NWP Monthly Digest | October 2020

Are Investors Getting Tricked This Year for Halloween?

Will investors be tricked this year for Halloween, or will they receive a stock market treat? Many are not optimistic after watching the political developments that unfolded earlier this week. Yes, the horror stories got off to an early start as America witnessed one of the most unprofessional debates in history. My wife is a school psychologist licensed to work with children from birth to the age of 21. Given her background, I thought it was appropriate to ask her for an assessment of the candidates? My only concern was that the candidates were well into their 70s, and her experience is limited in this demographic. After observing their conduct on Tuesday night, she assured me this would not be an issue since she has over ten years of experience working with kindergarten-like behavior. She went on to say, if she were to conduct a functional behavioral assessment, it would conclude:

“The function of the interruptions, insults, and voice raising was to gain peer attention and avoid attention on the personal misgivings of the candidates.” Alisa Glenn

Although Alisa had many interventions in mind to address the target behaviors, the easiest solution is to have a teacher moderate the next debate. I, for one, hope they spent some time in time out after that nauseating performance.

Let’s move on - every Halloween, I like to write about the events and themes that may scare clients, and there is a lot to write about this year. Let’s dive right into the scary stories of the year…

Scary Stories This Year

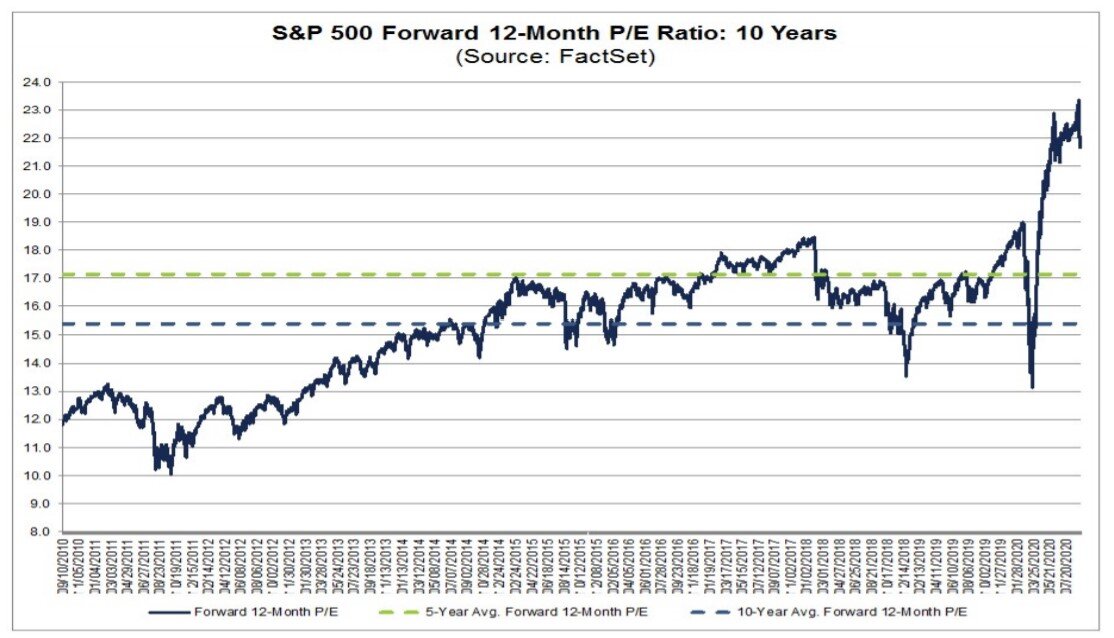

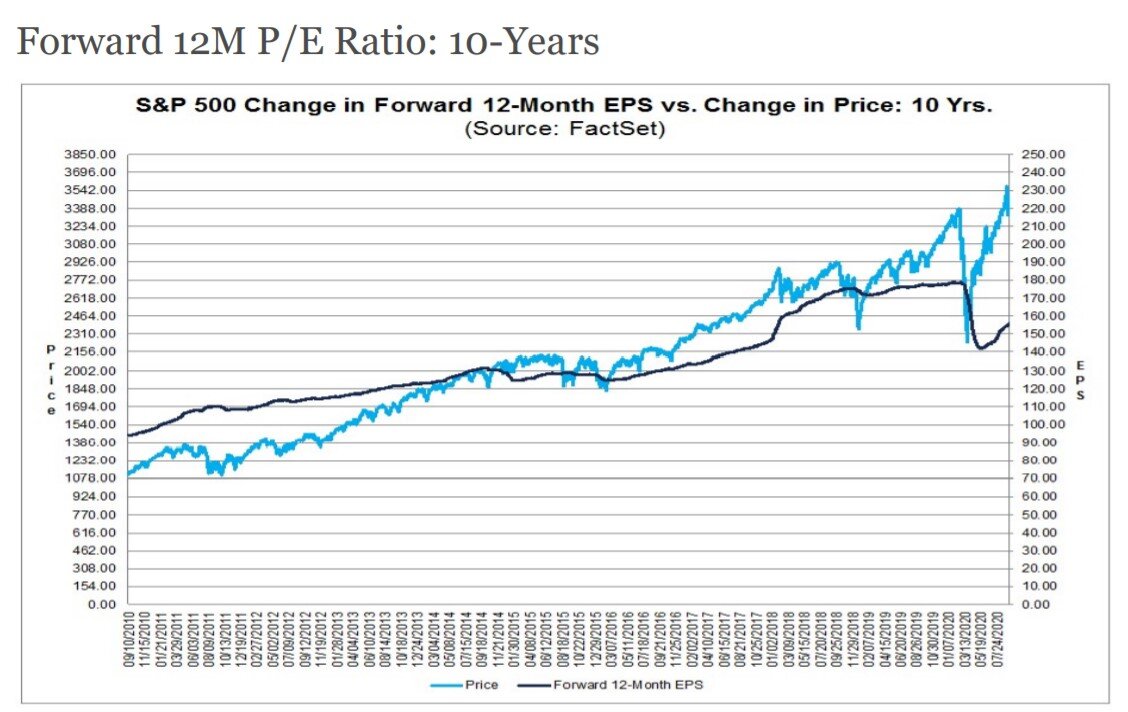

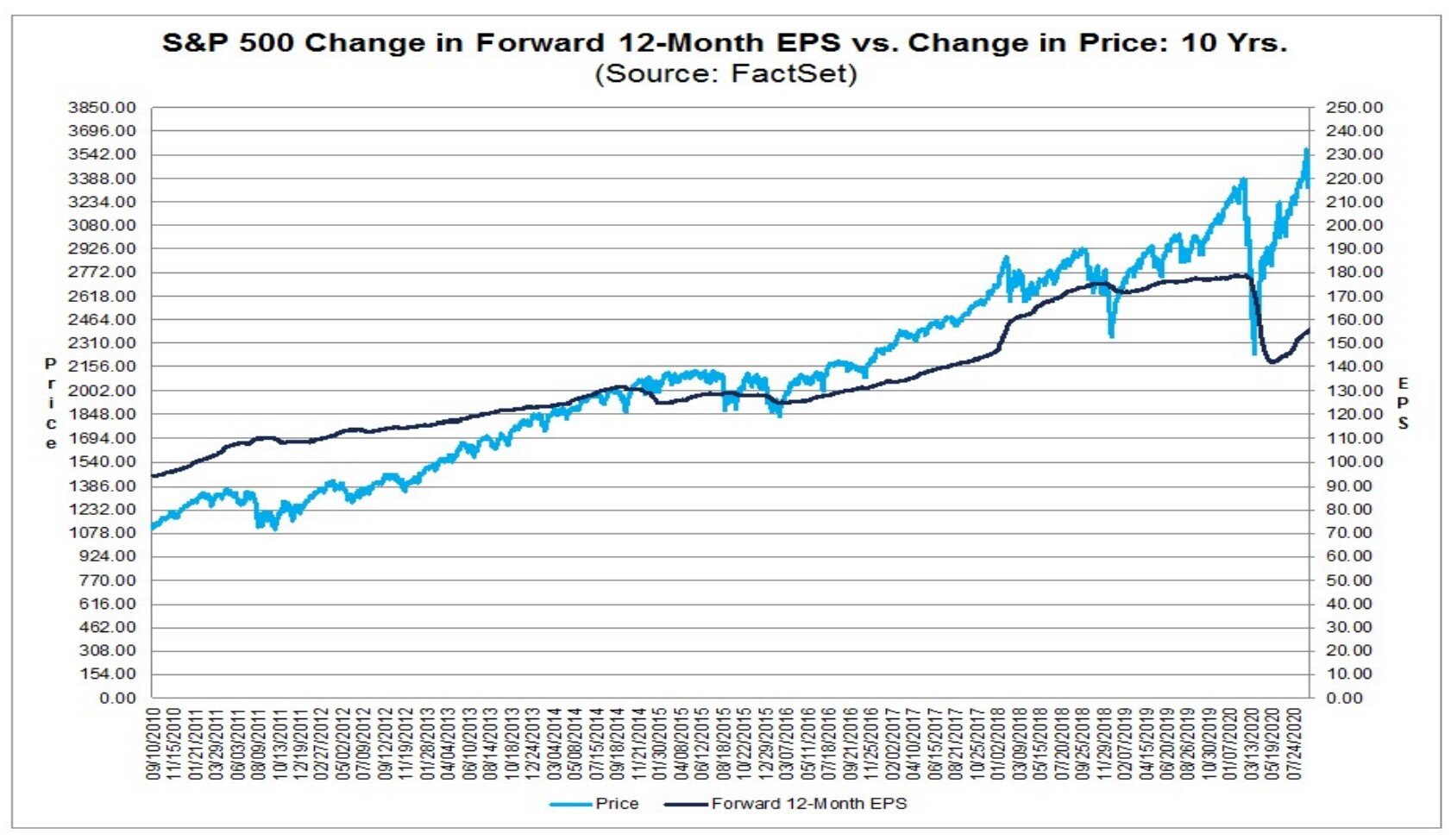

There Is No Alternative

Stocks just wrapped up the second straight quarter of gains. The S&P 500 finished the quarter up 8.5%, and the Dow Jones Industrial Average gained 7.6%. Many investors question why the stock market continues to rise as valuations reach levels not seen since the tech bubble? As of September 11, 2020, the price investors paid to invest in the S&P 500 was almost 22 times the expected earnings over the next 12 months (FactSet). Over the last ten years, investors paid an average of only ~17 times earnings to purchase the S&P 500. Do you see anything paranormal going on?

Are we seeing ghosts, or did the stock market realize it was just TINA in the closet? TINA is the acronym for “there is no alternative.” Even though the stock market is overvalued relative to its own history, it is very cheap compared to other investable alternatives, such as bonds. According to Ed Yardeni’s Fed’s Stock Valuation Model (this model measures the stock valuation relative to that of bonds), the stock market is around 85% undervalued when compared to the yields on Treasury Bonds.

Through this lens, current stock prices begin to look justified. In a 0% interest rate environment, bonds look unattractive, and stocks paying a 2% dividend yield while providing upside looks like a good bet, even if it means withstanding some short-term volatility.

Housing Prices

This year’s other ghastly development has been the explosion of home prices as inventory hits rock bottom and demand soars due to record low mortgage rates. The average home is selling at over four times the median income in the area across the country. These are the highest multiples we have witnessed going back to the housing bubble. In the county of Denver, the median household income is $68,069, and the median list price was $595,050 in August (St. Louis Fed). That is a multiple of almost nine times median household income! In 2008, this multiple was not even five times in Denver. Price increases are healthy if they are associated with a corresponding increase in wages, but this is not the scenario that is unfolding.

