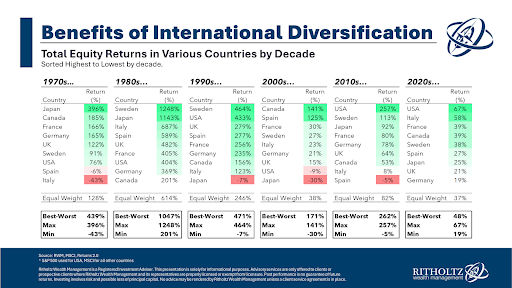

We can broaden our perspective and consider the merits of international investment. I also believe in international diversification as there is no certainty that the U.S. stock market will continue its past 15-year success into the next 15 years. Indeed, the U.S. stock market has been a clear winner in the last decade and a half, but as indicated by the chart, the leading markets shift with each decade. Each decade presents its own set of top and bottom performers, with significant disparities between them. The recent dominance of U.S. stocks could indicate a global market paradigm shift or simply be a case of recency bias—a common investor bias that attributes greater importance to recent events or what can quickly be recalled while minimizing the significance of long-term trends. Many overlook the previous U.S. stock market downturn from 2002–2009, when the market declined nearly 10%, or the booming Japanese stock market of the 1980s, which, after attracting global investments, crashed in the 90s and stagnated for three decades. In the 1970s and 80s, U.S. stocks were nearer the bottom than the top. However, the evident pattern is that alternating cycles of U.S. and international market superiority are a normal phenomenon.

Using this lens, diversification is a form of risk management. It helps you avoid the extremes—yes, you'll never be invested in the best performer, but it also means you'll never be fully exposed to the worst performer, and occasionally it can open you up to surprising winners. I hate to generalize, but the majority of my clients prioritize avoiding poverty over getting rich. Therefore, diversification aligns with their financial goals. I often tell my clients that their job is to focus on what they can control, which is in large part not spending more than what they make or what they can safely withdraw from their portfolio, and if they do their part, which is 90% of the heavy lifting, we will position their portfolio so they can accomplish their financial objectives. To put it in baseball terms, our goal is to consistently hit singles rather than to swing for home runs recklessly.

Noble Wealth Pro Tip of the Month

Review Your Property and Casualty Coverage

Insurance premiums have risen significantly in recent years, resulting in higher costs for less coverage. This means that policyholders are paying more while getting reduced coverage. It's crucial to review your insurance policies to ensure you're not overpaying, especially for coverage you don't need. Regularly assessing your insurance needs and comparing different policies can help you find the best coverage at the most affordable price.

