Building Castles in the Sky

One of the most fundamental aspects of economics and money is the relationship between supply and demand and its effect on prices. When the stock market reaches new highs, sometimes there just aren't enough buyers (i.e. demand) for the market to push higher. This means, the market can go down simply because it has gone up for so long.

You can't build castles to the sky - Things that go up, usually come down.

October has been one very tough month for stocks. After yesterday's ~600 point drop in the Dow Jones Industrial Average, we officially erased the gains the market had accumulated for the year up to that point. We're back to square one.

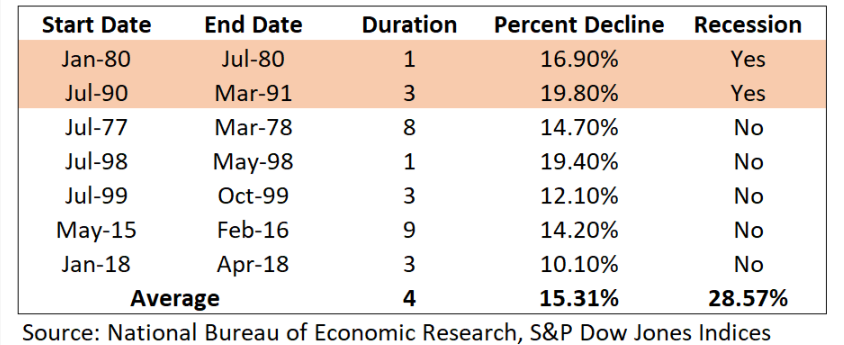

History has taught us that “corrections,” typically defined as a decline of more than 10% and less than 20%, can happen at any time and are part of a normal functioning market. I would encourage you not to worry about corrections as they may present us with opportunities and are typically short-lived. Since 1970, there have been seven corrections and only two of them were accompanied by a recession. Furthermore, the average duration of the bear market was only four months with an average decline of a little over 15%.

However, a “bear market,” typically defined as a decline of more than 20%, habitually occurs during recessions (two or more consecutive quarters of negative gross domestic product). In fact, there have been five bear markets after 1970 and four of them took place during a recession.

Predicting the pinnacle of the stock market for each cycle can be a fool’s errand and we do not attempt to spot the peak of the market. Instead, since bear markets are usually associated with a recession, we search for signs of a frothy economy to determine if we should be under or overweight risky assets. To be clear, we avoid significant deviations to your investment mandates, but we will err on the conservative side of your mandate if signals are flashing red. Below, are some of the useful leading indicators that we, at Noble Wealth Partners, use to gauge the durability of the stock market and the economy, so we can position portfolios accordingly. As of today, there are some warning signals but the majority of the indicators show there is more room for this market to run.

We won't spend too much time getting into the weeds here. All you need to know is that the "green lights" outweigh the "red lights" and "yellow lights." We're not ready to panic just yet and we continue to manage your portfolios with cautious optimism. We won't spend too much time getting into the weeds here. All you need to know is that the "green lights" outweigh the "red lights" and "yellow lights." We're not ready to panic just yet and we continue to manage your portfolios with cautious optimism.

Respectfully,

Your team at Noble Wealth Partners