NWP Monthly Digest | April 2025

This past weekend, my wife and I were driving to Jefferson County Stadium to watch our son’s track meet. JCS is about 6 miles from away from our home and is a straight shot down a main thoroughfare in the suburbs of Denver. As is the case all across the country in similar locations to this, you get quite an array of drivers navigating this stretch at various speeds.

A woman driving a Honda Accord was notably in a hurry, rushing up to the backsides of the cars in front of her, aggressively switching lanes, even utilizing turn lanes to pass other vehicles despite nothing resembling a log jam anywhere in site. I commented to my wife, “can you believe this person?”

As we continued our drive simply keeping up with traffic, we couldn’t escape the silver Honda Accord. Despite her aggressive driving, she seemed to be right with me at every traffic light, and when we arrived at the stadium, she was actually behind our car, still driving uncomfortably close to my bumper.

Now, I’m sure that all of you have experienced this exact same situation in your lifetime, perhaps even from both sides. But this particular encounter hit me pretty hard from a metaphorical perspective.

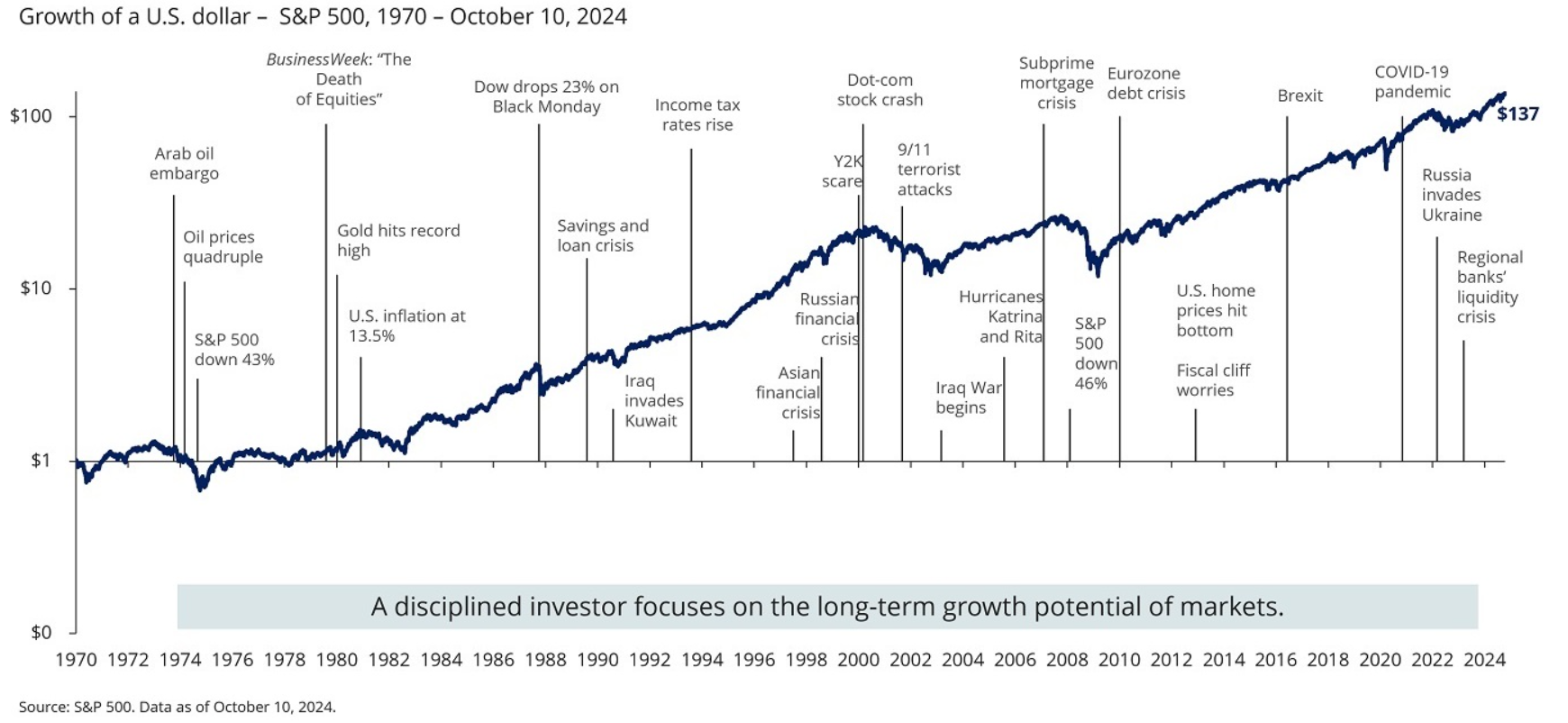

Personal finance and investing right now is extremely difficult. A chaotic series of policy changes from the White House, geopolitical tensions, and the changing landscape of artificial intelligence, seemingly on a weekly or even daily basis, make traditional investing paradigms seem obsolete. Inflation has restricted our purchasing power and cash flows, and an increasingly unaffordable and narrow housing market is making people feel stuck – people who want to buy a home can’t afford one, and people who are fortunate enough to own a home don’t want to give up their 3% mortgage rate. While the job market has yet to see mass layoffs, companies have basically stopped hiring people, too. We are experiencing our economic lives in the form of a traffic jam, and it’s even more frustrating than the real thing.

Naturally, a situation like this will bring out more than its fair share of silver Honda Accords, if you’re picking up what I’m putting down.

Grant and I receive A LOT of questions, but the intensity in which they come up is magnified in troubling times.

“Is it time to get out of the markets?”

“Should we be taking less risk right now?”

“How much did this chaos cost me today?”

“It looks like we need to be investing in international stocks more aggressively, shouldn’t we?” (note: this question often comes from the same people that wondered why we invested in international stocks in the first place)

Human nature causes people to feel the need to take action in times of frustration, and I’m certainly not one to believe that I can help conquer human nature. But I will leave you with what I think is sage advice that has been true for over 100 years in the modern world of investing.

Worrying about the stock market is like sitting in a rocking chair. It will give you something to do for a few hours a day, but you won’t actually get anywhere.

Much like the silver Honda Accord this past Saturday, rushing around and making changes to your portfolio might make you feel like you’re holding down the fort, but in reality, you’re only going to arrive at the same place in about the same amount of time as everyone else.

