NWP Monthly Digest | August 2020

It’s August and the summer is wrapping up faster than my first-round exit at the Steamboat Tennis Championships last weekend. Normally, I would complain but after months of isolation from the shelter/safe-in-place orders, it’s just good to be outside. Participating in social events like this tennis tournament should help many see the light at the end fo the tunnel. It may seem like we will be in lock-down forever, but historically, pandemics are usually gone within a year as populations develop resistance to the virus and possibly the favorable genetic mutation of the virus. In 1918, without modern medicine, populations developed resistance to the influenza virus in six to eight weeks, and the virus mutated to a less deadly version of itself by the end of 1918. By the spring of 1919, the pandemic had run its course. A lot has changed since then but it’s reasonable to assume economies can function closer to normal by the winter and the pandemic subsides in the spring of next year.

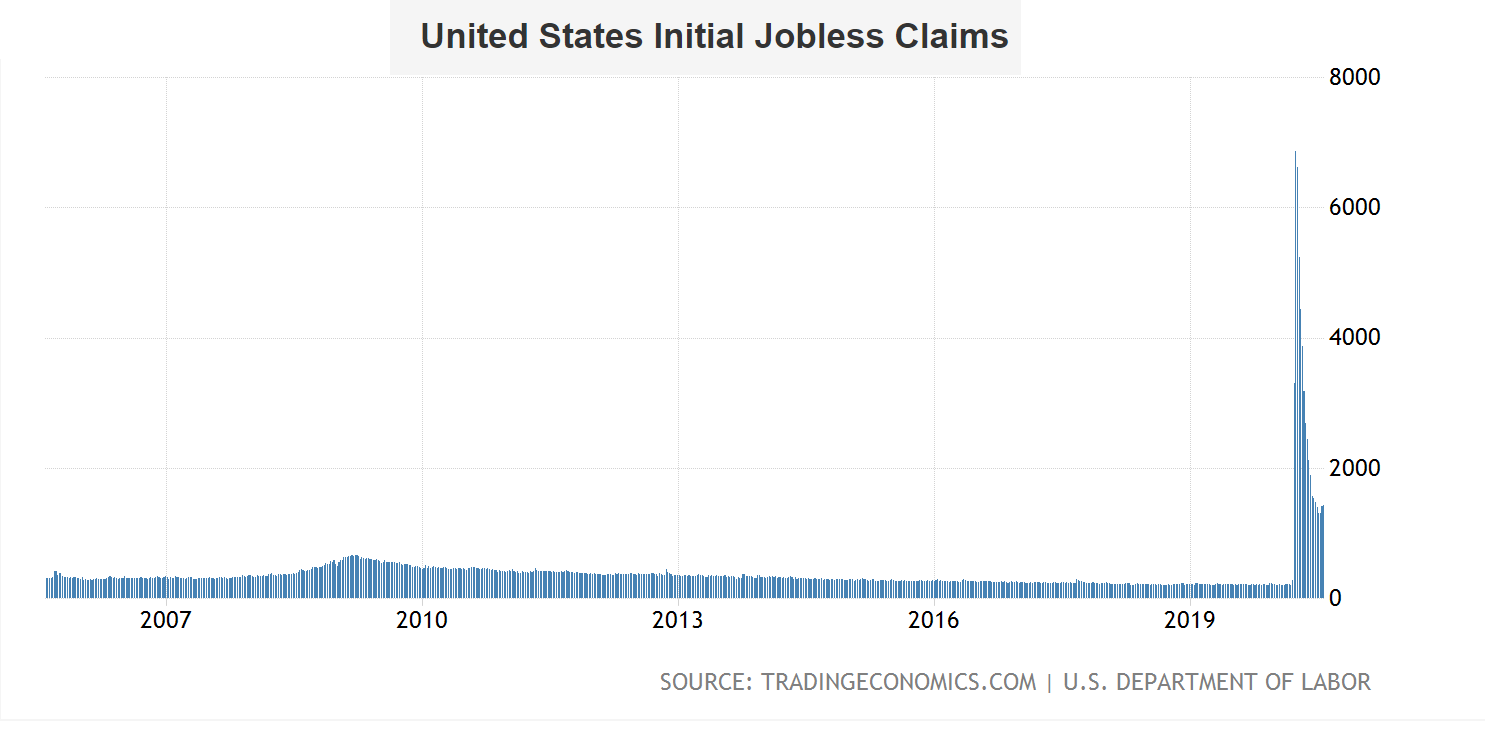

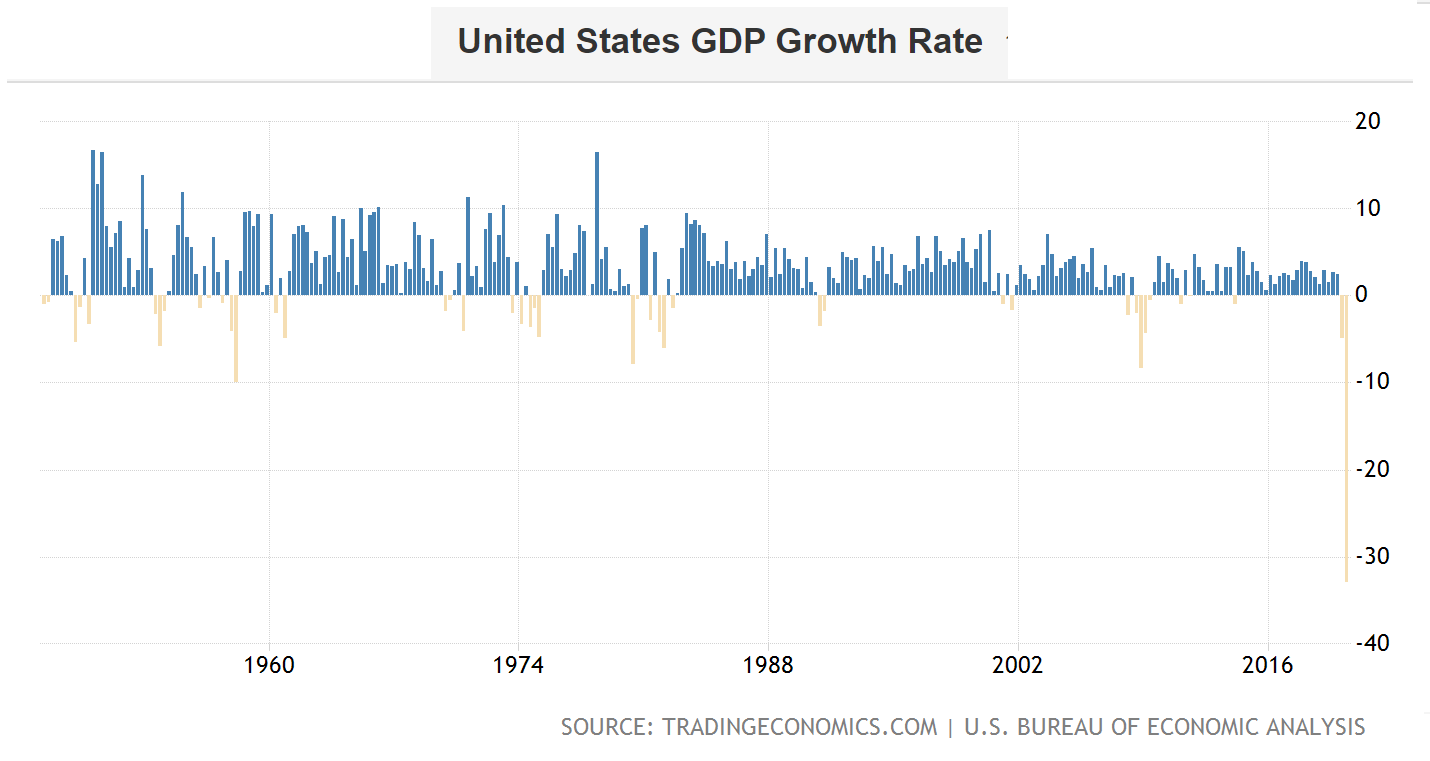