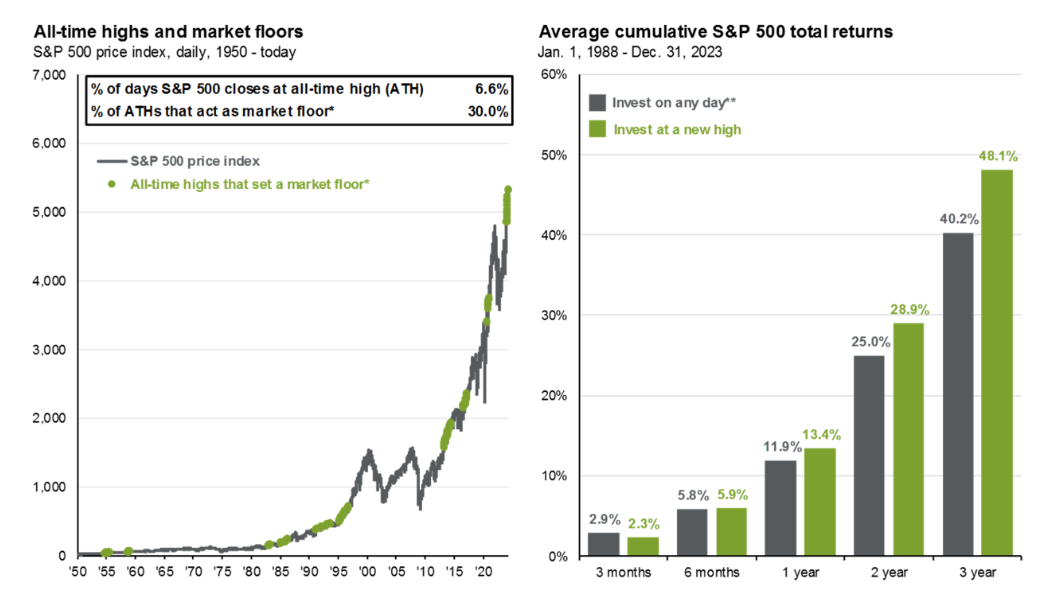

Buy at New Highs

There’s no time like the present - I often hear clients say they prefer to wait for a better time to invest in the stock market because it is at an all-time high. Contrary to popular belief, investors are actually better off buying when the market is at new highs. According to JP Morgan, the average returns for investors who put their money to work at a new all-time high are about 8% higher per year than for those who invest on any other day after three years' time.

Fun Facts of the Month

Golden Opportunity: The Commitment of Traders report released on June 7th showed that speculator positioning in gold futures rose to a record 53.1% of open interest (OI). In the four prior periods since 1986 when OI first exceeded 50%, gold’s median performance over the next three months was 4.9%, with gains three out of four times (CFTC).

Toolbelt Generation. Student enrollment in vocational colleges rose 16% in 2023 compared to growth of just 0.8% across all four-year institutions. The median annual pay for new construction hires rose 5.1% in 2023 to $48,089 compared to a rise of just 2.7% to $39,520 for new hires in professional services (National Student Clearinghouse, ADP).

Innovation = Income. From 1990 through 2015, the ten urban areas with the highest number of U.S. patent filings have seen their share of total filings increase from under 52% to more than 58%. Over that same span, the average nominal income in these ten regions increased by 36% compared to 25% for the entire country (St. Louis Fed).

Teens Prefer to Tok: In the same spring 2024 survey, teens ranked TikTok as their favorite app (35%), followed by Instagram (30%) and Snapchat (22%). Compared to the fall of 2023, TikTok fell 3 percentage points, Snapchat fell 6, and Instagram gained 7 (Piper Sandler).

Medical Bills Discharged: The Consumer Financial Protection Bureau (CFPB) proposed a new rule to remove medical bills from credit reports beginning next year. The CFPB estimates that the rule will improve the credit scores of 15 million Americans and result in the approval of 22,000 additional mortgages each year (CFPB).

Keeping up With the Joneses: Using data from 27 million Facebook users and financial information from the IRS, researchers found that for lower-income Americans, a 10% increase in friends of high socioeconomic status resulted in a 5% greater likelihood of the individual setting aside savings (Binghamton University).

RIP: Former NBA player and coach for the Lakers, Jerry West, passed away on June 12th, 2024. Known for inspiring the logo of the NBA, West appeared in the NBA Finals nine times. He still holds the record for most career points in the NBA Finals with 1,679 points and is still 117 points ahead of LeBron James (ESPN).

Don’t Get Caught up on the Points: In his recent commencement speech at Dartmouth, tennis great Roger Federer noted that while he won almost 80% of his career matches, he won only 54% of individual points. The only other players to win more than 54% of all points played in their careers are Rafael Nadal (54.49%) and Novak Djokovic (54.48%) (Ultimate Tennis Statistics).

Again? The S&P 500 outperformed the Dow Jones Industrial Average (DJIA) by more than eight percentage points year-to-date (YTD) through the end of May for the second year in a row. From 1930 to 2022, the S&P 500 never outperformed the DJIA by more than eight percentage points in the first five months of the year (Bespoke).

What A Ride: As of May 29th, NVIDIA’s (NVDA) market cap had grown ten times from its 2022 low, rising from $280 billion on October 14th, 2022, up to $2.8 trillion. NVDA now ranks as the third largest U.S. stock behind Apple (AAPL) at $2.9 trillion and Microsoft (MSFT) at $3.2 trillion (Bespoke).

Record Air Travel: On the Friday before Memorial Day Weekend (May 24th), the TSA screened 2.951 million travelers at U.S. airports, surpassing the prior record of 2.909 million from November 26th, 2023. Of the ten busiest travel days on record, five occurred in May (TSA).

Sun Sets in the West: Home prices in 10 of 20 cities tracked by Case-Shiller indices hit record highs in the latest monthly release for March, but five cities — all in the Western U.S. — are still down more than 5% from all-time highs: San Francisco, Seattle, Phoenix, Portland, and Denver (S&P CoreLogic).

