What's Different This Year?

Last week, Thanksgiving reminded me there are many things to be thankful for. Most importantly – friends, family, food, and shelter. Us Americans should also be grateful for a strong job market, a healthy economy, and tariff-free turkeys. As we near the longest expansion in U.S. history, just behind the ten-year expansion from 1991 to 2001, many of us have taken the investment and economic gains for granted and may not take the time to stop and think about how lucky we are. But what has really changed between Thanksgiving last year and Thanksgiving this year? Well, a lot has changed.

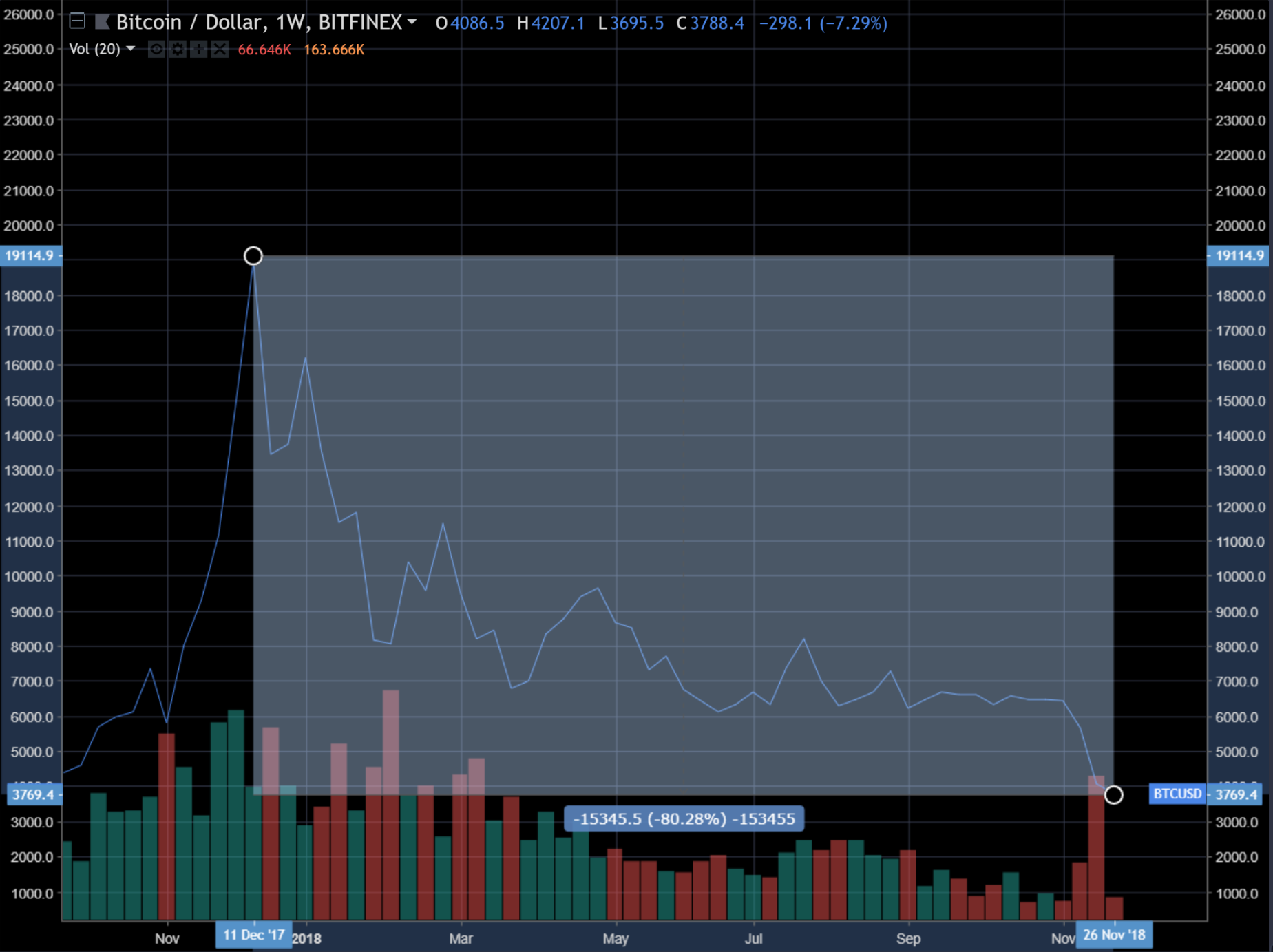

To me, the standout has to be the disappearance of Bitcoin discussions. Last year, many would ask me, “What do you think about Bitcoin, is it a good time to buy?” I tried to discourage them from chasing returns and hopefully I was able to persuade them to stay disciplined with their savings. Now that Bitcoin is down about 85% from the highs reached last year, it resembles the sagebrush blowing across the dusty road in an old western film. This year, not one person asked me about Bitcoin, blockchain, Ethereum, Litecoin, etc. So, have these mania investments gone into hibernation? Unfortunately, not. Instead, the Bitcoin-mania has morphed into Cannabis-mania. Now, people ask me about Tilray, Canopy, Cronos, and some other names that are in the news. Again, I encouraged investors to be pragmatic with their portfolio and asked them if they thought the price of these assets was justified by solid fundamentals? Or, has the price shot up to the top of Storm Peak? Many investors do not realize the stock market often rides the escalator up and the elevator down. Those in cannabis need to remember the chutes are close by.

In 2018, some are getting nervous about the stock market. Two 10% drops in one year!? Shocking right? Actually, this is normal market behavior but investors have habituated to a smooth ride in the stock market as the Fed held interest rates near zero, central banks around the world pumped liquidity into the market, and yield hungry investors were forced into riskier assets than they would otherwise be comfortable with. Now, the market has begun to normalize as the Fed takes its foot off the gas pedal (or just pedal for those electric car drivers). The problem is that normal market behavior is causing angst for a lot of investors. If we look at the 2018 market volatility from a historical perspective, it shouldn’t be something we lose sleep over.

Finally, I didn’t hear anyone talking about tech stocks or touting about how they have held Apple or Amazon in their personal portfolio. As volatility is inserted back into the market and correlations between asset classes widen, skill-based investing becomes an important ingredient to investing success. Investors can no longer ride the Q.E. (quantitative easing) wave and rely on the rising tide to lift all boats in the water. Many institutional investors have been underweight Apple and other tech names, and this may be the start of a rotation into more defensive names.

Instead of worrying about stock market volatility or the prospect of asset returns waning, Thanksgiving should remind us to be happy and grateful for what this bull market has brought us. Household net worth is up to over a 100 trillion dollars.

Yes, the Turkey may be tasting drier this year, but there is still plenty to feast on. Happy holidays to you and your loved ones and be thankful for everything you have.