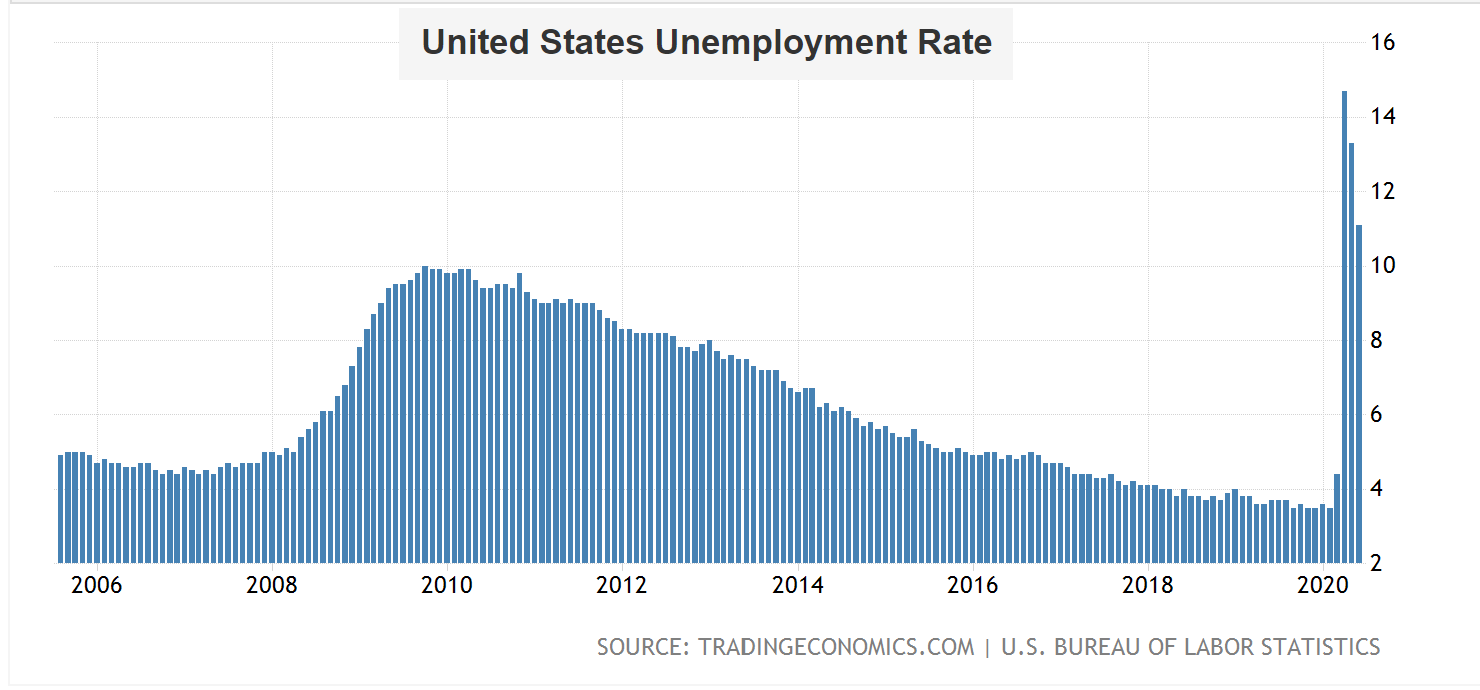

It’s unfortunate the pernicious impact on the economy cannot be undone. Last Thursday, we officially entered a recession (two consecutive quarters of negative GDP) when the Bureau of Economic Analysis reported a 32.9% decline in gross domestic product for the second quarter, after a 5% fall in the first quarter. This marked the largest drop on record, surpassing the previous record of 10% in the first three months of 1958. The decline in economic activity ended the largest expansion in U.S. history as the coronavirus pandemic forced many businesses including restaurants, cafes, stores, and factories to close and people to stay at home, hurting consumer and business spending. The economic impact has been catastrophic. Last week, more than 1.4 million people across the U.S. filed for unemployment benefits. To put that in perspective, unemployment claims did not reach 700 thousand at the depths of the financial crisis and the unemployment rate peaked at 10.1%. Today, the unemployment rate is 11.1% while capital is abundant, not frozen.

Did the stock market (S&P 500) miss that memo when it rallied ~46% from the lows back in March and sits just 4% below its all-time high? The stock market is aware we are in a deep recession and did not forget about the pandemic. However, when the Fed begins printing money, nothing else matters, and that printing press is working overtime. At 10% of GDP, the stimulus measures today are 1.9 times larger than the relief package in 2008 which only rose to 5.3% of GDP. And Washington is not done as they seek to implement the HEALS Act, its 5th economic stimulus bill of this pandemic. It’s clear the government has the economy on life support and that may be the reason things seem normal. But eventually, something has to give. Currency traders know this. Just look at the Euro’s 10% appreciation over the dollar. By some estimates, every $7 trillion of U.S. debt adds $7 thousand dollars of debt to every household, in addition to the $130k already owed from government borrowing. We managed to avoid the immediate pain but it will stay with us for years to come. Like slowly pulling off a bandaid over fifty years.