How does this happen? A combination of market dynamics and investor psychology. After COVID rippled through the country, home sellers pulled their listings off the market, and now active listings are running at the lowest levels in years - the scarcity principle is in full force. The scarcity principle is a condition where there is a mismatch in supply (too little) and demand (too much), resulting in systemic errors and cognitive bias. Eventually, prices will reflect their fundamental value, and this is the time investors look back with hindsight bias and say, “I knew that was going to happen.”

Rise of the Zombies

Investors need to look out for zombies this year. For investment professionals, zombies are companies that do not have profits at least two times their interest costs, with three-year average sales growth below 3%. In other words, zombies are unprofitable, cash-poor companies that should be dead, but they rely on financial markets to cover their costs and remain alive. In 1980, only 4% of companies met this definition. Today, that number is 18%. According to the Bank of International Settlements, only 25% of zombie companies from 1980 until 2017 survived. Unlike The Walking Dead (series on AMC), companies breathing have the upper hand in this fight.

Business Closures

Another grim and gloomy phenomenon is the increased closures of small businesses. Per a recent Yelp report, 60% of business closures are now permanent:

"As of August 31, 163,735 total U.S. businesses on Yelp have closed since the beginning of the pandemic (observed as March 1), a 23% increase since July 10. In the wake of COVID-19 cases increasing and local restrictions continuing to change in many states we’re seeing both permanent and temporary closures rise across the nation, with 60% of those closed businesses not reopening (97,966 permanently closed)."

I hope all of you, and your loved ones, are staying safe and my thoughts are with all of you that have been adversely impacted by this virus.