If you feel like you don’t actually have an investing plan, then you should be spending time trying to figure out what that is. But, if you have a sound investment policy and a diversified, durable portfolio - like our clients do - then you can afford to slow down a little and smell the roses when traffic jams like this start to build up.

The economy isn’t always fair, but it has a tremendous self-balancing mechanism. Supply and demand are undefeated, and corporations (especially those in America) are really, really good and figuring out how to make money.

This month, please enjoy our market recap and commentary below if you want to get more into the weeds on what we see going on.

A Formidable Quarter

The first quarter began on a positive note as markets cheered what they hoped would be a Trump 2.0 administration focused on deregulation and tax cuts. It ended not with a bang, but a whimper, as initiatives and rhetoric from Washington brought a stock market that was priced for perfection under scrutiny. Volatility gripped markets, and the major stock indices saw moderate declines as chaotic U.S. trade and tariff policies caused a steep plunge in business and consumer confidence, raising concerns that economic growth would dramatically slow and corporate earnings growth would disappoint. The end result was the worst quarterly performance for the stock market since 2022. All three major indexes lost ground this quarter, and the S&P 500 and the Nasdaq snapped a five-quarter winning streak.

2025 started strong as stocks rallied into and following Inauguration Day, as investors anticipated a “pro-growth” administration taking power, while fears of dramatic tariffs on “Day One” of the Trump presidency went unfulfilled. The S&P 500 hit a new all-time high shortly after President Trump’s inauguration, and the rally continued into late January after the Fed signaled it still expected to cut rates in 2025, further calming fears of a pause in rate cuts. However, at the very end of January, investors got a preview of looming tariff/trade volatility when President Trump threatened 25% tariffs on Colombia. Those tariffs were not ultimately implemented, so markets largely ignored them, and stocks finished January with a solid gain.

Trade and tariff policy became a major influence on markets in February and dramatically increased market volatility by month-end. During the first few days of February, President Trump threatened and then delayed 25% tariffs on Mexico and Canada, which temporarily spiked market volatility. However, the one-month delay of those tariffs led markets to believe that President Trump was using tariff threats as a negotiating tactic and that substantial tariffs would not be implemented after all. That sentiment helped ease investor concerns while economic data remained solid. Those factors combined to send the S&P 500 to a new all-time high on February 19. However, the rally would not last. In late February, consumer confidence declined dramatically, and some economic reports implied the trade and tariff uncertainty was starting to slow economic growth. Those fears were reinforced when the Atlanta Fed’s GDPNow turned negative, implying economic growth may be stalling. Meanwhile, tariff threats and general policy volatility continued through the end of the month, and that, combined with plunging consumer sentiment, sparked a “growth scare” among investors that weighed on stocks and sent the S&P 500 marginally lower in February.