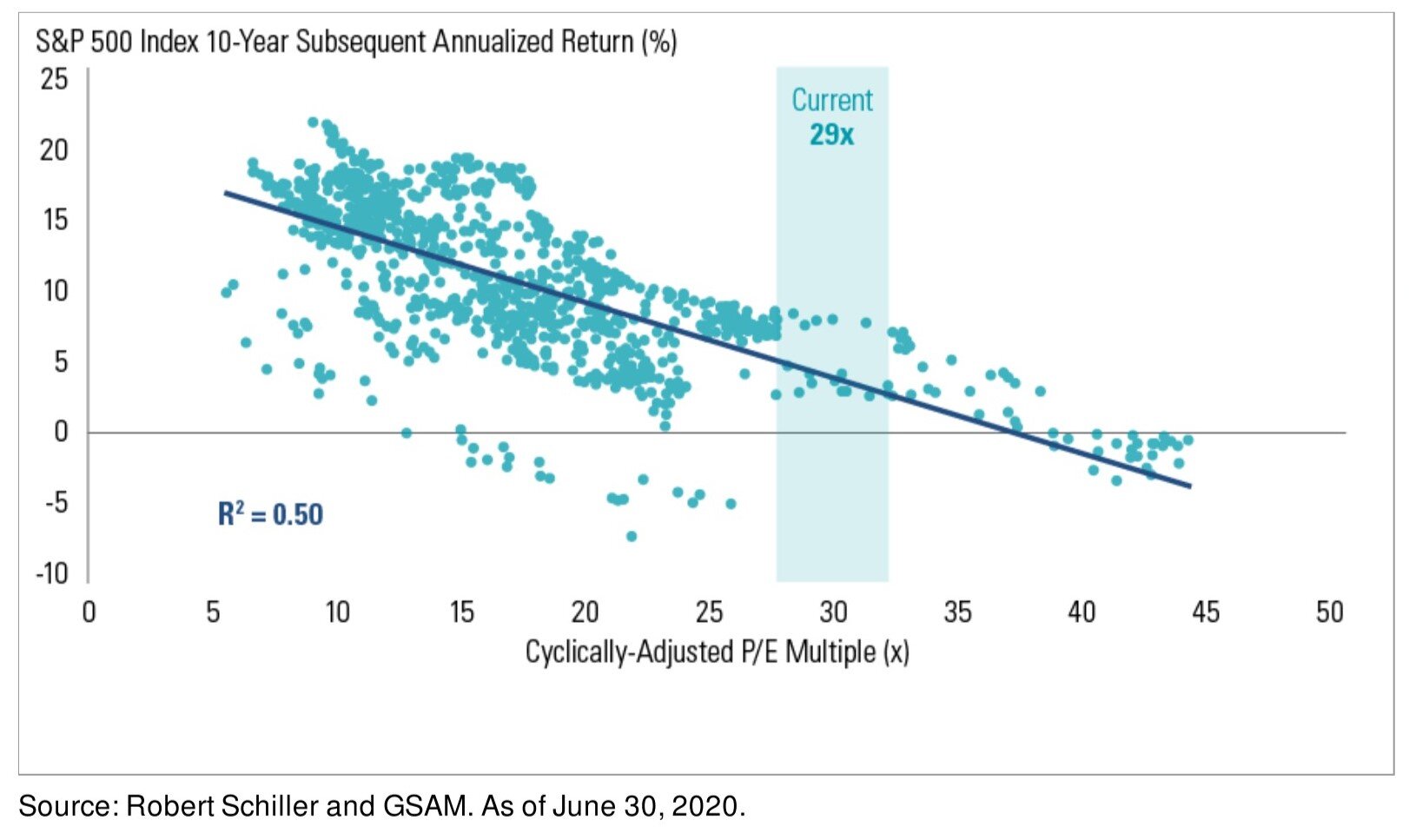

As schools across the country deliberate over reopening in time for the school year, universities may have to consider re-writing their Introduction to Finance textbooks. The most basic principle of investing - buy low and sell high, may need to be modified to - buy high and sell higher. Sounds crazy, but a flurry of exuberant investors trading on platforms like Robinhood has pushed already high valuations deep into orbit. In fact, some of those names have drastically outperformed the broader stock market in 2020. Take Tesla, a company that entered the year trading at a multiple of three times its revenues over the past 12 months (compared to a stock market trading at a multiple of two times revenues). Now, it trades at a multiple of 260 times the prior year’s revenues! For a company with profit margins of less than 2%, investors need the company to not just beat, but blowout already optimistic expectations vindicate the valuation. Don’t get me wrong, I love the company and love the car, but it’s difficult to fathom how Tesla has a market capitalization of over $275 billion. What about Nikola? Nikola is another great example of the exuberance of today’s stock market. The company is worth over $10 billion with less than $500 thousand of sales over the past 12 months.