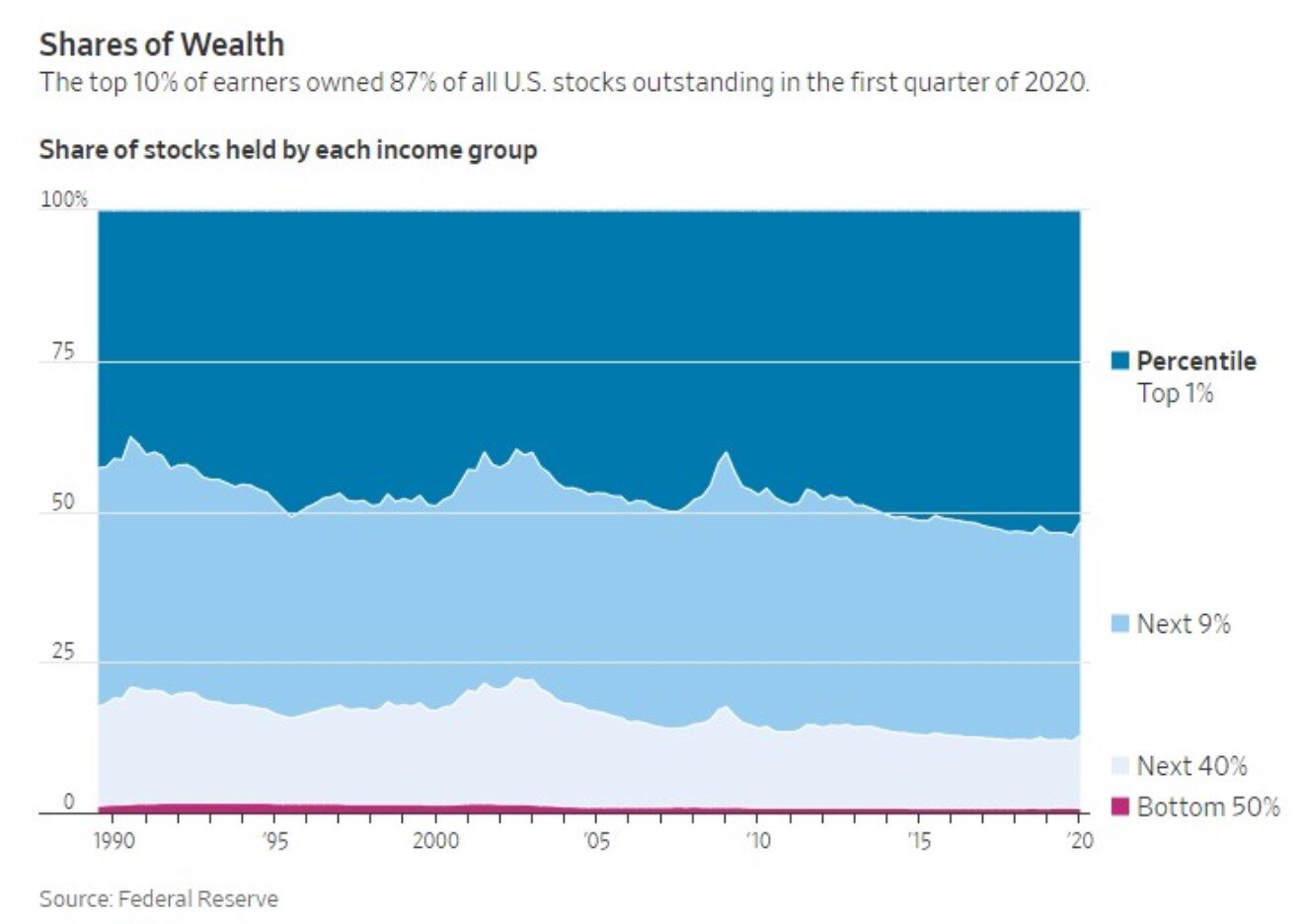

Income Inequality

Wealth distribution has been a popular theme as blue-collar workers have seen wages stagnate after the 1980s as interest rates began their secular decline synchronously. A decline in rates will inflate the fundamental value of an investment asset. If you don’t believe me, divide 100 by 5% to get $2,000; then divide 100 by 1% to get $10,000. That simple calculation may help you understand the power the interest rate has on the present value of a stream of future cash flows. For investors, these cash flows are interest payments, dividends, rent collections, etc. But this fall in interest rates has not benefited the blue-collar workers as it has for wealthy Americans since most have little exposure to the stock market. In fact, the bottom 50% own less than 1% of the stock market while the top 1% owns 54% of stocks (Federal Reserve). These two factors (among others) have resulted in a widening of the wealth gap.

The Fed rescued the wealthy, not the people economically impacted by the pandemic.

Should we celebrate the ~50% rally in the S&P 500 from the lows on March 23rd? Yes, the stock market climb has benefited many Americans, but those reaping the rewards are most likely those that have been least affected by the pandemic. As I mentioned above, wealthy individuals hold most of the wealth in the stock market. The surprising figure is the stark difference in the stock holdings between the wealthy and the Americans with the least amount of wealth. The richest 1% of Americans have 34% of their wealth invested in the stock market, the bottom half only has 2% of their wealth in the stock market! The top 10% hold far more money in financial assets than the bottom 90%, who have the majority of their wealth tied up in their primary residence. The wealthy are able to sell appreciated investments if their finances are stressed, and the less affluent do not have easy access to capital since their wealth is tied up in real estate. I agree that the Fed’s actions amid the pandemic were necessary, but these actions only exacerbated the distribution of wealth for Americans. We have to take action to help those Americans that have been left behind. If history is any guide, the growing disparity can have dire consequences (e.g., WWII).

Not on This List - the Election

Jeff and I have received calls from clients concerned about the election. Yes, there is usually increased volatility in the weeks before the election, as the market does not like uncertainty. However, the stock market tends to calm down after a winner emerges as there will be fewer unknowns since investors only have to explore the potential actions one candidate, not two. According to a recent study from Goldman Sachs, the average post-election rally is 5%, regardless of who wins.

Is it possible to write a Halloween newsletter without a poetic pandemic-themed parody of The Raven? Perhaps, but I don’t think I would read it 😉

The Dove

By Edgar Jerome Poe-well (fake name)

Once upon a mere pandemic, I lay in my bed, feeling apathetic,

Over many quaint and intriguing tomes of unrecognized smell —

While I nodded, nearly napping, suddenly I felt a scratching,

As the virus continued latching, latching onto my host cell.