What We’re Reading

Same as Ever# | Morgan Housel

Despite the ever-changing world, the fundamental patterns of human behavior and decision-making remain constant. The author Morgan Housel, one of my favorites, simplifies complex personal finance concepts into easy-to-understand text in his book "Same as Ever". This compelling book evaluates core truths about humans that remain consistent over time. By recognizing these consistencies, we can learn and use them to our advantage to achieve higher returns and a happier life by focusing our attention and efforts wisely.

Here are a few human traits that have not changed:

Luck plays a much larger role than many think. Entry-level employees hired at Nvidia just five years ago who received $70k of stock options that vested over four years would have seen the value of the stock options grow to about $10.6 million today if they were left unsold.

The quality of life has improved over time, but convincing people this is the case is challenging.

People usually do not seek to be rich but instead, seek to have more than those around them.

Our obsession with solving complex problems often comes at the expense of significant anxiety.

Success in ventures often tempts those owners to expand too quickly beyond their capacity.

We are always looking for a silver bullet when none exists.

Instead of being blind to these fundamental patterns, acknowledging them to get ahead is key:

Exercise patience in business ventures have a plan, and execute it. Don't let past success drive you to make unwise decisions.

Don't fixate on complexity. Take advantage of life's simple opportunities: eat well, exercise, and get adequate rest. There's no need to overcomplicate it.

Tell a compelling story instead of focusing on the numbers, as the audience will be more receptive.

Acknowledge when you have a tailwind in your favor. It might not have been solely your intellect and hard work that led to your success, and replicating that success might not be as straightforward. Be prudent with your finances.

Try to want less! Our tendency to want more significantly impacts our happiness and comes at a substantial cost. There's a fun fact above that shows how having wealthier friends on social media is linked to an increase in savings. However, this emphasizes our tendency to want more than those around us. It's important not to fixate on what others have. Instead, focus on what you have and resist the temptation to compare yourself to others.

Your ‘Independent’ Advisor Now Works for Private Equity. What It Could Mean for Your Portfolio | Barrons/Ian Salisbury

“That kind of product pushing has long been a profit engine for big Wall Street firms. But RIAs are supposed to adhere to the fiduciary standard, which suggests advisors should always act in clients’ best interest, without any of the conflicts that can arise from peddling in-house investments.”

I want to bring attention to an article I read in Barron's magazine about the challenges that the RIA (Registered Investment Advisor) industry is facing. As many of you may not have access to Barron's, I felt it was important to highlight the impact of private equity investments on RIA practices and their clients.

The RIA business, which is made up of independent advisors like myself, emerged due to dissatisfaction with the practices of traditional broker-dealers that often prioritized their own interests over those of their clients. Many RIA owners originally set out to provide clients with unbiased advice and personalized guidance.

However, as private equity firms acquire more of these RIA practices, there is growing concern that clients may be steered towards cookie-cutter solutions and products that primarily benefit the new private equity owners. I want to reassure our clients that at Noble Wealth Partners, we remain committed to our original mission of delivering client-centered, conflict-free advice. We have always operated as a fee-only practice to ensure that our clients' best interests come first.

I want to emphasize that our clients can trust that we will continue to uphold these principles and remain a reliable partner for the next twenty-five years and beyond.rs and beyond.

The Boston Celtics the NBA Title Period Their MVP Was Math | Robert O’Connell (WSJ)

A fascinating article discusses the strategy of the Boston Celtics and their statistically driven approach to managing a basketball team. Much like Billy Beane's method depicted in the movie Moneyball, I am always captivated by the strategy of teams that emphasize the sum of the parts over any individual star. The Celtics focused on the numbers to assemble a team greater than the sum of its parts, adding each component to complement the existing whole and prioritizing aspects most teams overlook—targeting players highly regarded by the coach rather than the media; picking up players who stretch the floor even if they aren't top picks for their position; and recognizing that the optimal shot is the three-pointer. On that last note, the aim is to take three-pointers, not necessarily to make them, as they understand the numbers will eventually favor them. Kudos to the Celtics, and WSJ subscribers should read this captivating article.