When the stock market is trading at valuations this high, it does not point to an imminent crash. But it would be unwise to think stock market returns will be the same over the next ten years, as they were over the last ten years. At current valuations using the CAPE (cyclically adjusted price-to-earnings ratio), a historical regression would point to returns of only ~5% on an annual basis (see the picture). A stark difference from what we have seen during this expansion.

The concept that asset price returns and historical returns eventually revert to their long-run average, describes the mean reversions theory of finance. However, once could say the mean reversions concept is not limited to the stock market and extends to each and every one of your lives. Good times usually do not last forever and the bad times get better. Think about it. For those that have lost a job, or have been dumped by a boyfriend or girlfriend, it may have felt like the end of the world. Then, you were resilient, you found a better job, or a spouse that completes you, or a best friend, or a new hobby and your life had never been better. We have all been through this. Through this prescient phenomenon, one can say the quality of our lives will follow a mean-reverting pattern. I know these have been difficult times for a lot of you but if we know this concept to be true, things will get better. I don’t know how and I don’t know when, but I do know each of you will go back to being as happy, or happier than you were before the pandemic.

I hope all of you, and your loved ones, are staying safe and my thoughts are with all of you that have been adversely impacted by this virus.

Noble Wealth Pro Tip of the Month

There is no secret to getting rich

Those claiming to have the silver bullet to building wealth are either fooling themselves or fooling you. Outside of sheer luck, there is no easy way to get rich. Building wealth takes hard work and discipline. This is common sense for most of our readers, but sometimes people forget and would prefer to not do the heavy lifting.

Diversify your assets

The combined market capitalization of Alphabet, Amazon.com, Apple, Facebook, and Microsoft is 22% of the S&P 500. That’s a lot. In fact, it is more than the 18% share that Microsoft, Cisco, General Electric, Intel, and Exxon Mobil commanded at the tech bubble peak in March 2000. And just like in 2000, the five Big Tech stocks have trounced the market over the past year. The concentration of these positions in the S&P 500 poses a risk to investor’s portfolios should they underperform. Nothing lasts forever. If you have a large amount of wealth in these colossal stocks, consider trimming these positions and protect your assets by diversifying your portfolio.

It’s a great time to refinance…again

Mortgage rates are hitting new lows. Yes, they may get lower but that does not mean it is a bad time to refinance.

When you refinance, consider using a lender that asks for little or no upfront costs. Yes, you can get a lower rate if you pay but if rates continue to fall and you have to refinance again, that money is wasted. Also, compare the rates of the 15-year and the 30-year mortgage. Would you give up the flexibility of the 30-year mortgage if it only saved you 0.25%? Since August 1991, the average spread between the 30-year and the 15-year mortgage rate has been 0.55%. This should provide you with a good starting point for your analysis but your number may be higher or lower depending on your unique circumstances. For example, if the rate on the 30-year is only higher than the 15-year by 0.50% or less and you value the flexibility of the longer mortgage, consider sticking with the longer option. Please reach out if you would like our help you with your decision.

On July 16, 2020, the spread was ~0.50% which is around 39th percentile.

Things We’re Reading and Enjoying

The Great Influenza by John M. Barry

A New York Times Bestseller, The Great Influenza examines the scientific, social, and political context of the 1918 influenza pandemic. The author questions the extent to which human error and willful ignorance worsened the terrible consequences of the disease.

The Real Lord of the Flies by Rutger Bregman

Our secret superpower is our abilty to cooperate - Rutger Bregman

A short read in The Guardian covering a true story of a group of boarding students that voyaged into the ocean on a fishing boat and found themselves marooned on an island for over 15 months. The students’ inspiring behavior was a stark contrast to the dark tale in the original Lord of the Flies. Unfortunately, when the boys returned to Nuku’alofa, the police threw them in jail for “borrowing” a fisherman’s boat. Tough luck!

The New York Times has a great article for you to stay apprised on the progress of a vaccine.

Enjoy the rest of your summer and stay safe!

“There is nothing noble about being superior to your fellow man. True nobility is being superior to your former self.” Ernest Hemingway