“Tis coronavirus,” I muttered, latching onto my host cell —

Knowing this, I still felt well.

Businesses closed, infections grew stronger; this bear market would last a bit longer.

Dear Congress, “Take action!” I implore. It is your duty—the oath you swore.

They came together and would soon enact what we now know as the CARES Act.

And as quietly as a whisper, came quantitative easing, easing only—and nothing more.

Clients were terrified, shaken to the core. "Invest my cash, are you sure?"

“Don’t fight the Fed.” We said — nevermore.

Ah, distinctly as I remember, market troughs and peaks in March and September.

Amid unconventional measures, which some do deplore; angst lingers, many remain indoors.

Eagerly, I look ahead to the morrow—as we honor lost lives and those in sorrow.

Moving past the days of yore, we now face debts we must all endure.

Interest payments will come tapping, tapping outside our chamber door --

We are buried in debt — forevermore.

Noble Wealth Pro Tip of the Month

It’s FAFSA Time

If you have a senior in high school or know someone who does, make sure they’re prepared for the upcoming FAFSA registration, the Free Application for Federal Student Aid. Today is the first day you can file the FAFSA application for the 2021-2022 school year. The deadline is June 30, 2021, but you should try to file your FAFSA as close to October 1st as possible to improve your chances of qualifying for the most grant, scholarship, and work-study aid.

There Is No Secret to Getting Rich

Those claiming to have the silver bullet to building wealth are either fooling themselves or fooling you. Outside of sheer luck, there is no easy way to get rich. Building wealth takes hard work and discipline. This is common sense for most of our readers, but sometimes people forget and prefer not to do the heavy lifting.

Diversify Your Assets

Alphabet, Amazon.com, Apple, Facebook, and Microsoft's combined market capitalization is 22% of the S&P 500. That’s a lot. In fact, it is more than the 18% share that Microsoft, Cisco, General Electric, Intel, and Exxon Mobil commanded at the tech bubble peak in March 2000. And just like in 2000, the five Big Tech stocks have trounced market returns over the past year. The concentration of these positions in the S&P 500 poses a risk to investor’s portfolios should they underperform. Nothing lasts forever. If you have a large amount of wealth in these colossal stocks, consider trimming these positions and protect your assets by diversifying your portfolio.

Approach Investing With a Shrewd Mind

To be successful in managing your wealth, you should have a mix of optimism and pessimism. Most people cannot be both optimistic and pessimistic, but the great ones are. Bill Gates was incredibly optimistic when he bet that everyone would have a personal computer in their home. Meanwhile, his pessimism was exposed when he enforced a rule to maintain at least 12 months of cash, so he could pay every employee if his company did not have any revenues for an entire year. Investing in the stock market requires the same skill set. Those that do not believe in the economy will not be able to invest successfully in the market. However, over-optimism can also lead to wealth destruction if investors catch themselves too far over their skis.

Impact of a Biden Presidency

Whether you are a republican or a democrat, it is wise to think about wealth planning strategies if we encounter a Biden presidency.

Key features of Biden’s proposed plan:

Increase the top tax bracket to 39.6% (same as the pre-TCJA rate) for individuals with incomes over $400,000.

Elimination of the Qualified Business Income (QBI) tax deduction for pass-through business owners (e.g., partnerships, LLCs, S corporations, and sole proprietors) whose individual annual income is $400,000 or more.

Capping the value of the rate at which itemized deductions can be taken to 28%.

A flat retirement contribution credit, as determined by a specific percentage (currently anticipated to be 26%) of the contribution amount to replace deductions of those retirement account contributions.

Enhancements to personal income tax credits made by the proposal include a higher Child Tax Credit (increased from $2,000 for children under 17 to $3,600 for children under 6 and $3,000 for all other children under 17), Child and Dependent Care Credit (from $3,000 to $8,000 for one child, and from $6,000 to $16,000 for two or more).