The market declines accelerated in March as President Trump made good on his threat to implement 25% tariffs on Mexico and Canada (and an additional 10% tariff on China). President Trump delayed some of those tariffs on Mexico and Canada until early April, but many other tariffs were left in place, shattering investors’ belief that tariff threats were just a negotiating tactic. Meanwhile, several corporations from various sectors began to lower earnings guidance, citing reduced consumer spending and business investment. Those guidance cuts reinforced fears that policy uncertainty could cause an economic slowdown, and the S&P 500 fell to a six-month low. In late March, markets tried to rebound amidst a lull in tariff threats, but it didn’t last as President Trump announced 25% auto tariffs on March 26, sending stocks lower once again. The S&P 500 finished the quarter near the year-to-date lows.

In sum, investor optimism for a pro-growth agenda and tax cuts was replaced by rising concerns about a new global trade war and a slowing U.S. economy, as policy uncertainty and ineffective communication crushed investor and consumer confidence.

First Quarter Performance Review

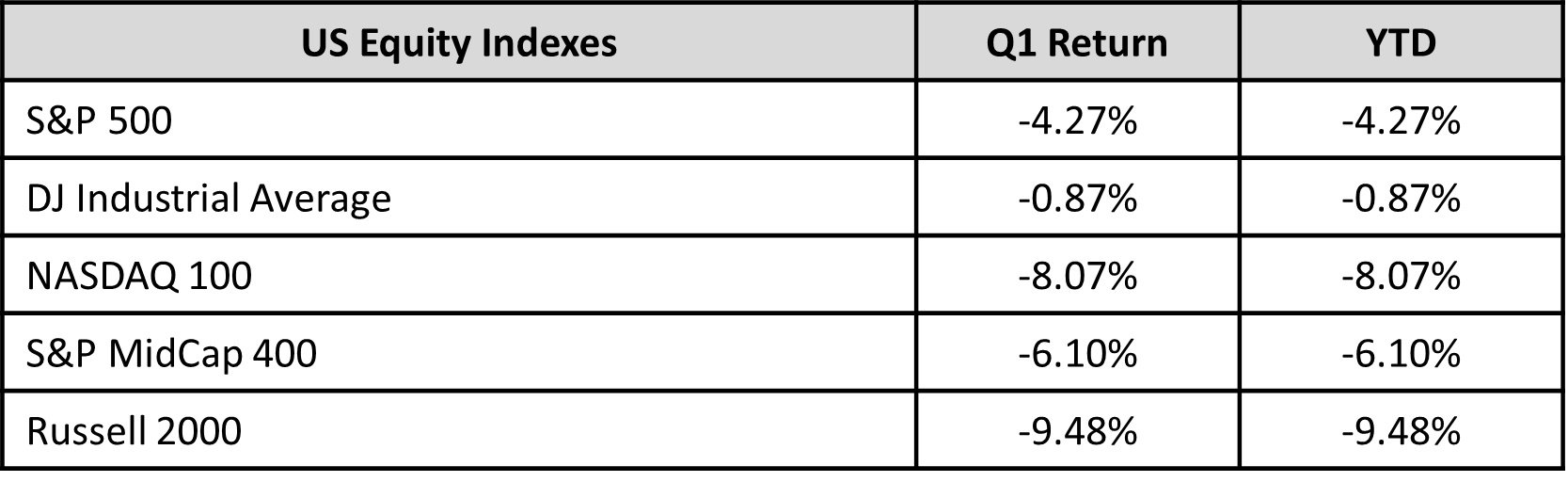

While the S&P 500 logged a moderately negative return for the quarter, if we look under the hood, we see that the declines in the index were mostly due to sharp drops in widely held technology and consumer stocks, as other parts of the market proved resilient.