Long-term capital gains and qualified dividend tax rates would increase to ordinary income tax rates for income over $1 million.

1031 Exchanges would be eliminated for taxpayers with annual income over $400,000.

Eliminate the step-up in basis rules that currently apply to inherited assets (that are not considered Income In Respect of a Decedent).

50% reduction of the exclusion amount for estate and gift taxes, from $11.58 million to the pre-TCJA amount of $5.79 million.

If you are in a relatively high tax bracket, here are some planning strategies to begin thinking about:

Accelerating and recognizing income in 2020

Utilize pre-tax contributions in your 401(k)

Recognizing capital gains

Roth conversions

Estate reduction techniques

Please call us at (720)588-4103 to discuss these items to make sure any recommendations are appropriate for your particular financial situation.

Delegate and Focus on the Biggest and Most Important Tasks in Your Life

In Morgan Housel’s book, “The Psychology Of Money,” the author explores the differences between being rich and being wealthy; the second examines what it takes to not feel “rushed” (hint: it’s all about delegation to focus on the biggest and most important tasks); and the last explores recent research finding that those who work with financial advisors don’t just do better with their money… they’re also happier with it, too!

“Nothing in life is quite as important as you think it is while you’re thinking about it.” Daniel Kahneman.

Things We’re Reading and Enjoying

Explore the Transcripts | Wall Street Journal

Put the candidates on the record with Talk 2020. Quickly search years of public statements made by Trump and Biden, and filter them by keyword, topic, or candidate. Track how the candidates’ stances changed over time, hone in on the issues you care about and get your questions answered as the election enters the volatile home stretch.

One Up On Wall Street by Peter Lynch

Lynch offers easy-to-follow advice for sorting out the long shots from the no shots by reviewing a company’s financial statements and knowing which numbers really count. He offers guidelines for investing in cyclical, turnaround, and fast-growing companies. He even offers some advice that may have stopped many from investing in Nikola.

“In my experience, the next of something almost never is.” Peter Lynch.

Personal finance: How to save, spend, and think rationally about money | Big Think

In this video, social innovator and activist Vicki Robin, psychologist Daniel Kahneman, Harvard Business School professor Michael Norton, and author Bruce Feiler offer advice on achieving financial independence, learning to control your emotions, spending smarter, and teaching children about money.

Why It Could Be Time for a Crash in College Tuition by Jack Hough in Barron’s

A short but great article that may change your perspective on higher education. Barron’s interviews Aswath Damodaran, a New York University finance professor, and not the sort that talks loosely about dollar amounts. Some people call him the dean of valuation—he’s written four books on the subject. Barron’s published some of his thoughts on stocks earlier this summer. Damodaran says that higher education is an example of stakeholder capitalism run amok; that it should serve students but instead serves overlapping and sometimes conflicting interests; that it should have been restructured a hundred years ago, but hasn’t, because of its control over the degree system, combined with inertia. Society has been trained to prize four-year degrees.

8,000 Days Of Retirement by Joseph Coughlin

Coughlin suggests that the best way to think about retirement is as the fourth of a series of 8,000-day life segments. The first 8,000 days – which is about 22 years – takes us from birth to adulthood, when we graduate college and become (hopefully!) productive adults. The second 8,000 days takes us from college graduation to ‘midlife’ (age 44), and the next 8,000 days takes us from midlife to ‘retirement’ (at age 66). And prompts the question: what do you want to do with those next/last 8,000 days?

The Way to Wealth by Benjamin Franklin

The first American book on personal finance, "The Way to Wealth" by Benjamin Franklin, is still the best and wisest money book ever written. Franklin's book is timeless and sets the basis for most financial books of today. It is a short, high-quality book delivering superior knowledge for earning classical prosperity and wealth. It is a mini-bible for prudent financial conduct and getting rich.

Happy Halloween!

“There is nothing noble about being superior to your fellow man. True nobility is being superior to your former self.” Ernest Hemingway