To that point, on a sector level, only four of the 11 S&P 500 sectors finished the quarter with a negative return, and two of those four sectors saw only fractional declines. As mentioned, the consumer discretionary and tech sectors were by far the worst-performing sectors in the first quarter, as both saw substantial declines. And, since those two sectors carry some of the largest weights in the S&P 500, they weighed on the overall index performance. The consumer discretionary sector was the worst performer for the quarter, as it was hit by intense weakness in one of the largest consumer stocks (Tesla), combined with general concerns about lower consumer spending in the face of policy uncertainty. The technology sector was the other substantially negative performer in the first quarter, as tech stocks fell following the debut of the Chinese AI program DeepSeek, which challenged assumptions about the future economic benefit of AI for major tech firms.

At the sector level, energy was the top-performing sector in Q1, thanks to rising demand expectations following strong Chinese economic data and after some European countries committed to increasing debt to fund economic growth. The healthcare, utilities, and consumer staples sectors logged modest gains in Q1, as those traditionally defensive sectors were viewed as more insulated from any new trade wars and tend to be more resilient in the face of an economic slowdown.

From an investment style standpoint, value significantly outperformed growth in Q1, as growth strategies posted substantial losses due to their large weightings in tech and consumer stocks. Value strategies logged a slightly positive return over the past three months and benefited from exposure to a broader array of sectors that traded at lower valuations and were not as impacted by the negative headlines in the first quarter.

US Equity Indexes

Source: YCharts

Finally, looking at performance by market cap, small caps declined sharply in the first quarter and lagged large caps thanks to a combination of rising worries about economic growth and still-high interest rates. Large-cap indices also declined in the first quarter, although those losses were more modest.

Source: YCharts

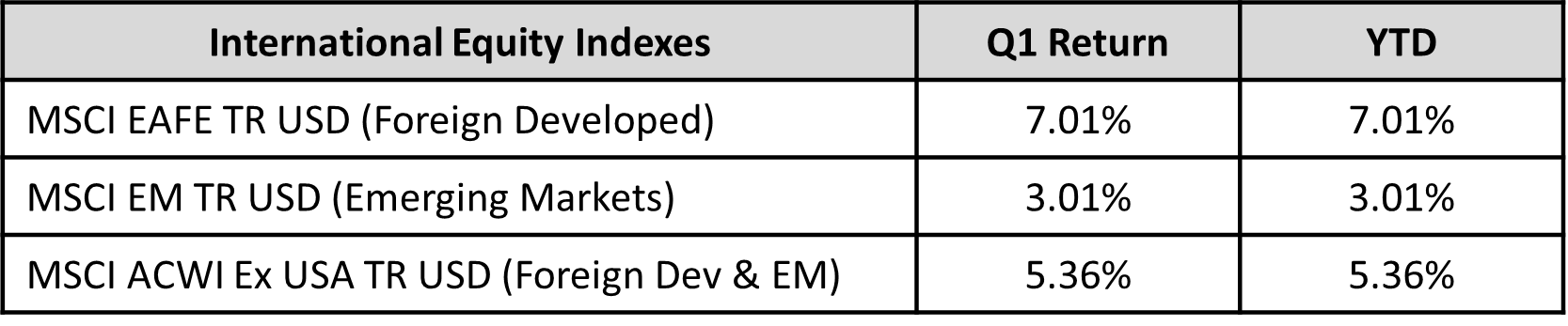

International Equity Indexes

Internationally, foreign markets massively outperformed the S&P 500 and finished the quarter with a substantially positive return. Foreign developed markets saw the largest gains and outperformed emerging markets after Germany and other EU countries signaled a willingness to increase deficit spending to boost economic growth and defense. Emerging markets logged more modest gains thanks to better-than-expected Chinese economic data.

Source: YCharts

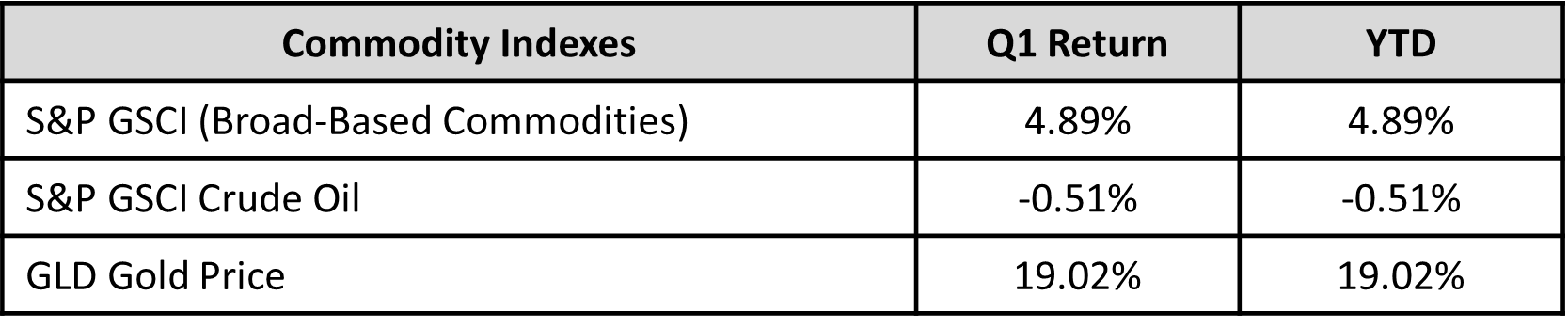

Commodity Indexes

In the first quarter, commodities showed modest gains, largely fueled by the strength of gold, which reached a record high, trading above $3,000 per ounce. This surge in gold prices was attributed to a weaker U.S. dollar and increased demand driven by policy volatility from the new administration. While oil experienced a slight loss, it ended the quarter well above its lows, thanks to better-than-expected economic data from China and rising expectations for increased demand from Europe.

US Bond Indexes

Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a modestly positive return for the first quarter of 2025. Better-than-expected inflation readings and general concerns about economic growth boosted bonds broadly and helped longer-duration bonds to outperform shorter-duration bills and notes, as investors sought higher long-term yields amidst policy uncertainty.

Source: YCharts

Turning to the corporate bond market, higher-quality but lower-yielding investment-grade bonds outperformed higher-yielding but lower-quality bonds in the first quarter, reflecting investor concerns about future economic growth amidst policy uncertainty. However, both investment-grade and high-yield corporate bonds finished the first quarter with modest gains, reflecting a still-present sense of economic optimism from bond investors.

Second Quarter Market Outlook

Stocks begin the second quarter of 2025 following their worst quarterly performance in nearly three years, weighed down by policy uncertainty and concerns about a potential economic slowdown. However, while these headwinds are real, it’s important to recognize that the market’s pullback in Q1 was driven largely by fears of what might happen, rather than by actual weakness in economic data. If policy developments and economic trends prove more stable than currently anticipated, we could see a meaningful rebound in the months ahead.

On trade and tariff policy, there’s clearly room for improvement in the administration’s communication strategy. Encouragingly, there were signs late in the first quarter that officials are becoming more aware of this need and are working to deliver clearer, more consistent messaging. Regardless of the final policy details, better communication will likely be viewed as a market positive and could help support a recovery.

In terms of economic growth, despite heightened fears early in the year, the actual data has remained relatively strong. Jobless claims stayed low, manufacturing and service sectors continued to expand, and the unemployment rate held near 4.0%. In short, there was little in Q1 data to suggest the economy is materially weakening. If this trend continues into Q2, it should help ease recession concerns and support market momentum.

Looking at market valuations, the Q1 pullback has brought the S&P 500 to more reasonable levels. Earlier in the year, investor sentiment was overly optimistic, but that has since shifted to a more cautious tone—conditions that have historically supported future gains. The recent volatility has reset both valuations and expectations, which could prove to be a constructive development for markets moving forward.

It’s also worth noting that not all areas of the market declined in the first quarter. In fact, more than half of the S&P 500 sectors posted gains, and two others had only minor declines. This underscores that the recent volatility did not result in a broad market breakdown, and that there are still areas of strength and opportunity in this environment.

In summary, while the first quarter presented challenges and the second quarter begins with continued uncertainty, there are important positives to consider—most notably, a still-resilient economy and the potential for market-friendly policy developments such as deregulation and tax relief. So, despite the current cautious sentiment, the outlook is not universally negative.

At Noble Wealth Partners, we’ve successfully navigated market cycles like this before. We remain focused on helping you manage through short-term volatility while staying aligned with your long-term goals. Successful investing is a long-term journey, and your diversified strategy is built to weather both up and down markets.

That’s why it’s essential to stay invested, remain patient, and follow the plan we’ve created together—one that reflects your financial situation, risk tolerance, and time horizon.